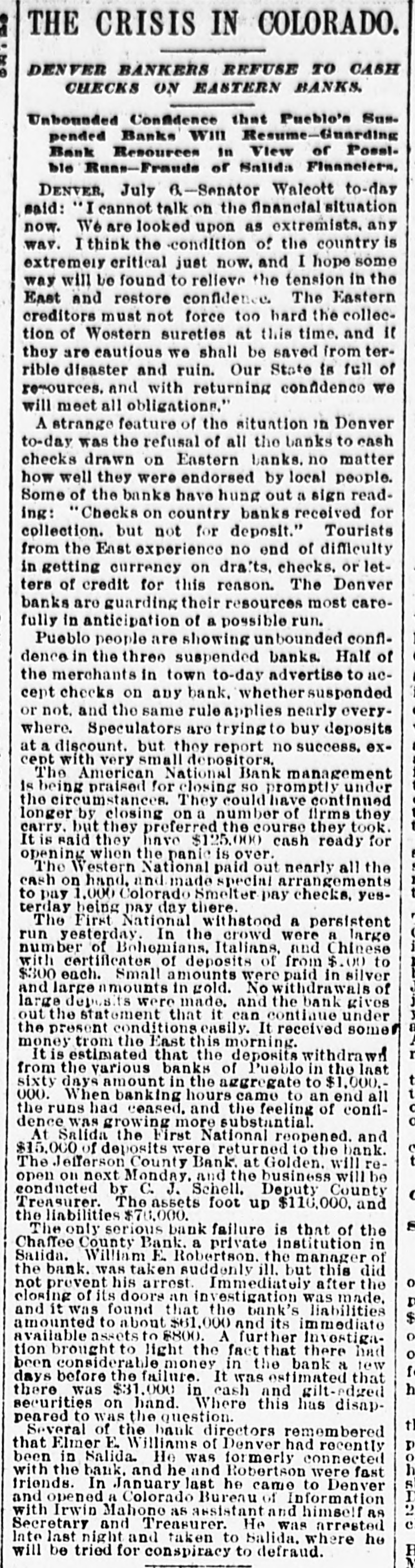

Article Text

has been selling a good many freightears on time, and, being unable to realize on them, went to the wall. When the news reached St. Louis it created great consternation among the brokers, as all the parties interested were heavily concerned in a number of big local enterprises. The Madison Car Works were controlled by what is known as the "Granite" Mountain people, who were also behind the Merchants' bridge, the Security building and a number of mining enterprises. Six months ago it bonded itself for $500,000. This was used to pay off the outstanding indebtedness and to enlarge the plant, and is known to have left the company with plenty of working capital. The works were running at full capacity, turning out between forty and fifty cars a day. Major Rainwater, one of the leading members of the company, says that it was embarrassed by paper they had indorsed and which was not paid at maturity. This paper has been received by the company in the settlement of accounts, etc. Major Rain water had no idea how much of this paper is in existence. The concern is one of the largest of the kind in the United States. It was the intention of the capitalists who operated the plant to make the town of Madison another such a place as Pullman, and the project was meeting with much success. PITTSBURG, July 1.-The Speat White Sand Company has assigned. Liabilities $60,000, assets $200,000. The stringency in the money market and the complete shut-down of the glass factories are the cause of the failure. SALIDA, Colo., July 1.-The Chaffee County Bank made an assignment this morning. Its liabilities are. between $80.000 and $90,000, while its assets are not yet known. Slow collections are given as the cause of the failure. A run was started on the First National Bank, which closed at 11:30 until Monday. The directors say the depositors will be paid in full. WEBB CITY, Mo., July 1.-The Exchange Bank of this city assigned to-day. The deposits amount to about $60,000. The liabilities are not yet known. The stringency of the money market and the withdrawal of deposits are assigned as the cause of failure. OURAY, Colo., July - The First National Bank closed this morning, owing to the want of currency. The assets are $110.000, and the liabilities $42,000. The bank will probably resume in a few days. A run was inaugurated on Thatcher Brothers' Merchants' and Miners' Bank, but it was only a slight flurry.