Click image to open full size in new tab

Article Text

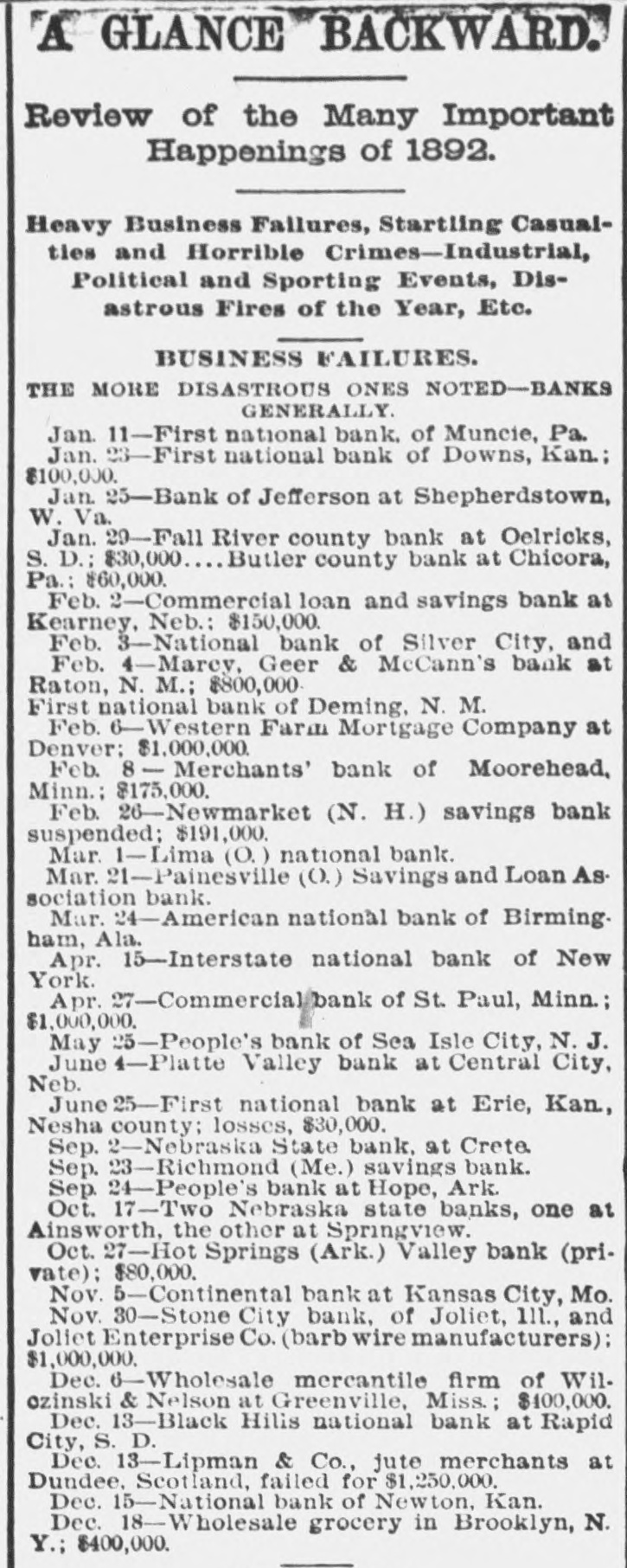

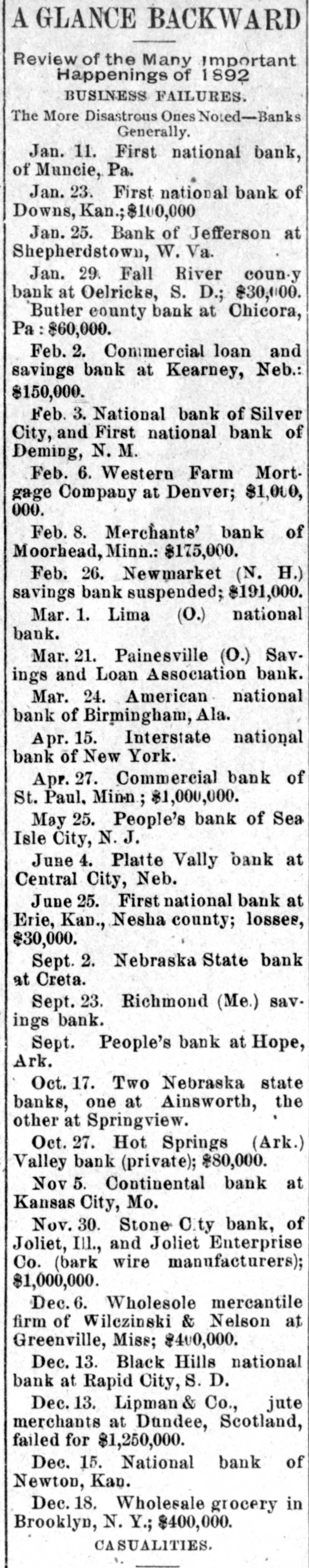

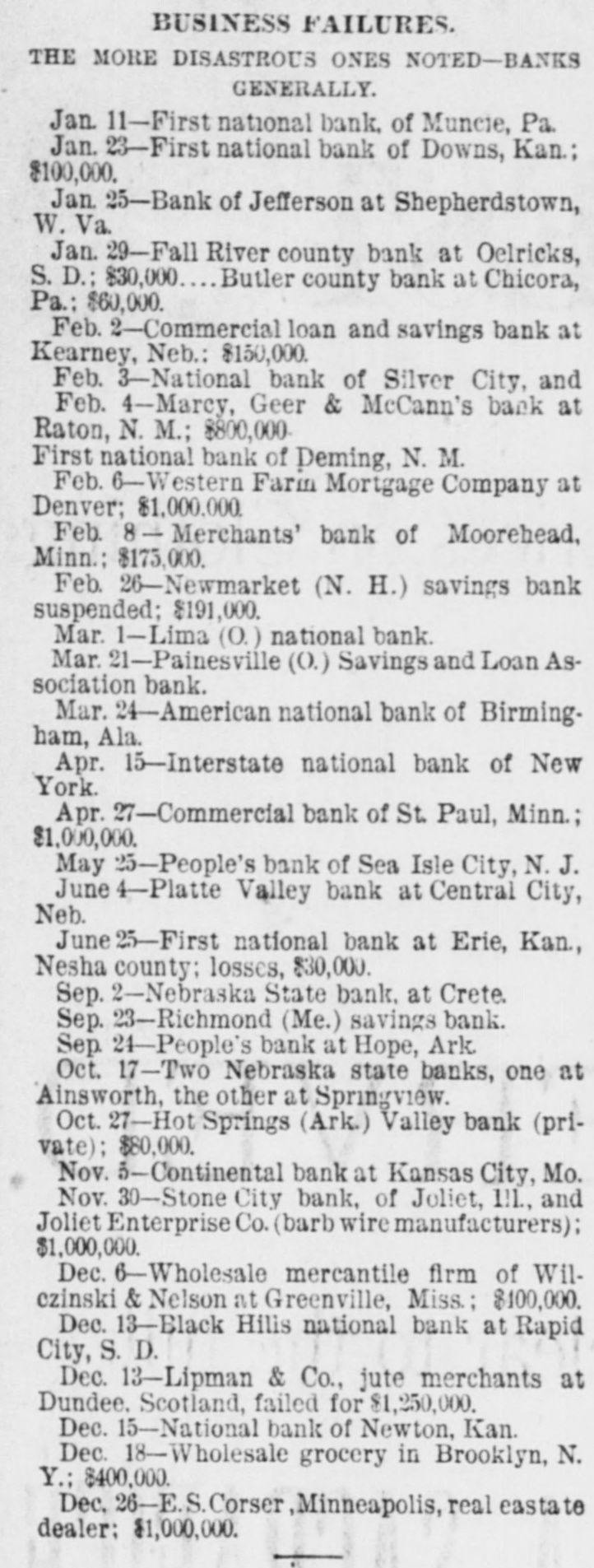

PERSONAL AND GENERAL. THE Inman steamer City of New York, from New York to Liverpool, passed Brow Head at 2 p. m., on the 24th, five days and twenty-one hours from Sandy Hook, the best eastern time ever made by this line. This does not beat the record, however. SEVENTY carloads of grain from Argona, Kas., arrived in New Orleans, on the 24th. by special train over the Missouri Pacific and Texas Pacific. The shipping direct to New Orleans, it is said, makes a difference of four or five cents a bushel. JOHN R. BUCHTEL, founder of Buchtel college, died at his home in Akron. O., on the 23d. from paralysis, with which he was stricken five years ago. Mr. Buchtel was 72 years old. During his lifetime he had made gifts to Buchtel college amounting to $500,000. ELDER ANDREW J. STEWART. of the Mormon church, has secured from the Mexican government a concession of 100,000 acres of land, 90 miles southeast of Chihuahua, upon which Elder Stewart agrees to locate 500 Mormon families. THE state military board of Nebraska, which has been investigating the accounts of A. V. Cole, adjutant general under Gov. Thayer, report a shortage of $1,440. THE five-year limit as relates to pastorates is to be retained in the Methodist Episcopal church, notwithstanding the efforts in the general conference to have it abolished. MELROSE CROSBY, aged 28 years, who has been living on Dry creek, was killed, on the 24th. three miles from Boulder, Col., by lightning. He was riding on a load of hay from Dry creek when the bolt hit him. His body was carried to Boulder, and it was not disfigured in the least. CoL. ALBERT A. POPE, the bicycle maker of Boston, has offered a reward of $500 for the detection of the miscreants who attempted to retard the recent relay race by stretching barbed wire across the riders' roads. AN immense reservoir of 12,000 barrelsof oil, the property of the Standard Oil Co., at Whiting, Ind., exploded, on the 23d. with a terrific force, entailing a loss of $20,000. Theshock was felt 30 miles away, and gave rise toearthquake stories. A BIG mastiff went mad at Anderson. Ind., on the 24th, and attacked Lizzie King, chewing her face in a shocking manner. She will probably die. The dog was shot. Gov. BROWN of Kentucky, on the 24th, signed the "separate-coach bill." The law provides that every passenger railway train shall be provided with a separate coach for negroes. It goes into effect ninety days after the adjournment of the legislature. THE Brotherhood of Locomotive Engineers in session at Atlanta, Ga., reelected Past Master Arthur grand chief engineer for four years. The next international convention will be held in May, 1894, biennial meetings being substituted for annual. CORA NIcHOLLs,the26-year-old daughter of James Nicholls, a wealthy farmer, living near Pittsburgh, Pa., was found dead in a barn by her father, on the 24th, with a bullet hole in herright temple. It is not known whether she was accidentally killed, committed suicide or met with foul play. Her relatives are inclined to the belief that the shooting was accidental, as there was no cause for suicide. THE usual conferments of honor on the occasion of Queen Victoria's birthday anniversary includes this year a peerage for Prince George of Wales with the titles of duke of York, earl of Inverness and Baron Killarney. SirJulian Pauncefote, British minister to Washington, receives the grand cross of the Order of the Bath. Chief-Justice Lacasti, of Quebec, is knighted. PRESIDENT DIAZ of Mexico has appointed Senor Matias Romero, the present minister to the United States, minister of finance: Senor Jos Yves Limantour, assistant secretary of finance, and Senor Gomez Garias, minister to England. No successor to Senor Romero as minister to the United States will be appointed at present. JOHN LANGDON, aged 16 years, and Alva Plant. aged 15 years, of Ostrander, Wis., were drowned in the Little Wolf river. on the 24th, by the capsizing of a boat. THE People's bank of Sea Isle. N. J., has closed its doors. It is stated that the suspension was made on account of lack of business, and it is believed that all depositors will be paid in full. Gov. PRINCE of New Mexico, on the 24th. issued a notice offering $250 reward for information leading to the names of the capitol incendiaries or in-