Article Text

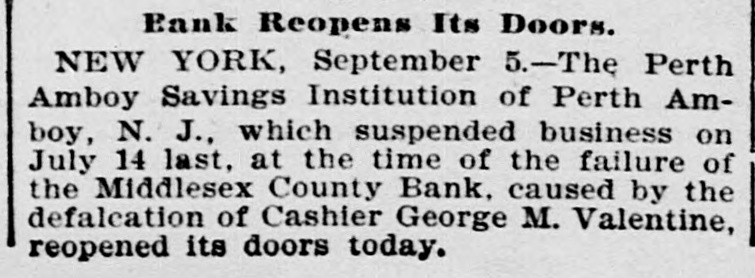

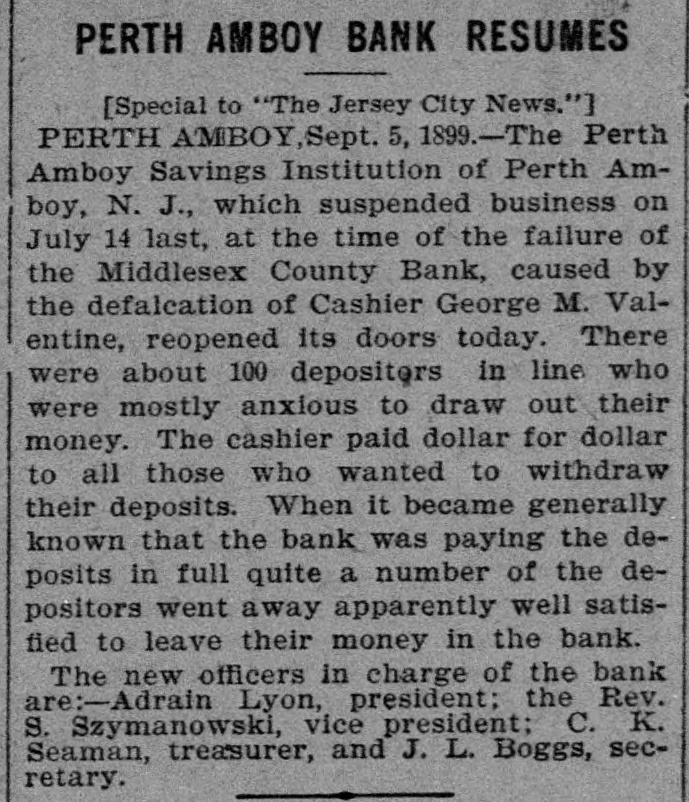

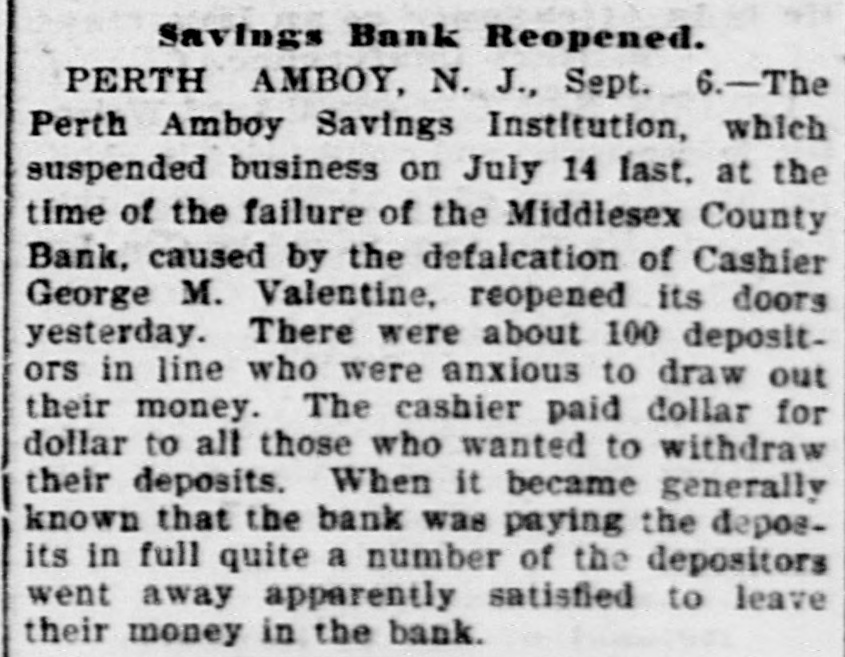

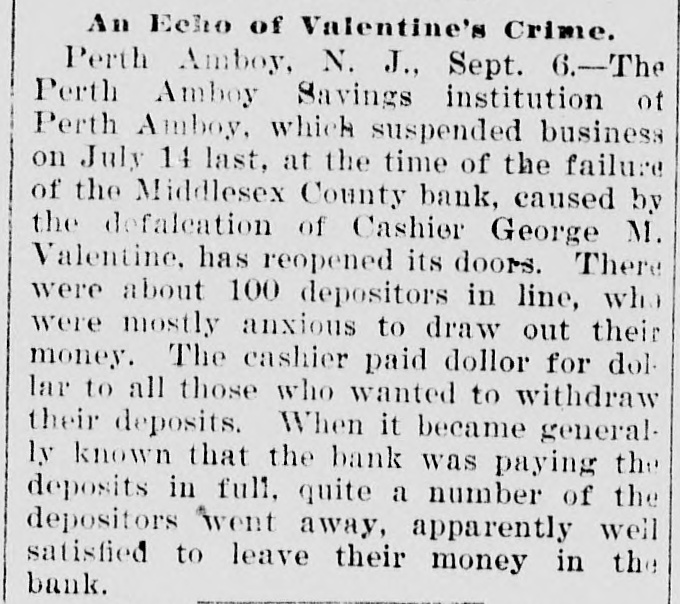

Defalcation Estimated As High As $165,000. Failure Here Had Nothing To Do With Matter. New York, July 14.-George M. Valentine, cashier of the Middlesex County Bank of Perth Amboy, N. J, which was closed this morning, surrendered himself lats today and is now in jall on account of a shortage in the bank's funds which has been estimated as high as $165,003 When it was learned that the Middlesex County bank had "failed to open for tusiness, crowds surfounded the Perth Amtoy Favings institution. The officers of the Middlesex County Bank and the officers of the Perth Ambey Savings Institution are identical, the business of both banks Laving been transacted over the same counters. Hence, to those not familiar with banking details, the suspension at the offices of the one bank seemed to presage the dow full of the other institution. It because necessary to call upon the police to maintain order. U. B. Watson, the president of both banks,Estated that the funds of the Perth Amtoy Savings institution were not touched, that the $300,000 deposited to the account of the savings institution was absolutely safe, and that no matter how badly the Middlesex County Pank had been wrookel, the savings bank would be able to meet all demanda made upon it by the depositors. Thesa words of assurance had the effect of checking the run on the tank. President Watson Iste tonight gave ent 2% statement in which he says that the Ferth Amtoy Huvings Institution was in a perfectly Founa condition and had lost about $7000 which is fully covered by the surplus of $90,030. The total loss by reason of the defalcations has not been fully computed, bnt the estimate given tonight by the examiner places it at about 8123 000. The securities of the sarints part of the bank were found intact in the safe deposit vaulta of the Park National bank to which the cashier had access.