Click image to open full size in new tab

Article Text

BAYARD MAN RECEIVES SHOTGUN WOUND IN LEG WHEN WEAPON DISCHARGED DURING STRUGGLE

Certificates Valid for Repayment

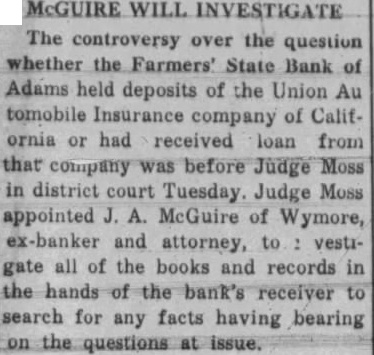

Lincoln. Dec. suit from Gage county the supreme court today reversed action by district court throwing three certificates deposi for total of $5,000 held the Union Automobile Insurance company of the Lincoln in the failed Farmers State Bank of Adams, which the company presented as claims against the guaranty fund. These certificates had been issued originally the Bankers National Insurance company and assigned the Union. Payment contested by the bank receiver and the Guaranty fund commission.

Was Picking Corn When Other Man Enters Field, and gument Ensues

VICTIM IS EXPECTED TO MAKE RECOVERY

Formal Filing of Charges Will Be Made After Ruzicka's Condition Certain

Bayard, Dec. to StarRuzicka, age 27, in the right leg on Tuesday morning during an altercation with Albert when shot discharged during struggle. The full charge the 410 calibre shotgun entered Ruzicka's leg about four inches above the right knee, missing the bone and causing only flesh wound. Ruzicka husking corn on the Dugan farm. miles north Bayard, when Hesseltine proached with the gun in his hand. Ruzicka says that he told the latter not come too near him with the but came on and they engaged in argument. scuffle ensued in which Ruzicka tried obtain the gun which in some manner discharged. Young then went to Ross Chapman farm and forced the latter the point the to take car and drive Hesseltine to what known the corner on the road, where the latter the car and proceeded foot to the Kuhn Brothers ranch, about miles away. and there hired of the men to drive him Alliance. Not having any money, he left the the Kuhn ranch in payment for the trip and taken far as Broncho Lake, near Alliance, where again alighted and continued the rest of the way on foot. In the meantime Ruzicka had summoned assistance and brought to Bayard where he given treatment, and Chief of Police Webb and Irvin Thurston, night marshal. started pursuit of Hesseltine. They arrived Alliance short while after he did and soon located him rooming house He offered no resistance and brought back Bayard for the night and taken the county at Bridgeport Wednesday. Ruzicka, who reported having excellent chances for recovery. states that he can no reason for the attack on him young Hesseltine. The latter, however, refuses to talk except to say that he has ample justification for his the affair. No date been set for Hesseltine's hearing, the nature the charges depending on Ruzicka's recovery.