Article Text

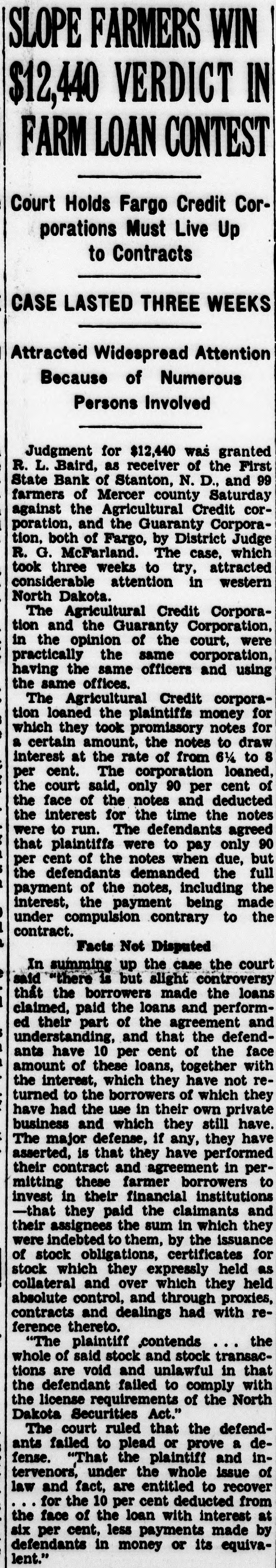

SLOPE FARMERS WIN $12,440 VERDICT IN FARM LOAN CONTEST Court Holds Fargo Credit Corporations Must Live Up to Contracts CASE LASTED THREE WEEKS Attracted Widespread Attention Because of Numerous Persons Involved Judgment for $12,440 was granted R. L. Baird, as receiver of the First State Bank of Stanton, N. D., and 99 farmers of Mercer county Saturday against the Agricultural Credit corporation, and the Guaranty Corporation, both of Fargo, by District Judge R. G. McFarland. The case, which took three weeks to try, attracted considerable attention in western North Dakota. The Agricultural Credit Corporation and the Guaranty Corporation, in the opinion of the court, were practically the same corporation, having the same officers and using the same offices. The Agricultural Credit corporation loaned the plaintiffs money for which they took promissory notes for a certain amount, the notes to draw interest at the rate of from 6½ to 8 per cent. The corporation loaned, the court said, only 90 per cent of the face of the notes and deducted the interest for the time the notes were to run. The defendants agreed that plaintiffs were to pay only 90 per cent of the notes when due, but the defendants demanded the full payment of the notes, including the interest, the payment being made under compulsion contrary to the contract. Facts Not Disputed In summing up the case the court said "there is but slight controversy that the borrowers made the loans claimed, paid the loans and performed their part of the agreement and understanding, and that the defendants have 10 per cent of the face amount of these loans, together with the interest, which they have not returned to the borrowers of which they have had the use in their own private business and which they still have. The major defense, if any, they have asserted, is that they have performed their contract and agreement in permitting these farmer borrowers to invest in their financial institutions -that they paid the claimants and their assignees the sum in which they were indebted to them, by the issuance of stock obligations, certificates for stock which they expressly held as collateral and over which they held absolute control, and through proxies, contracts and dealings had with reference thereto. the "The plaintiff ,contends whole of said stock and stock transactions are void and unlawful in that the defendant failed to comply with the license requirements of the North Dakota Securities Act." The court ruled that the defendants failed to plead or prove a defense. "That the plaintiff and intervenors, under the whole issue of law and fact, are entitled to recover for the 10 per cent deducted from the face of the loan with interest at six per cent, less payments made by defendants in money or its equivalent."