Article Text

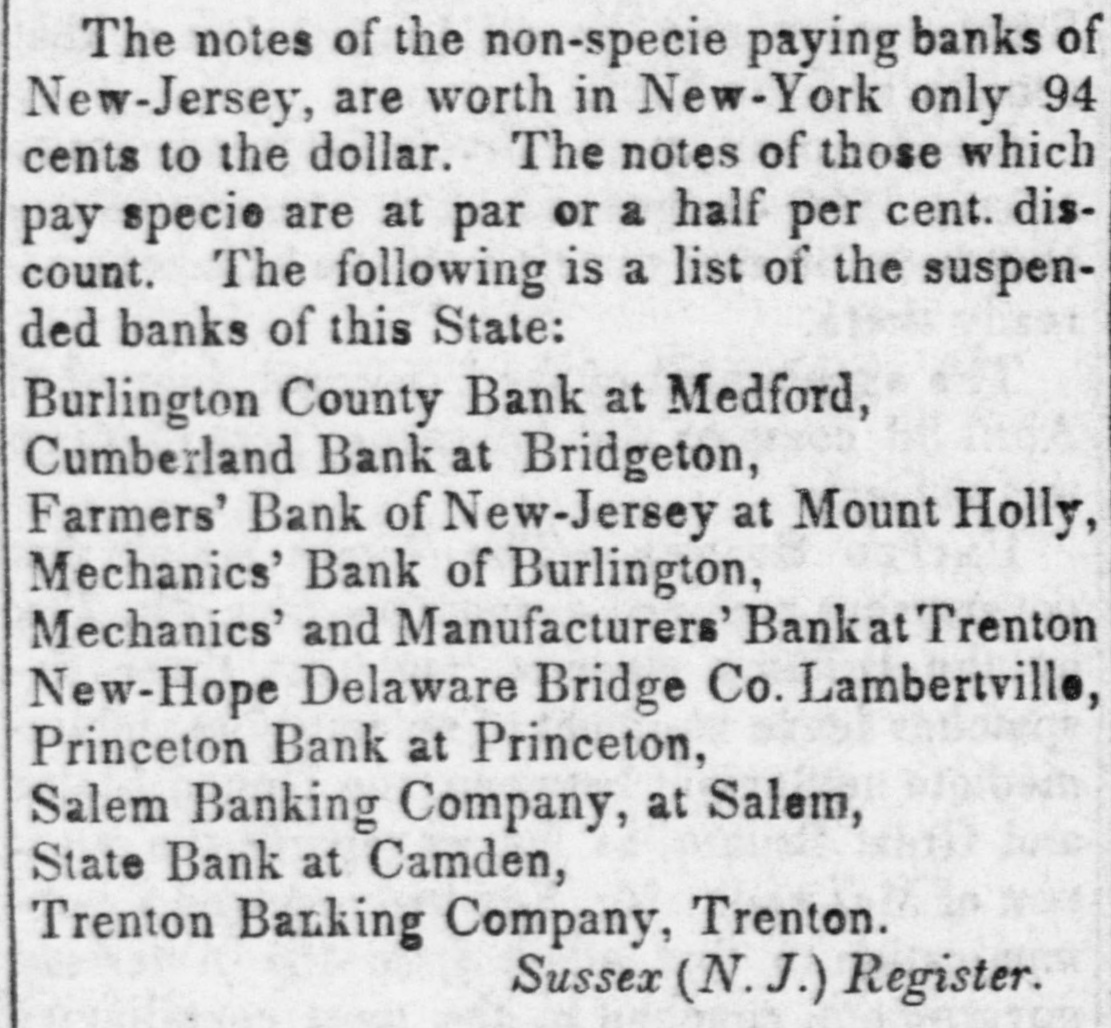

The notes of the non-specie paying banks of New-Jersey, are worth in New-York only 94 cents to the dollar. The notes of those which pay specie are at par or a half per cent. discount. The following is a list of the suspended banks of this State: Burlington County Bank at Medford, Cumberland Bank at Bridgeton, Farmers' Bank of New-Jersey at Mount Holly, Mechanics' Bank of Burlington, Mechanics' and Manufacturers' Bankat Trenton New-Hope Delaware Bridge Co. Lambertville, Princeton Bank at Princeton, Salem Banking Company, at Salem, State Bank at Camden, Trenton Banking Company, Trenton. Sussex (N. J.) Register.