Article Text

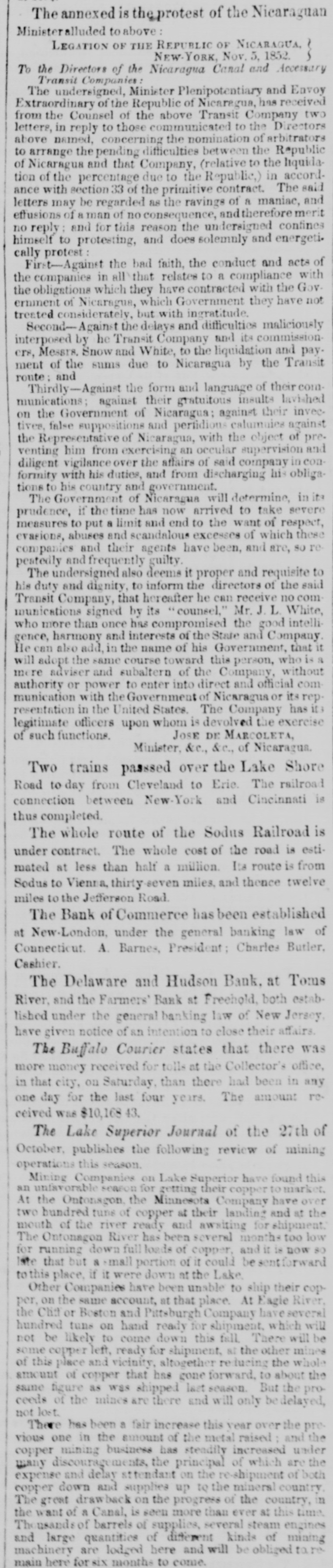

The annexed the protest of the Nicaraguan Minister alluded to above LEGATION OF THE REPUBLIC OF NICARAGUA } NEW-YORK Nov. 5. 1852. To the Directors of the Nicaragua Canal and Accessary Transit Companies: The undersigned, Minister Plenipotentiary and Envoy Extraordinary of the Republic of Nicaragua, has received from the Counsel of the above Transit Company two letters, in reply to those communicated to the Directors above named, concerning the nomination of arbitrators to arrange the pending difficulties between the Republic of Nicaragua and that Company, (relative to the liquidation of the percentage due to the Republic,) in accordance with section 33 of the primitive contract. The said letters may be regarded as the ravings of a maniac, and effusions of aman of no consequence, andtherefore merit no reply and for this reason the undersigned confines himself to protesting, and does solemnly and energeti. cally protest rit-Against the bad faith, the conduct and acts of the companies in all that relates to a compliance with the obligations which they have contracted with the Government of Nicaragua, which Government they have not treated considerately, but with ingratitude. Second-Agains the delays and difficulties maliciously interposed by he Transit Company and its commissioners, Messrs. Snow and White, to the liquidation and payment of the sums due to Nicaragua by the Transit route: and Thirdly-Against the form and language of their communications; against their gratuitous insults lavished on the Government of Nicaragua: against their invectives, false suppositions and pertidious calumnies against the Representative of Nicaragua, with the object of preventing him from exercising an occular supervision and diligent vigilance over the affairs of said company in conformity with his duties, and from discharging his obligations to his country and government. The Government of Nicaragua will determine, in its prudence, if the time has now arrived to take severe measures to put a limit and end to the want of respect, evasions, abuses and scandalous excesses of which these companies and their agents have been, and are, so repeatedly and frequently guilty. The undersigned also deems it proper and requisite to his duty and dignity, to inform the directors of the said Transit Company, that hereafter he can receive no communications signed by its counsel," Mr. J.L. White, who more than once has compromised the good intelligence, harmony and interests of the State and Company He can also add, in the name of his Government, that it will adopt the same course toward this person, who is mere adviser and subaltern of the Company, without authority or power to enter into direct and official communication with the Government of Nicaragua or its rep. resentation in the United States. The Company has it legitimate officers upon whom is devolved the exercise JOSE DE MARCOLETA, of such functions. Minister, &c., &c., of Nicaragua. Two trains passed over the Lake Shore Road to day from Cleveland to Eric. The railroad connection between New-York and Cincinnati is thus completed. The whole route of the Sodus Railroad is under contract. The whole cost of the road is estimated at less than half a million. Its route is from Sodus to Vienna, thirty seven miles. and thence twelve miles to the Jefferson Road The Bank of Commerce has been established at New-London, under the general banking law of Connecticut A. Barnes, President: Charles Butler. Cashier. The Delaware and Hudson Bank, at Toms River, and the Farmers' Bank st Freehold both established under the general banking law of New Jersey, have given notice of an intention to close their affairs. The Buffalo Courier states that there was more money received for tolls at the Collector's office, in that city, on Saturday, than there had been in any one day for the last four years. The amount received was $10,168.43 The Lake Superior Journal of the 27th of October publishes the following review of mining operations this season. Mining Companies on Lake Superior have found this an unfavorable season for getting their copper market At the Ontonsgon the Minnesota Company have over two hundred tuns of copper at their landing and at the mouth of the river ready and awsiting for shipment. The Ontonagon River has been several months too low for running down full loads of copper, and it is now so late that but a mall portion of it could be entforward this place. if it were down at the Lake Other Companies have been unable to ship their copper, on the same account, at that place. At Eagle River, the Chil or Boston and Pittsburgh Company have several hundred tuns on hand ready for shipment, which will not be likely to come down this fall There will be some copper left, ready for shipment, at the other mines of this place and vicinity, altogether reducing the whole amount of copper that has gone forward, to about the same figure as was shipped last season. But the proceeds of the mines are there and will only be delayed, not lost There has been a fair increase this year over the previous one in the amount of the metal raised and the copper mining business has steadily increased under many discouragements the principal of which are the expense and delay attendant on the re-shipment of both copper down and supplies up to the mineral country The great drawback on the progress of the country, in the want of a Canal, is seen more than ever at this time The usands of barrels of supplies, several steam engines and large quantities of different kinds of mining machinery are lodged here and will be obliged tare main here for six months to come.