Click image to open full size in new tab

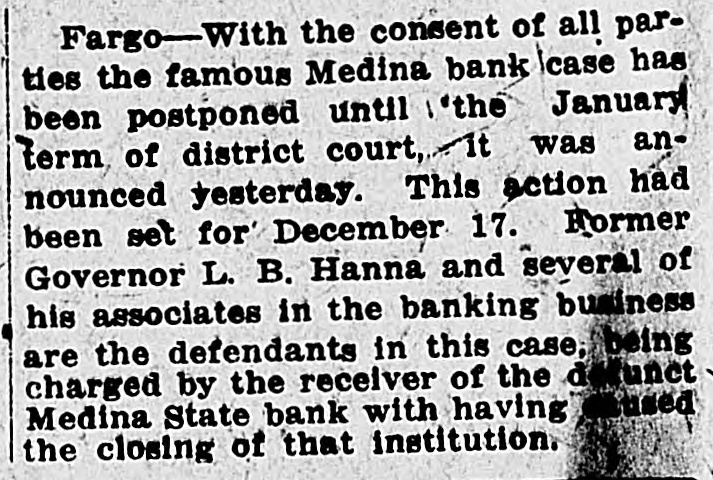

Article Text

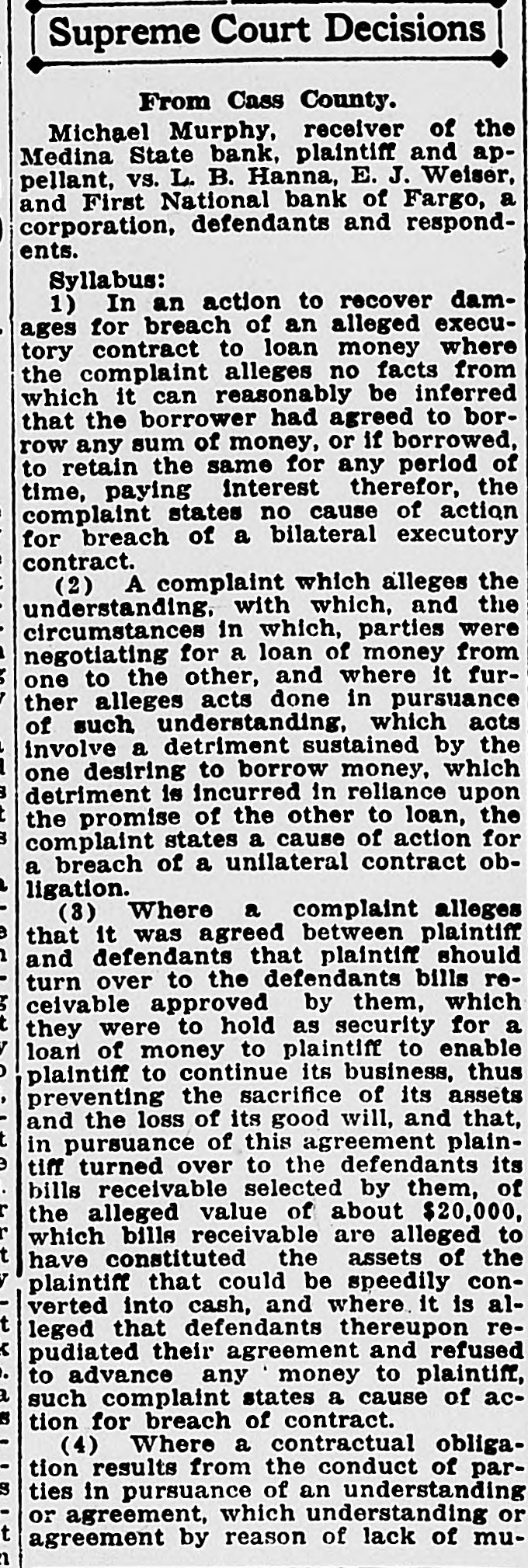

# Supreme Court Decisions

From Cass County.

Michael Murphy, receiver of the Medina State bank, plaintiff and appellant, vs. L. B. Hanna, E. J. Weiser, and First National bank of Fargo, a corporation, defendants and respondents.

Syllabus:

1) In an action to recover damages for breach of an alleged executory contract to loan money where the complaint alleges no facts from which it can reasonably be inferred that the borrower had agreed to borrow any sum of money, or if borrowed, to retain the same for any period of time, paying interest therefor, the complaint states no cause of action for breach of a bilateral executory contract.

(2) A complaint which alleges the understanding, with which, and the circumstances in which, parties were negotiating for a loan of money from one to the other, and where it further alleges acts done in pursuance of such understanding, which acts involve a detriment sustained by the one desiring to borrow money, which detriment is incurred in reliance upon the promise of the other to loan, the complaint states a cause of action for a breach of a unilateral contract obligation.

(3) Where a complaint alleges that it was agreed between plaintiff and defendants that plaintiff should turn over to the defendants bills receivable approved by them, which they were to hold as security for a loan of money to plaintiff to enable plaintiff to continue its business, thus preventing the sacrifice of its assets and the loss of its good will, and that, in pursuance of this agreement plaintiff turned over to the defendants its bills receivable selected by them, of the alleged value of about $20,000, which bills receivable are alleged to have constituted the assets of the plaintiff that could be speedily converted into cash, and where it is alleged that defendants thereupon repudiated their agreement and refused to advance any money to plaintiff, such complaint states a cause of action for breach of contract.

(4) Where a contractual obligation results from the conduct of parties in pursuance of an understanding or agreement, which understanding or agreement by reason of lack of mu-