Article Text

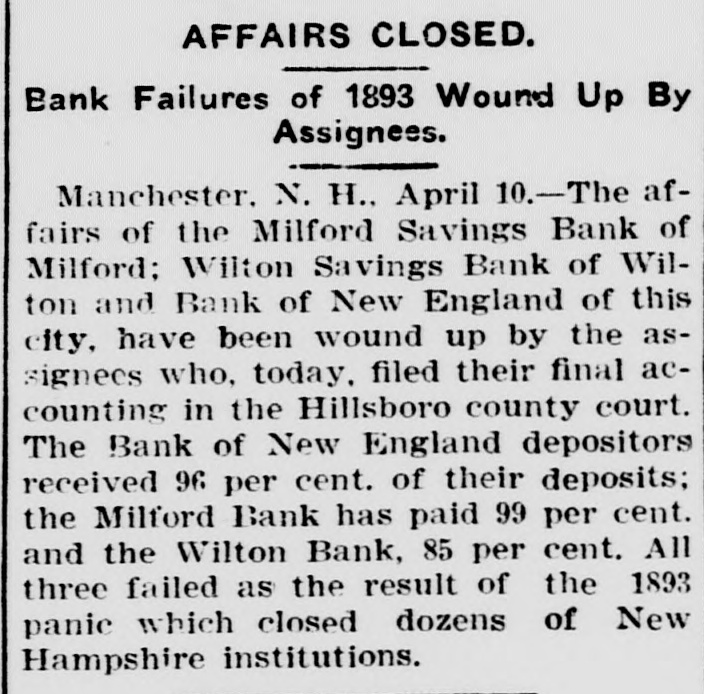

AFFAIRS CLOSED. Bank Failures of 1893 Wound Up By Assignees. Manchester. N. H.. April 10.-The affairs of the Milford Savings Bank of Milford: Wilton Savings Bank of Wilton and Bank of New England of this city, have been wound up by the assignees who, today. filed their final accounting in the Hillsboro county court. The Bank of New England depositors received 96 per cent. of their deposits; the Milford Bank has paid 99 per cent. and the Wilton Bank, 85 per cent. All three failed as the result of the 1893 panic which closed dozens of New Hampshire institutions.