Article Text

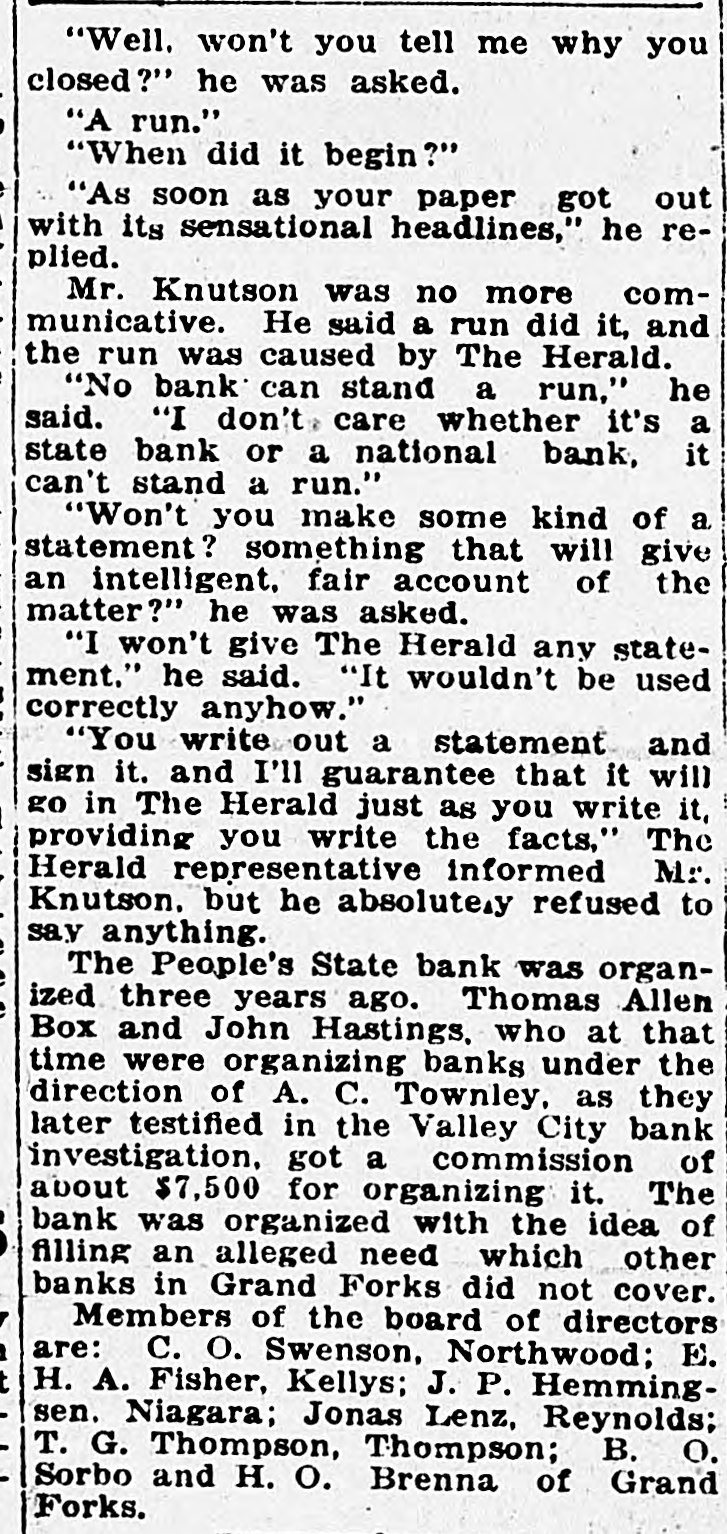

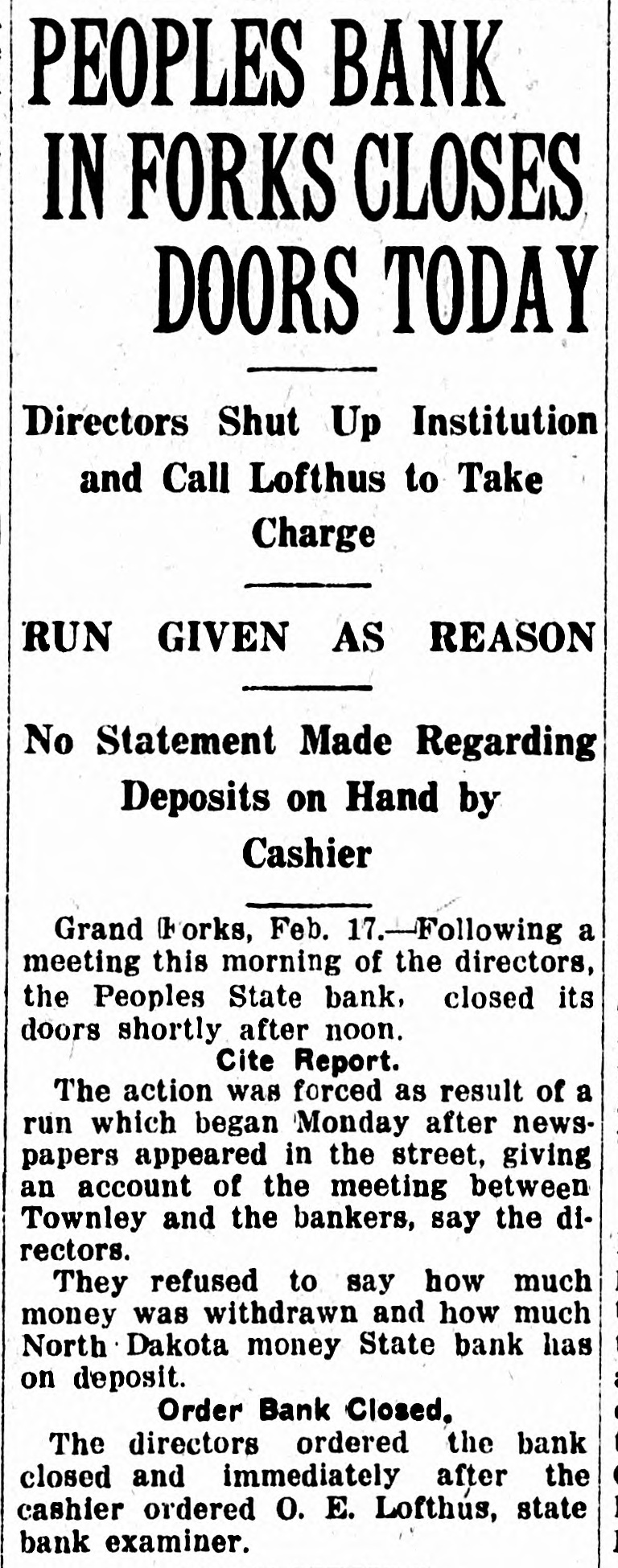

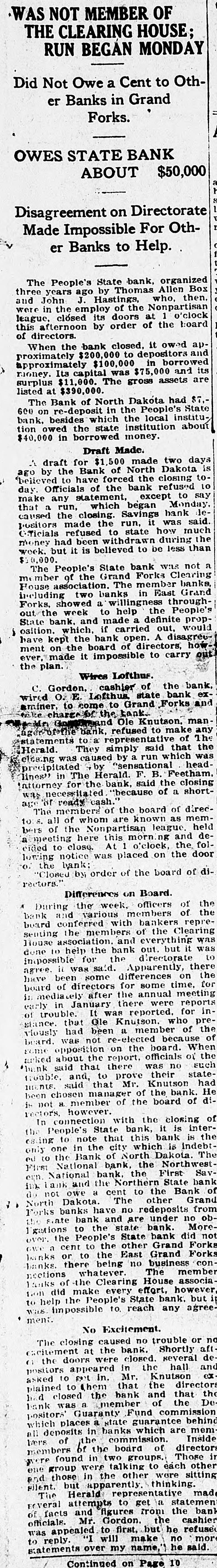

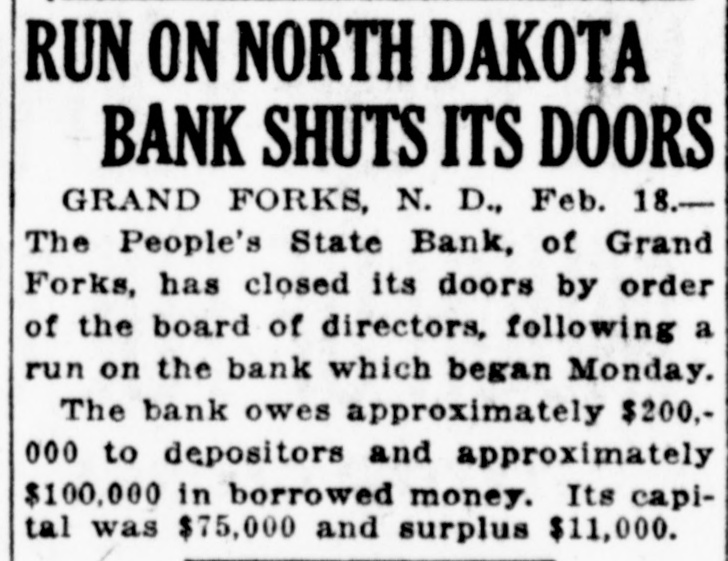

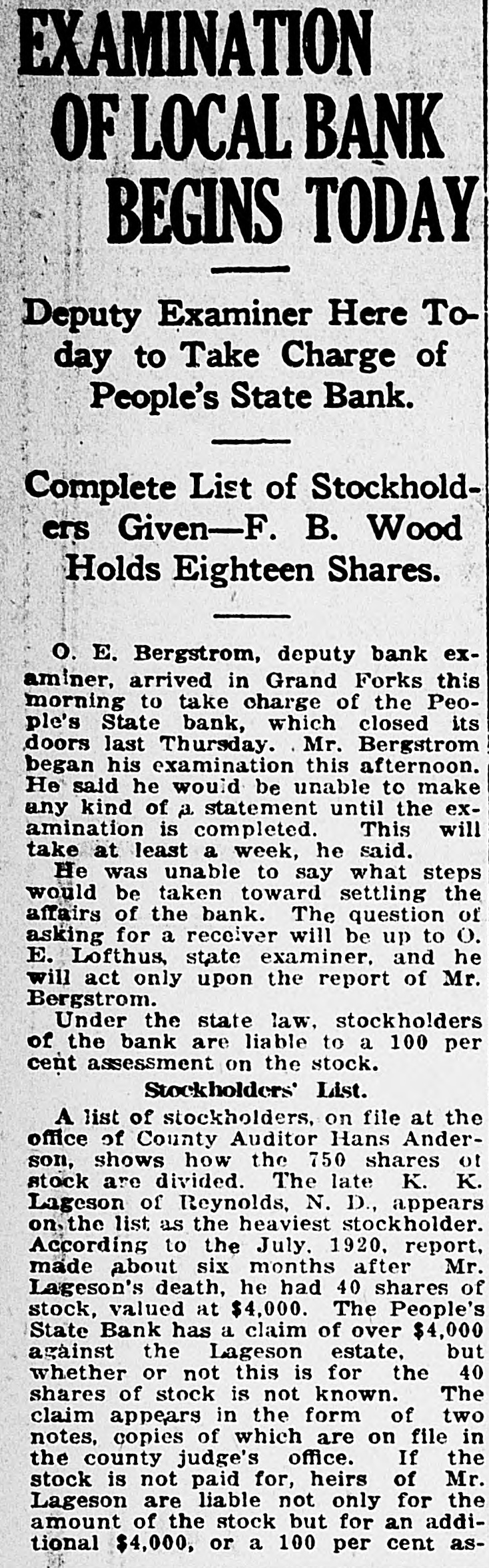

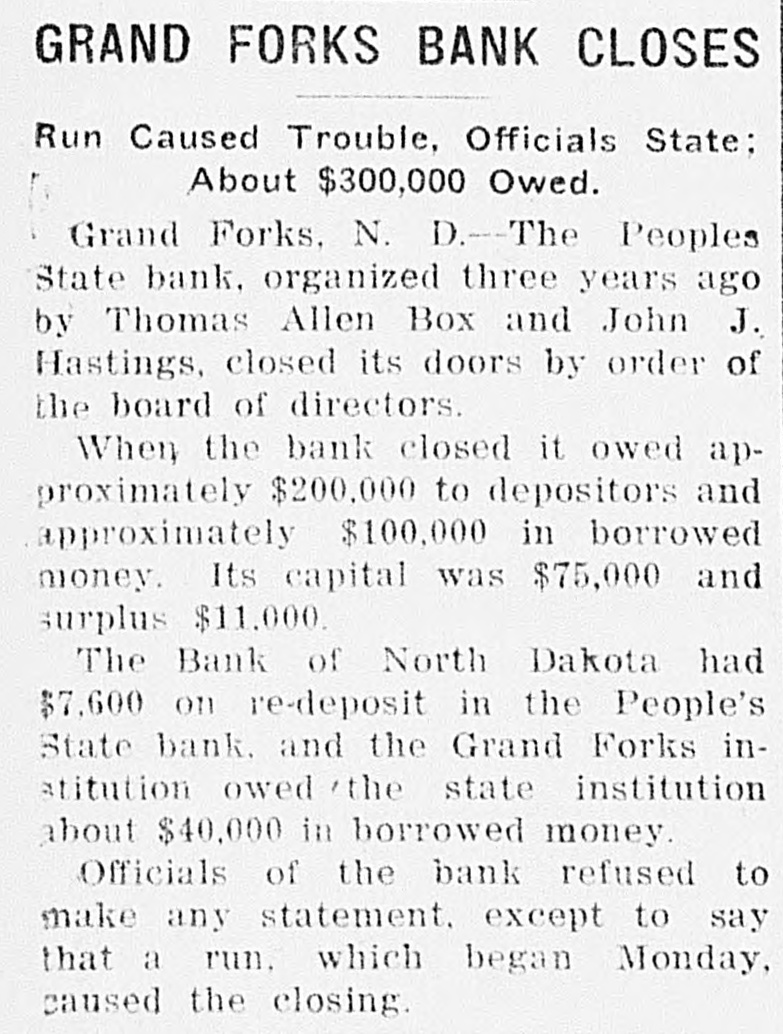

"Well, won't you tell me why you closed?" he was asked. "A run." "When did it begin?" "As soon as your paper got out with its sensational headlines," he replied. Mr. Knutson was no more communicative. He said a run did it, and the run was caused by The Herald. "No bank can stand a run," he said. "I don't care whether it's a state bank or a national bank, it can't stand a run." "Won't you make some kind of a. statement? something that will give an intelligent, fair account of the matter?" he was asked. "I won't give The Herald any statement." he said. "It wouldn't be used correctly anyhow." "You write out a statement and sign it. and I'll guarantee that it will go in The Herald just as you write it, providing you write the facts," The Herald representative informed Mr. Knutson. but he absolute.y refused to say anything. The People's State bank was organized three years ago. Thomas Allen Box and John Hastings, who at that time were organizing banks under the direction of A. C. Townley, as they later testified in the Valley City bank investigation, got a commission of about $7,500 for organizing it. The bank was organized with the idea of filling an alleged need which other banks in Grand Forks did not cover. Members of the board of directors are: C. O. Swenson, Northwood; E. H. A. Fisher, Kellys; J. P. Hemmingsen. Niagara; Jonas Lenz, Reynolds; T. G. Thompson, Thompson; B. O. Sorbo and H. O. Brenna of Grand Forks.