Click image to open full size in new tab

Article Text

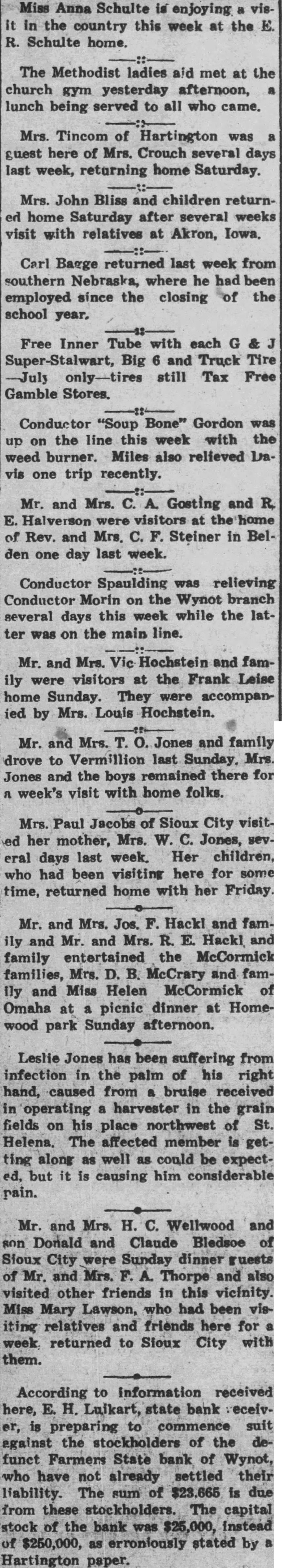

Miss Anna Schulte is enjoying a visit in the country this week at the E. R. Schulte home.

The Methodist ladies aid met at the church gym yesterday afternoon, a lunch being served to all who came.

Mrs. Tincom of Hartington was a guest here of Mrs. Crouch several days last week, returning home Saturday.

Mrs. John Bliss and children returned home Saturday after several weeks visit with relatives at Akron, Iowa.

Carl Barge returned last week from southern Nebraska, where he had been employed since the closing of the school year.

Free Inner Tube with each G & J Super-Stalwart, Big 6 and Truck Tire -July only-tires still Tax Free Gamble Stores.

Conductor "Soup Bone" Gordon was up on the line this week with the weed burner. Miles also relieved Davis one trip recently.

Mr. and Mrs. C. A. Gosting and R. E. Halverson were visitors at the home of Rev. and Mrs. C. F. Steiner in Belden one day last week.

Conductor Spaulding was relieving Conductor Morin on the Wynot branch several days this week while the latter was on the main line.

Mr. and Mrs. Vic Hochstein and family were visitors at the Frank Leise home Sunday. They were accompanied by Mrs. Louis Hochstein.

Mr. and Mrs. T. O. Jones and family drove to Vermillion last Sunday. Mrs. Jones and the boys remained there for a week's visit with home folks.

Mrs. Paul Jacobs of Sioux City visited her mother, Mrs. W. C. Jones, several days last week. Her children, who had been visiting here for some time, returned home with her Friday.

Mr. and Mrs. Jos. F. Hackl and family and Mr. and Mrs. R. E. Hackl and family entertained the McCormick families, Mrs. D. B. McCrary and family and Miss Helen McCormick of Omaha at a picnic dinner at Homewood park Sunday afternoon.

Leslie Jones has been suffering from infection in the palm of his right hand, caused from a bruise received in operating a harvester in the grain fields on his place northwest of St. Helena. The affected member is getting along as well as could be expected, but it is causing him considerable

Mr. and Mrs. H. C. Wellwood and son Donald and Claude Bledsoe of Sioux City were Sunday dinner guests of Mr. and Mrs. F. A. Thorpe and also visited other friends in this vicinity. Miss Mary Lawson, who had been visiting relatives and friends here for a week. returned to Sioux City with them.

According to information received here, E. H. Luikart, state bank eceiver, is preparing to commence suit egainst the stockholders of the defunct Farmers State bank of Wynot, who have not already settled their liability. The sum of $23.665 is due from these stockholders. The capital stock of the bank was $25,000, instead of $250,000, as erroniously stated by a Hartington paper.