Article Text

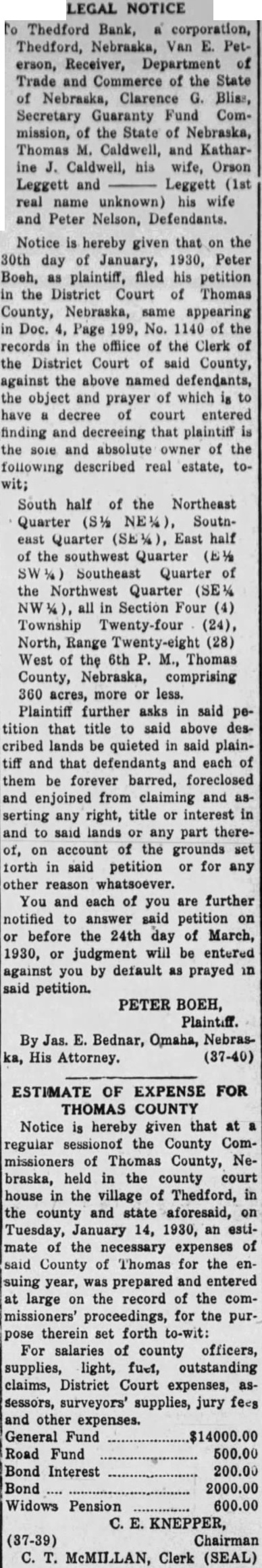

LEGAL NOTICE Thedford Bank, corporation, Thedford, Nebraska, Van Peterson, Receiver, Department of Trade and Commerce of the State of Nebraska, Clarence G. Bliss, Secretary Guaranty Fund Commission, of the State of Nebraska, Thomas M. Caldwell, and Katharine Caldwell, his wife, Orson Leggett and Leggett (1st real name unknown) his wife and Peter Nelson, Defendants. Notice is hereby given that on the 30th day of January, 1930, Peter Boeh, as plaintiff, filed his petition in the District Court of Thomas County, Nebraska, same appearing in Doc. 4, Page 199, No. of the records in the office of the Clerk of the District Court of said County, against the above named defendants, the object and prayer of which to have decree of court entered finding and decreeing that plaintiff the sole and absolute owner of the following described real estate, towit; South half of the Northeast Quarter Southeast Quarter East half of the southwest Quarter Southeast Quarter of the Northwest Quarter (SE% all in Section Four (4) Township (24), North, Range (28) West of the 6th M., Thomas County, Nebraska, comprising 360 acres, more or less. Plaintiff further asks in said petition that title to said above described lands be quieted in said plaintiff and that defendants and each of them be forever barred, foreclosed and enjoined from claiming and serting right, title or interest in any and to said lands or any part thereof, on account of the grounds set forth in said petition or for any other reason whatsoever. You and each of you are further notified to answer said petition on or before the 24th day of March, 1930, or judgment will be entered against you by default as prayed in petition. PETER His Attorney. BOEH, Plaintiff. (37-40) ESTIMATE OF EXPENSE FOR THOMAS COUNTY Notice is hereby given that at regular sessionof the County Commissioners of Thomas County, Nebraska, held in the county court house in the village of Thedford, in the county and state aforesaid, on Tuesday, January 14, 1930, an estimate of the necessary expenses of said County of Thomas for the ensuing year, was prepared and entered at large on the record of the commissioners' proceedings, for the purpose therein set forth to-wit: For salaries of county officers, supplies, light, fuel, outstanding claims, District Court expenses, assessors, surveyors' supplies, fees and other expenses. General Fund $14000.00 Road Fund 500.00 Bond Interest 200.00 Bond 2000.00 Widows Pension 600.00 KNEPPER, (37-39) Chairman McMILLAN, Clerk (SEAL)