Article Text

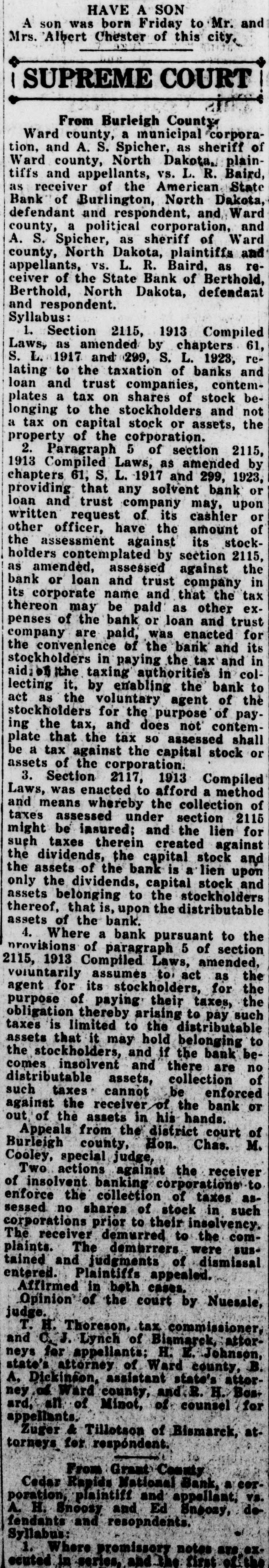

HAVE A SON A son was born Friday to Mr. and Mrs. Albert Chester of this city, SUPREME COURT From Burleigh County Ward county, a municipal corporation, and A. S. Spicher, as sheriff of Ward county, North Dakota, plaintiffs and appellants, vs. L. R. Baird, as receiver of the American State Bank of Burlington, North Dakota, defendant and respondent, and Ward county, a political corporation, and A. S. Spicher, as sheriff of Ward county, North Dakota, plaintiffs and appellants, vs. L. R. Baird, as receiver of the State Bank of Berthold, Berthold, North Dakota, defendant and respondent. Syllabus: 1. Section 2115, 1913 Compiled Laws, as amended by chapters 61, S. L. 1917 and 299, S. L. 1923, relating to the taxation of banks and loan and trust companies, contemplates a tax on shares of stock belonging to the stockholders and not a tax on capital stock or assets, the property of the corporation. 2. Paragraph 5 of section 2115, 1913 Compiled Laws, as amended by chapters 61, S. L. 1917 and 299, 1923, providing that any solvent bank or loan and trust company may, upon written request of its cashier or other officer, have the amount of the assessment against its stockholders contemplated by section 2115, as amended, assessed against the bank or loan and trust company in its corporate name and that the tax thereon may be paid as other expenses of the bank or loan and trust company are paid, was enacted for the convenience of the bank and its stockholders in paying the tax and in aid, the taxing authorities in collecting it, by enabling the bank to act as the voluntary agent of the stockholders for the purpose of paying the tax, and does not contemplate that the tax so assessed shall be a tax against the capital stock or assets of the corporation. 3. Section 2117, 1913 Compiled Laws, was enacted to afford a method and means whereby the collection of taxes assessed under section 2115 might be insured; and the lien for such taxes therein created against the dividends, the capital stock and the assets of the bank is a lien upon only the dividends, capital stock and assets belonging to the stockholders thereof, that is, upon the distributable assets of the bank. 4. Where a bank pursuant to the provisions of paragraph 5 of section 2115, 1913 Compiled Laws, amended, voluntarily assumés to act as the agent for its stockholders, for the purpose of paying their taxes, the obligation thereby arising to pay such taxes is limited to the distributable assets that it may hold belonging to the stockholders, and if the bank becomes insolvent and there are no distributable assets, collection of such taxes cannot be enforced against the receiver of the bank or out of the assets in his hands. Appeals from the district court of Burleigh county, Hon. Chas. M. Cooley, special judge, Two actions against the receiver of insolvent banking corporations to enforce the collection of taxes assessed no shares of stock in such corporations prior to their insolvency. The receiver demurred to the complaints. The demurrers were sustained and judgments of dismissal entered. Plaintiffs appealed. Affirmed in both cases. Opinion of the court by Nuessle, judge. T. H. Thoreson, tax commissioner, and C.J. Lynch of Bismarck, attorneys for appellants; H. E. Johnson, state's attorney of Ward county, B. A. Dickinson, assistant state's attorney of Ward county, and H. Bosard, all of Minot, of counsel for appellants. Zuger & Tillotson of Bismarck, attorneys for respóndent. From Grant County Cedar Rapids National Bank, a corporation, plaintiff and appellant, vs. A. H. Snoosy and Ed Sneozy, defendants and resopndents. Syllabus: 1. Where promissory notes ex-