Article Text

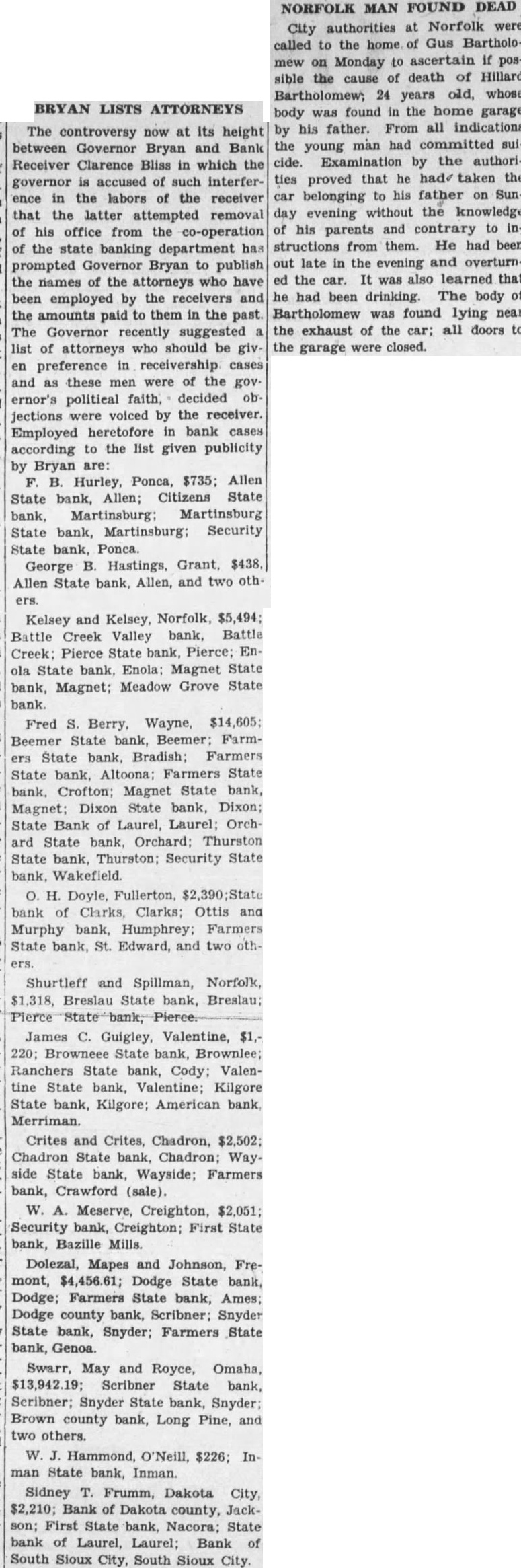

LIGHTNER RETIRES FROM BANK SUIT (Continued from Page One) ceiver matter. The conference between Attorney Beynon and Judge Lightner was not in open court. Another objection made by Beynon to Lightner's participation in based on the fact that the case was to the disLightner was appointed bench by Governor Bryan trict during previous administration. Other cases in which the receivership matter has been heard have come before judges whom Bryan had appointed, Beynon charged, and he believed these judges should be dis qualified The hearing today is to decide the right of Governor Bryan in his attempt to transfer receiverships of failed banks in the state to E. Luikart. newly appointed secretary of trade and of the commerce after he had discharged Clarence Bliss, who was the republican appointee of Governor Weaver as head of the department, and who still holds his appointment by the district courts of the state as the receiver of 200 failed banks. The governor claims that receivof the banking erships are part department and that they are unjurisdiction though receivder his ers are appointed by the courts. There is said to be some contention on the right of the legislature to tell whom they must appoint This is mainly the to contention in the present hearing. Bliss has indicated he will not the transfer of the receiveroppose the applications for ships as long as entered and handled transfers are but he in the regular claims the governor does not have to discharge him from his the right official capacity through the court's appointment. The banks involved in this hearing include the First State bank of North Bend; the Scribner State: Dodge State and the Snyder State bank, all of Dodge county and the Farmers State bank of Belgrade, Boone State bank; Farmers State State bank of Chapman State, Clarks State, Farmers State bank of Farmers State of GenFullerton,