Article Text

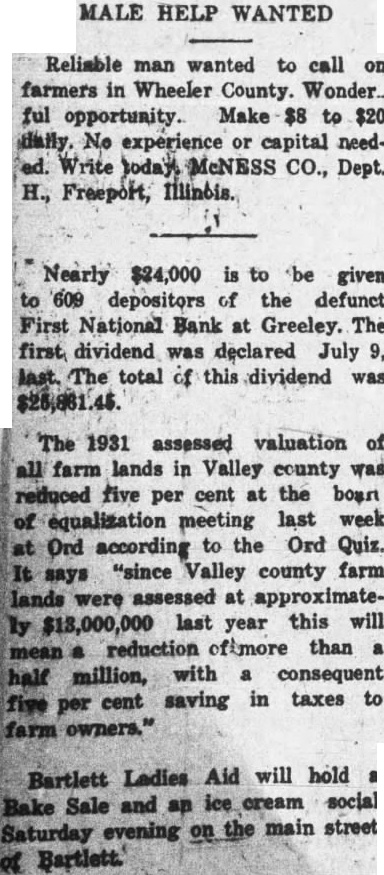

MALE HELP WANTED Reliable man wanted to call on farmers in Wheeler County. Wonder.. ful opportunity. Make $8 to $20 daily. No experience or capital needed. Write today. McNESS CO., Dept. H., Freeport, Illinois. Nearly $24,000 is to be given to 609 depositors of the defunct First National Bank at Greeley. The first dividend was declared July 9, last. The total of this dividend was The 1931 assessed valuation of all farm lands in Valley county was reduced five per cent at the boart of equalization meeting last week at Ord according to the Ord Quiz. It says "since Valley county farm lands were assessed at approximately $13,000,000 last year this will mean a reduction ofimore than a half million, with a consequent five per cent saving in taxes to farm owners." Bartlett Ladies Aid will hold a Bake Sale and an ice cream social Saturday evening on the main street of Bartlett.