Article Text

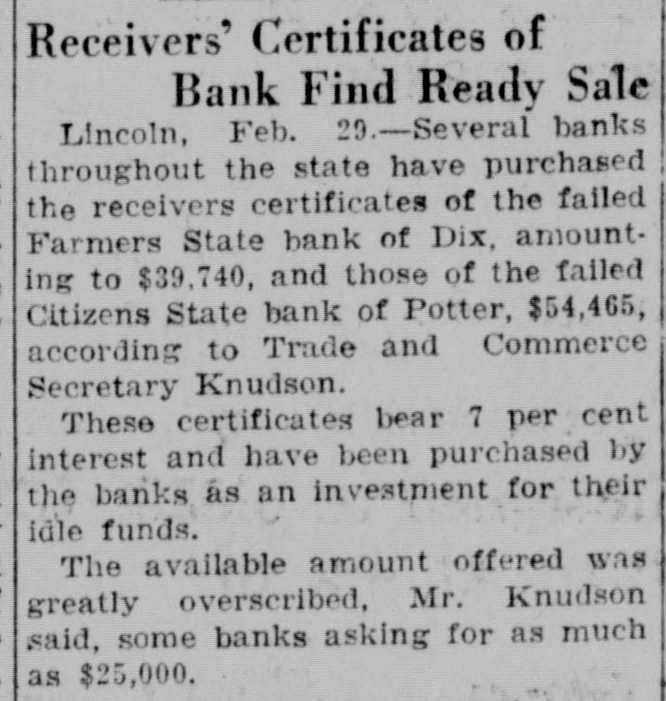

Receivers' Certificates of Bank Find Ready Sale Lincoln, Feb. 29.-Several banks throughout the state have purchased the receivers certificates of the failed Farmers State bank of Dix, amount. ing to $39,740, and those of the failed Citizens State bank of Potter, $54,465, according to Trade and Commerce Secretary Knudson. These certificates bear 7 per cent interest and have been purchased by the banks as an investment for their idle funds. The available amount offered was greatly overscribed, Mr. Knudson said, some banks asking for as much as $25,000.