Article Text

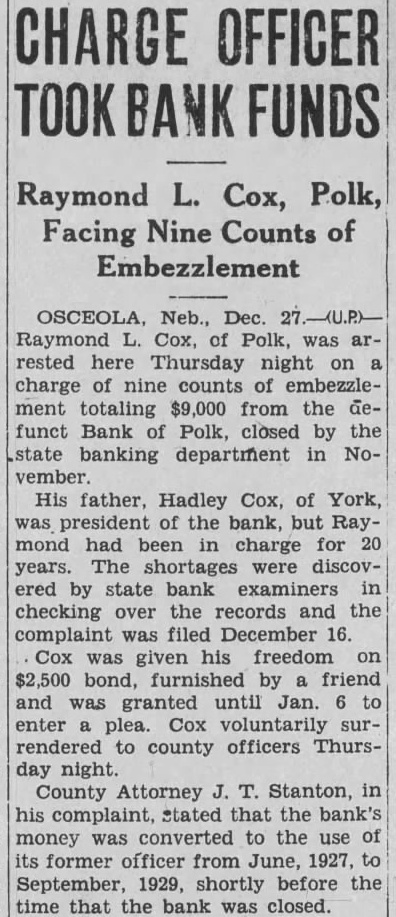

CHARGE OFFICER Raymond L. Cox, Polk, Facing Nine Counts of Embezzlement OSCEOLA, Neb., Dec. Raymond Cox, of Polk, was arrested here Thursday night on charge of nine counts of embezzlement totaling $9,000 from the funct Bank of Polk, closed the state banking department in November. His father, Hadley Cox, of York, was president of the bank, but Raymond had been in charge for 20 years. The shortages were discovered by state bank examiners checking over the records and the complaint was filed December 16. Cox was given his freedom on $2,500 bond, furnished by friend and was granted until Jan. enter plea. Cox voluntarily surrendered to county officers Thursday night. County Attorney Stanton, in his complaint, stated that the bank's money was converted to the use of its former officer from June, 1927, to September, 1929, shortly before the time that the bank was closed.