Article Text

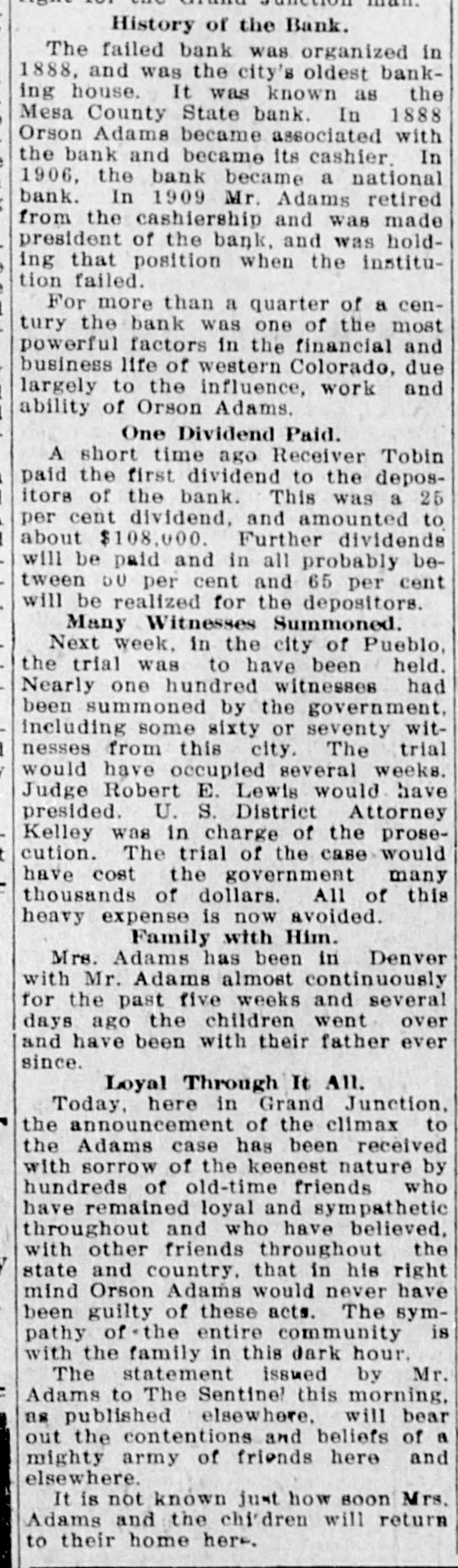

LOT CICC man History of the Bank. The failed bank was organized in 1888, and was the city's oldest banking house. It was known as the Mesa County State bank. In 1888 Orson Adams became associated with the bank and became its cashier In 1906, the bank became a national bank. In 1909 Mr. Adams retired from the cashiership and was made president of the bank, and was holding that position when the institution failed. For more than a quarter of a cenI tury the bank was one of the most powerful factors in the financial and business life of western Colorado, due largely to the influence, work and ability of Orson Adams. One Dividend Paid. A short time ago Receiver Tobin I paid the first dividend to the depositors of the bank. This was a 25 per cent dividend, and amounted to I about $108,000. Further dividends will be paid and in all probably between 50 per cent and 65 per cent will be realized for the depositors. Many Witnesses Summoned. Next week. in the city of Pueblo, the trial was to have been held. Nearly one hundred witnesses had been summoned by the government, including some sixty or seventy witI nesses from this city. The trial / would have occupied several weeks. Judge Robert E. Lewis would have presided. U. S. District Attorney Kelley was in charge of the proset cution. The trial of the case would have cost the government many thousands of dollars. All of this heavy expense is now avoided. Family with Him. Mrs. Adams has been in Denver with Mr. Adams almost continuously for the past five weeks and several days ago the children went over and have been with their father ever since. Loyal Through It All. Today, here in Grand Junction, the announcement of the climax to the Adams case has been received with sorrow of the keenest nature by hundreds of old-time friends who have remained loyal and sympathetic throughout and who have believed, with other friends throughout the y state and country. that in his right mind Orson Adams would never have been guilty of these acts. The sympathy of the entire community is with the family in this dark hour. The statement issued by Mr. Adams to The Sentine! this morning, as published elsewhere, will bear out the contentions and beliefs of A mighty army of friends here and elsewhere. It is not known just how soon Mrs. Adams and the children will return to their home here.