Click image to open full size in new tab

Article Text

STATE CAPITOL NEWS

Seventeen residents of Cass county were granted a temporary restraining order by the federal court against the state department of agriculture to keep the state from cutting down their cedar trees. The petitioners have been notified that their trees were infected by orange reust and wre menacing orchards. The state law provides that where this is true the trees shall be cut down.

The capitol commission has notified the city of Lincoln that it is ready to remove rails and ties of the railroad spur running up to the capitol building. The spur may be classed as railroad seven blocks long, one of the smallest in the country. It is owned by the state and was granted a ten year franchise by the city of Lincoln. $1,200 was deposited with the city to cover the esimated cost of paving damages. When the rails are removed the city of Lincoln must replace the paving at its own expense. The road was used to transport materials for the new capitol building and the state saved thousands of dollars by owning its own transportation system.

The board of pardons met last week and granted six cummutations of sentence, six penitentiary paroles, and five refomatory paroles. It is believed that road building will be considerably curtailed in Nebraska this year due to reduced gasoline tax receipts and lowered federal appropriations. Governor Bryan's campaign expense account was filed recently and showed that the spent $2,698 in the campaign of which $525 went for radio time, $1,230 postage, $692 newspaper advertising and printing, $251 for other expense. The account also gave a list of contributions to his campaign ranging from $9 to $100. Under a court order the state engineer and the state auditor have been restrained from making final payment of $23,000 to a construction company which recently completed the highway viaduct at Grand Island. The action was brought by a surety company which alleges that the construction company is insolvent and asks this protection so that all credStors can be paid. Statements filed by Dwight Griswold, republican candidate for governor, show that he spent $4,336. Of this amount $400 was for postage, $576 for newspaper advertising, $407 for printed matter. The balance was for salaries and miscellaneous expenses through his campaign headquarters. Governor Bryan has appointed a commision of 24 persons headed by Frank D. Eager, Lincoln, to take charge of an exhibit for the state of Nebraska at the Chicago World's Fair which will open in June 1933. The exhibit will depend upon voluntary subscriptions, the soliciting of which will be done by a committee. The governor recommended a $40,000 appropriation to the legislature at the last session. The legislature reduced this to $15,000 and specifying that the state show only alfalfa. The governor vetoed this appropriation as inadequate. The capital commission opened bids on electrical fixtures for the house chamber and for ornamental light posts around the grounds reCently. An estimate submitted by the state auditor placed the complete reost of the capital building at $10,600,565. Total receipts in the capitol fund to date amount to $9,575,000. At present there is a balance of $327,000 on hand. Tax levies for 1931 and '32 will raise about $600,000 up to July 1, 1933. The annual spring round-up of graduates of the University of Ne- braska will be held May 5 and 6. This will allow graduates to attend Ivy Day and other school closing events.

Depositors of failed state banks at Wisner, Anselmo, Hartington, Crab Orchard and Pierce received $104,000 as dividends recently.

Representatives of a drainage district near Dakota City called on the governor and state engineer recently urging that piling of a highway bridge over a creek used by the district be removed. The bridge has caused flooding of the land, it is said.

Harry Sackett of Beatrice has been named as the keynote speaker and temporary chairman of the republican state conyention to be held in Lincoln May 5. The members of the platform committee have also been named.

During the second week in April there were only six bank suspensions in the United States and these were offset by four reopenings. This is a new low record of bank suspensions since 1928 Senator L. J. Dickinson of Iowa has been selected temporary chairman of the republican national con vention and will deliver the keynote address when the gathering opens June 14 in Chicago Nebraska Democrats in attendance at the state convention in Omaha May 5 will hear Fred G. Hawxby, Auburn attorney, who has been chosen as temporary chairman of the meeting and will make the keynote address.

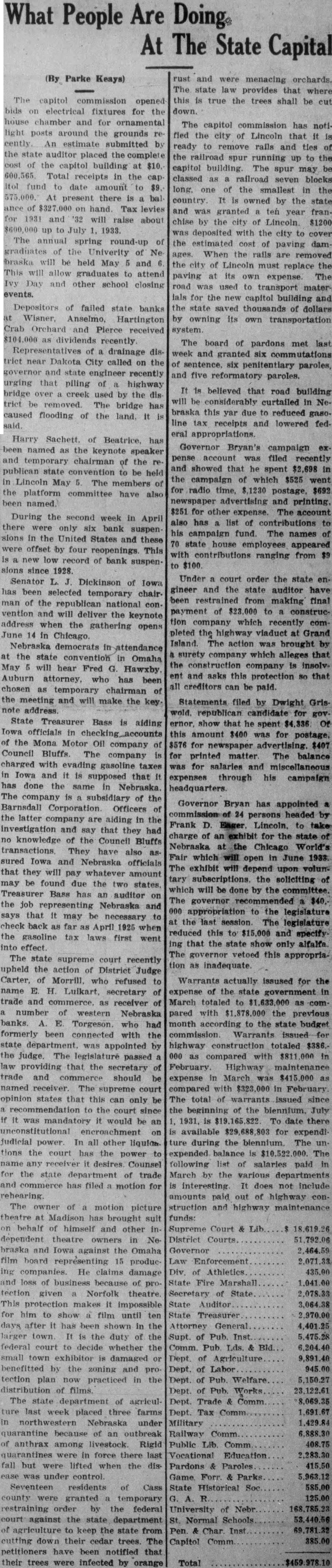

State Treasurer Bass is aiding Iowa officials in checking accounts of the Mona Motor Oil company of Council Bluffs. The company is charged with evading gasoline taxes in Iowa and it is supposed that it has done the same in Nebraska The company is a subsidiary of the Barnsdall Corporation. Officers of the latter company are aiding in the investigation and say that they had no knowledge of the Council Bluffs transactions. They have also assured Iowa and Nebarska officials that they will pay whatever amount may be found to be due the two states. Treasurer Bass has an au ditor on the job representing Nebraska and says that it may be necessary to check back as far as April 1925. The state supreme court recently upheld the action of District Judge Carter of Morill who refused to name E. H. Luikart, secretary of trade and commerce, as receiver of a number of western Nebraska state department, was appointed by banks. A. E. Torgeson, who had formerly been connected with the state department, was appointed by the judge. The legislature passed law providing that the secretary of trade and commerce should be named receiver. The supreme court opinion states that this can only be a recommendation to the court since if it was mandatory it would be an unconstitutional encroachment on judicial power. In all other liquidations the court has the power to name and receiver it desires, Counsel for the state department of trade and commerce has filed a motion for rehearing. The owner of a motion picture theatre at Madison has brought suit on behalf of himself and other in dependent theatre owners in Nebraska and Iowa against the Omaha film board representing 15 producing companies. He claims damage and loss of business because of protection given a Norfolk theatre. This protection makes it impossible for him to show a film until ten days after it has been shown in the larger town. It is the duty of the federal court to decide whether the small town exhibitor is damaged or benefitted by the zoning and protection plan now practiced in the distribution of films. The state department of agriculture last week placed three farms in northwestern Nebraska under quarantine because of an outbreak of anthrax among livestock. Rigid quarantines were inforce there last fall but were lifted when the diseast was under control. Warrants actually issued for the expense of the state government in March totaled to $1,633,000 as compared with $1,878,000 the previous month according to the state budget commission. Warrants issued for highway construction totaled $386,000 as compared with $811,000 in February. Highway maintenance expense in March was $415,000 as com pared with $323,000 in February. The total of warrants issued since the beginning of the biennium, July 1, 1931, is $19,165,822. To date there is available $29,688,803 for expend iture during the biennium. The un expended balance is $10,522,000. The following list of salaries paid in March by the various departments is interesting. It does not include amounts paid out of highway con struction and highway maintenance funds.

Supreme Court and Lib..$ 18,619.26 Districts Courts 51,792.06 Governor 2,464.59 Law Enforcement 2,071.33 Div: of Athletics 485.00 State Fire Marshall 1,041.00 Secretary of State State Auditor 3,064.38 State Treasurer 2,970.00 Attorney General 4,401.00 Supt. of Pub. Inst. 5,475.28 Comm. Pb. Lds. & Bld... 6,204,40 Dept. of Agriculture 9,891.40 Dept. of Labor 945.00 Dept. of Pub. Welfare 5,150.27 Dept. of Pub Works 23,122.61 Dept. Trade & Comm. 8,069.35

Dept. Tax Comm. 1,691.67

Military 1,429.84 Railway Comm. 6,888.30 Public Lib. Comm. 408.75 Vocational Education 2,283.30 Pardons Paroles 415.50 Game, Forr. & Parks 5,963.12 State Historical Soc. 585.00 G. A. R. 125.00 University of Nebr. 168,785.23 St. Normal Schools 53,440.56 Pen. Char. Inst. 69,781.32 Capitol Comm. 385.00

Total

$459,978.10

Hearing was opened last week before district court in Lancaster county in the injunction suit to prevent a referendum proposition on the new truck license law, S. F. 33, at the general election next fall Petitions were submitted in 88 counties of the state and 66,740 signers secured, asking for referendum of the law. A group of men headed by William Banning secured an injunction against the referendum mat ter, alleging that the petitions were not sufficient and had not been properly signed. Depositions have been taken in 80 counties to learn the facts regarding the petitions and the present hearing is with regard to this matter. The outcome of the case will determine whether or not the truck bill will be submitted to the voters at the coming November election.