Article Text

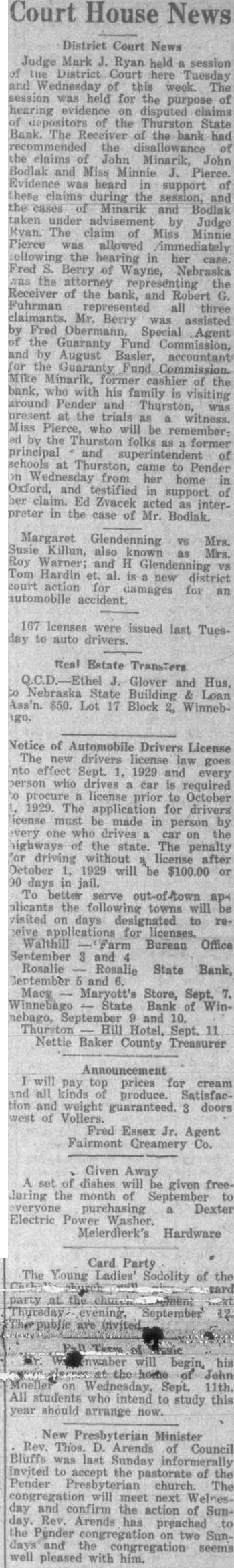

Court House News District Court News Judge Mark Ryan session District Court Tuesday and Wednesday this week. The session was held for the purpose of hearing on disputed claims the State Bank. The of the bank had the claims John Minarik, John Bodlak and Minnie Pierce. Evidence heard support these claims during the and the cases Minarik and Bodlak taken under advisement by Judge Ryan. The claim of Miss Minnie Pierce allowed /immediately the hearing in case. Fred Berry of Wayne, Nebraska Receiver of the bank, and Robert G. Fuhrman all three claimants. Berry was assisted Fred Special Agent the Guaranty Commission, by August Basler, accountant the Guaranty Fund Mike Minarik, the bank, with his around Pender and present trials witness. Miss Pierce, rememberby the Thurston folks former principal and of schools came to Pender from home Oxford, and testified in support her claim. Ed Zvacek acted interpreter in the case of Mr. Bodlak. Margaret Glendenning Mrs. Susie Killun, known Mrs. Warner; and Glendenning Tom Hardin et, al. district court action for damages for an automobile accident. 167 lcenses were issued last Tuesday to auto drivers. Real Estate TransTers Glover and Hus. Nebraska State Building Loan Ass'n. $50. Lot 17 Block Notice of Automobile Drivers License The drivers license law goes nto effect Sept. 1929 and every person drives car is required procure license to October 1929. The application for drivers icense must made person drives ighways the state. penalty driving without license after October 1929 will $100.00 days jail. To better serve out-of-town ap+ plicants the following towns will visited on days designated to refor licenses. Walthill Bureau Office Sentember and Rosalie Rosalie State Bank, and Macy Maryott's Store, State Bank nebago, and 10. Hotel, Sept. 11 Nettie Baker County Treasurer Announcement will pay prices for cream all kinds produce. tion and guaranteed. doors west of Vollers. Fred Essex Jr. Agent Fairmont Creamery Co. Given Away set dishes will given freeduring the month of Dexter Electric Meierdierk's Hardware Card Party The Young Ladies' Sodolity of the sard September Sept. 11th. All students who intend study this year should arrange now. New Presbyterian Minister Thos. Arends Council Bluffs was last Sunday invited accept the pastorate of the Pender church. The congregation and confirm the action of SunRev. Arends preached Pender congregation two Suncongregation seems well pleased with him.