Article Text

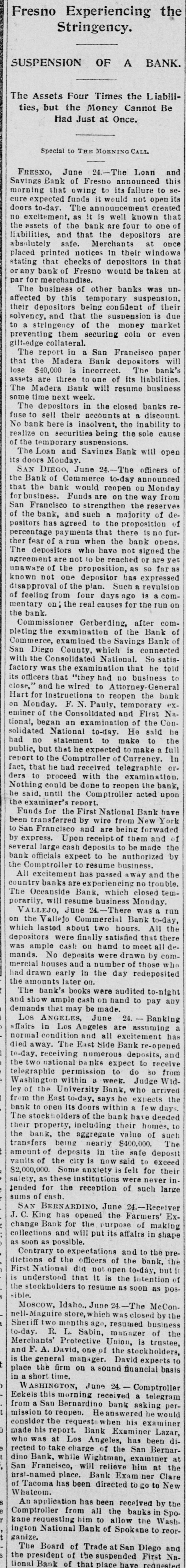

Fresno Experiencing the Stringency. SUSPENSION OF A BANK. The Assets Four Times the Liabilities, but the Money Cannot Be Had Just at Once. Special to THE MORNING CALL FRESNO. June 24.-The Loan and Savings Bank of Fresno announced this morning that owing to its failure to seexpected funds it would not open its created doors cure to-day. The announcement that excitement, as it is well known no the assets of the bank are four to one are liabilities, and that the depositors absolutely safe. Merchants windows at once placed printed notices in their stating that checks depositors in that at or any bank of Fresno would be taken par for merchandise. The business of other banks was unaffected by this temporary suspension, their their depositors being confident of due solvency, and that the suspension market is stringency of the money preventing to a them securing coin or even gilt-edge The report collateral. in a San Francisco paper will that the Madera Bank depositors bank's $40,000 is incorrect. The lose are three to one of its liabilities. assets The Madera Bank will resume business some time next week. The depositors in the closed banks discount. reto sell their accounts at a fuse bank here is insolvent, the inability to realize on securities being the sole cause of the temporary suspensions. The Loan and Savings Bank will open its doors Monday. SAN DIEGO, June 24.-The officers of Bank of Commerce to-day announced that the the bank would reopen on Monday for business. Funds are on the way from San Francisco to strengthen the reserves of the bank, and such majority of de- of positors has agreed to the proposition furpercentage payments that there is no ther fear of run when the bank opens. The depositors who have not signed agreement are not to be reached or are yet unaware of the proposition, as so fara known not one depositor has expressed disapproval of the plan. Such revulsion of feeling from four days is a commentary on: the real causes for the run the bank. Commissioner Gerberding, after com- of pleting the examination of the Bank Commerce, examined tb Savings Bank San Diego County, which is connected with the Consolidated National. So satisfactory was the examination that he told officers that "they had no busine33 close," its and he wired to Attorney-General Hart for instructions to reopen the bank ex on Monday. F. N. Pauly, temporary Na. eminer of the Consolidated and First tional, began an examination of the Consolidated National to-day. He said to the he had no statement to make public, but that he expected to make full report to the Comptroller of Currency. In fact, that he had received telegraphic or ders to proceed with the examination. Nothing could be done to reopen the bank, said, until the Comptroller acted upon the examiner's report. Funds for the First National Bank have been transferred by wire from New York to San Francisco and are being forwaded by express. Upon receipt of them and the of several large cash deposits to be made by bank officials expect to be authorized the Comptroller to resume business. All excitement has passed away and the country banks experiencing no trouble The Oceanside Bank, which closed temporarily, will resume business Monday. VALLEJO, june 24.-There was run on the Vallejo Commercial Bank to-day. the which lasted about two hours. All depositors were finally satisfied that there ample cash on hand to meet all de mands. was No deposits were drawn by com- who mercial houses and number of those had drawn early in the day redeposited the amounts later on. The bank's books were audited to-night and show ample cash on hand to pay any demands that may be made. Los ANGELES, June 24. Banking affairs in Los Angeles are assuming has a normal condition and all excitement died away. The East Side Bank re-opened and to-day, receiving numerous deposits, the two national anks expect to receive from telegraphie permission to do 50 Washington within a week. Judge Widof the University Bank. who arrived the ley from the East to-day, says he expects bank to open its doors within few days The stockholders of the bank have deeded their property, including their homes, to the bank, the aggregate value of such transfers being nearly $400,000. The amount of deposits in the safe deposit vaults of the city is now said to exceed $2,000,000. Some anxiety is felt for their safety, as these institutions were never in tended for the reception of such large sums of cash. SAN BERNARDINO, June 24.-Receiver J. C. King has opened the Farmers' Exchange Bank for the purpose of making collections and will put its affairs in shape as soon as possible. Contrary to expectations and to the predictions of the officers of the bank, the First National did not open to-day, but understood that it is the intention of is the stockholders to resume as soon as possible. Moscow. Idaho.. June 24.-The McConnell-Maguire store, hich was closed by the Sheriff two months ago, resumed business to-day. R. L. Sabin, manager of the Merchants' Protective Union, is trustee, and A. David, one of the stockholders, is the general manager. David expects place the firm on a sound financial basis in a short time. WASHINGTON, June 24. - Comptroller Eckels this morning received a telegram from San Bernardino bank asking permission to reopen. Heanswered he would consider the request when his examiner made report. Bank Examiner Lazar, who was at Los Angeles, has been directed to take charge of the San Bernardino Bank, while Wightman, examiner at San Francisco, will relieve him at the first-named place. Bank Examiner Clare of Tacoma has been directed to go to New Whateom. An application has been received by the Comptroller from all the banks in Spokane requesting him to allow the Washington National Bank of Spokane to reorganize. The Board of Trade at San Diego and the president of the suspended First Nalional Bank of that place have requested