Article Text

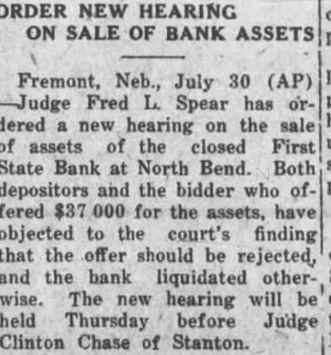

BUFFALO COUNTY. ELMCREEK BEACON NOTES. Mrs. Will Vogt underwent a major operation in the hospital at Kearney last Saturday. Born, to Mr. and Mrs. V. O. Forsland (Alta Grace Craig) of Kearney, March 19. son. John Nickel lost three stacks of hay this week when fire blew from a burning stack bottom. Mrs. L. W. Corlise. of Kearney, visited her daughter, Mrs. C. S. Hendrickson, from Friday until Tuesday. Mrs. Martha Milbourn received telegram Friday telling of the sudden death of her granddaughter, Mrs. Tom Headley Friday morning. March 16. Floyd Worthing and family are making visit with relatives in Litchfield this week, taking advantage of time before Jake Smith leaves the store for his own store at Miller. Earl Kenfield stopped off in Elm creek Tuesday to visit his family He is employed on an A. T. and T, gang, which were routed to North Platte to string a stretch of wire in new circuits to the coast. GIBBON REPORTER NOTES. Miss Helen Frederick, who has been at the hospital In Kearney the past two weeks, is gradually improving Mr. and Mrs. Milt Beebe arrived home Monday from Hot Springs, Ark., where they spent the winter months. Mrs. Hunter of Kearney. who was a member of the Woman's Study League while living here, attended the reunion banquet Supt. G. W. Eaton, formerly of Glbbon, re-elected as superintendent of the Maxwell schools for two years at a substantial increase in salary Some of the members of the Woman's Study League attended the Kearney club banquet at the new Fort Kearney Hotel, Wednesday Joseph Bauer died at the home of his son, John, Tuesday at about noon. Several days ago Mr. Bauer had another stroke from which he did not rally Much encouraging sentiment was prevalent at the meeting held Tuesday evening for the promotion of a cheese factory at Kenesaw. Chester Webster received a painful injury last Saturday when he fell from a scaffolding and broke his arm and also his-shoulder SHELTON CLIPPER NOTES. DEPOSITORS SUE BANK. Mr. and Mrs. Oscar Hall are the parPremont. Neb., March 26.-A suit to ents of daughter. born Sunday compel the First State bank, or North March 18. Bend. now in the hands of the guar- Editor C. E. Johnson, of the Gibantee fund commission, to pay $17,- hon Reporter, who has been ill the past 000 held in certificates of deposit to few weeks with auto-intoxication, is depositors has been instituted in dis- reported as being improved at this trict court by eight depositors. This is time. the second such case in a short time, Mrs. George W. Smith left Wedmaking the total involved nearly $30.- nesday for York to attend the state 000, The petitions sets forth that the D. A. R. conference in there money rightfully belongs to the plain- this week. Mrs. Smith is the regent tiffs and should be paid to them. A of the Shelton chapter. similar case against the Snydey State Attorney H. G. Wellensiek, of Grand bank was decided in favor of the plain- Island, a Shelton business visitor tiffs in the lower court and is now Monday, being here on the opening pending in the supreme court. day of the First State bank, of which he is the president. H. C. (HI) Porter, motorman on Idaho apples $1.00 box. East of City a Los Angeles electric car, was fatally National Bank. injured Monday near Van Nuys, Cali fornin. when two ears on single track Kodak Enishing. Midwess Gamera Shop met in a headon collision. C. J. Hornsby came over from Hastings Monday and spent two days here serving as cashier of the First State bank, and getting acquainted with eustomers of the new financial institution. J. T. Allen received a telegram on Sunday morning conveying the news of the death of his mother, Mrs. Elvira Allen, which occurred at nine p. m. Saturday at the home of her daughter. Mrs. McMahon, in San Francisco, RAVENNA NEWS NOTES. Bill Eckerson spent one day last week in Kearney on business. The mother of Miss Ida Ruble, of Ravenna, died in a hospital at Norfolk, Thursday morning of last week. Miss Eva Stearman, fifth grade teacher in the Ravenna public schools, was severely bitten by a dog Monday evening. Mrs. A. A. Mrkvicka was taken to the St. Francis hospital in Grand Island. Monday, in the Love ambulance. Anton Jelinek has recently started construction of a double garage on bis two lot property aeross the street and north from the Catholic church. A. Froelich, of Gibbon, who has been manager of the Farmers Produce company for the past several months, has obtained complete control of the plant by purchase from the former owner, K. J. Powell. Ralph Mingus. son of O. P. Mingus, of Ravenna, and for many years one of Ravenna high schools most stellar athletes, is visiting in Ravenna this week. Mr. Mingus is in Y. M. C. A. work in Chicago