Article Text

(SYLLABUS) Before in insolvent bank money an may be recovered on the trust fund theory, claimant must show facts to prove that it not simply general deposit.

Heard before Goss, Rose, Good, Eberly and Paine, PAINE, This claim by the heirs for payment in full of the balance of deposit made in bank by the executor of the estate, which bank has since become insolvent. James C. Flannigan vicepresident and one of the managing officers of the Citizens Bank of Stuart. While such officer, he was appointed by the county court of Keya Paha county as executor of the tate of John Thomas Payn. A public sale was the property of said Payn on July 25, 1928, being the date of his death, and the said Flannigan deposited more than in said bank as the proceeds of said sale. This deposit made was in the name, Estate of John Thomas Payn, deceased, James C. Flannigan, executor." Checks were drawn said fund by the executor until the balance of the deposit amounted to $4,020.95, at which time the bank went into the hands of receiver. After the bank failed, the county court assigned the funds in the bank to the heirs, who filed their petition of intervention in the district court for against the receiver of bank, alleging that they entitled to payment in full. The receiver denied the liability, and upappeal to the district court it was held that the funds so deposited but general claim, and not trust fund. Among the propositions of law advanced for the reversal of this order of the district court by the appellants are these: The right to follow trust funds is property right, and includes all situations where there fiduciary position, or where one person has the legal title or possession of but property, its ownership is in another; trust funds do not lose their character by being deposited in bank, so long as such funds can distinguished in the hands of the trustee. The general rule that of deposit funds, rightfully made by an executor, cannot be impressed with trust after the bank in which it placed becomes insolvent set out Gray Elliott, 361, 53 554, in which case pointed out that when the bank fails virtually disappears as responsible and party, the rights and equities of the general depositors must be considered. Section Comp. 1929. provides generally that the claims depositors shall, at the time of the closing of bank be first lien on all the assets of such bank: but it was held in State Farmers State Bank, 121 Neb. 532, 237 857, (notes, pp. that this did not to apply fund converted by the bank trustee to own use. This court has held that, where the trust property can be specifically identified, and so found in the hands the insolvent bank's receiver, the beneficial owner may recover the same. Higgins Hayden, 53 Neb. 280. Many courts have held that, where specific money marked and kept separate and intact, unmingled with the money of the bank, the owner is entitled to the full recovery thereof. St. Augustine Paint McNair, 59 Fed. (2d) 755. deposit in bank in the ordinary course of its business presumed be general deposit, even if made by an executor. Leach Beazley, 337, 374. The executor in the case at bar had

(SYLLABUS) Items sent to bank for collection and the proceeds thereof are held in trust for the owner. Where collecting bank attempts to remit by draft on collection item. which attempt fails on account of its insolvency, the trust character of the fund is not destroyed in the absence of request for or an agreement to take exchange of the bank in payment. Check or draft ordinarily does not discharge an obligation, unless paid. 4. Whether bank, which fails, after collecting an item. debtor or trustee will be determined by the tent of the parties.

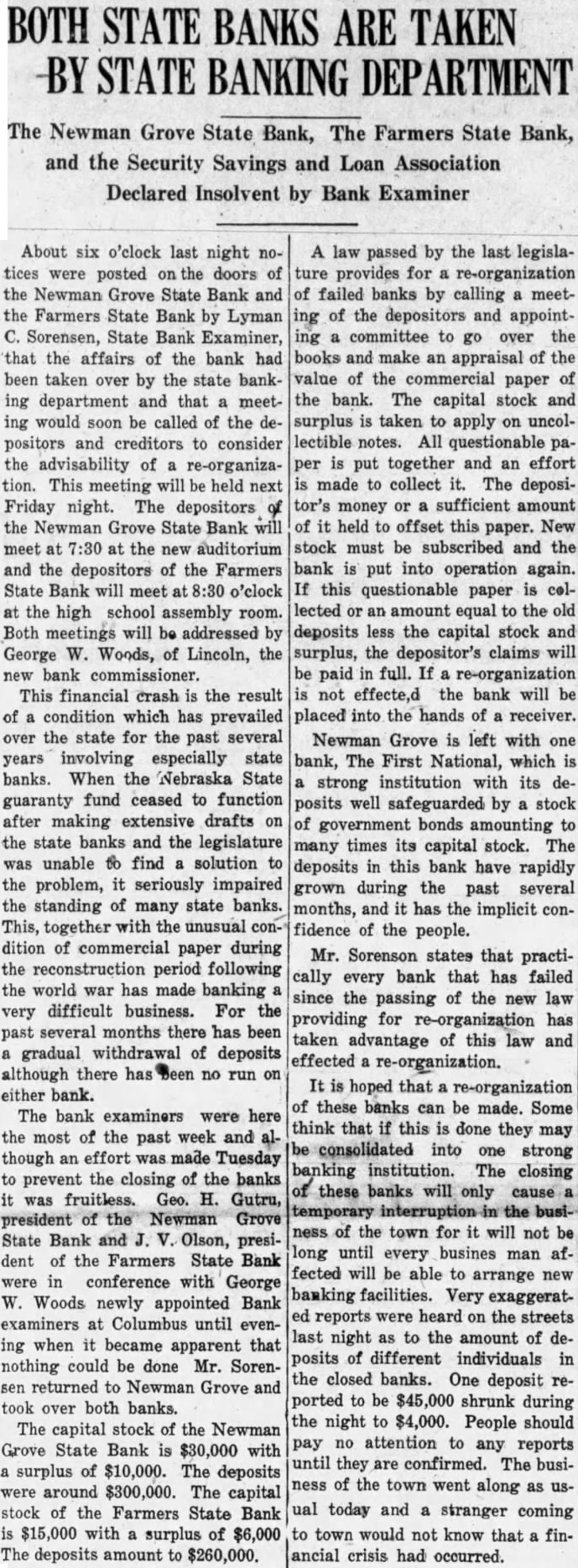

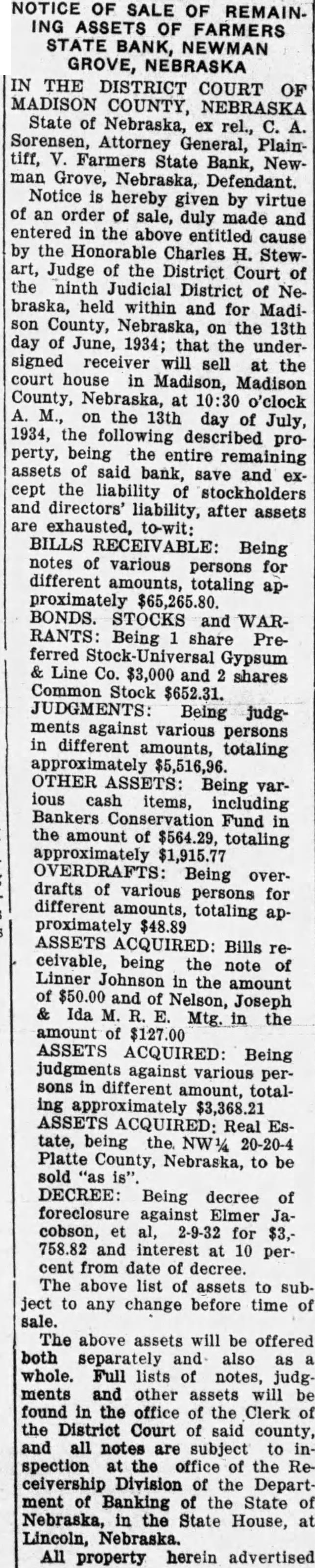

Heard before Goss, C. Rose, Dean, Eberly, Day and Paine, JJ. DAY, This proceeding to establish claim against the insolvent Farmers State Bank of Newman Grove and to impress the assets thereof with trust. The Federal Reserve Bank of Kansas City sent the state bank various checks drawn upon it directly to it by mail for collection. The two banks did not carry reciprocal counts, but the state bank, as the collecting bank, was bound to remit the proceeds. This the state bank tempted to do by sending its draft on correspondent bank, which was not paid because of the insolvency of the state bank. The trial court held that the Federal Reserve Bank had valid claim against the state bank and impressed the assets with trust, entitled to priority over claims of depositors and general creditors. This transaction occured few days before section Comp. St. 1929 (the uniform collection law) took effect, 80 it is not governed by it.

The checks and the proceeds thereof were held the by state bank as trustee (State Nebraska State Bank, 120 Neb. 539; Laws 1925, ch. 29) and the judgment of the trial court right, unless, as contended by the receiver of the state bank, there an express or implied agreement that remittance should be made by draft, which amounted to purchase of the exchange of the Farmers State Bank by the Federal Reserve Bank. Under an express agreement between the two banks, the state bank was to collect and mit. By custom of long standing, the state bank had remitted by draft, and from this argued that the Federal Reserve Bank, with knowledge of this custom, exchanged its checks for the draft of the state bank and established the relation of debtor and creditor, rather than that of cipal and agent. If this be true, then the character of the fund was immediately upon the issuance of the draft. the instant case, the contract tween the forwarding and receiving banks did not arise of out custom, but out of an agreement between them, by which the collecting bank agreed to collect the to and remit at to the once forwarding bank. The forwarding bank in this case had no desire or intention to purchase the of the exchange state bank. It was their this purpose, by transaction, to collect upon the checks drawn on the state bank in cash or its equivalent. While it true that for long time the state bank had mitted by means of its draft and that the Federal Reserve Bank had accepted said draft, the draft was the medium by which the state bank tempted to remit and heretofore had transferred funds of which was trustee. If the draft accomplished the of the trust purpose transferring fund from the state bank to the Federal Reserve Bank, then the trust fund extinguished by payment, but on the other the draft was not paid upon presentation, then there was no transfer of the funds. check or draft is never of payment an unless the check is paid. bad check never valid obligation. Omaha Nat. Bank Brady State Bank, 113 Neb. 711. In determining whether or not bank which, after collecting check itself, upon fails debtor or trustee, the court will look to the intent of the parties. Federal Reserve Bank Peters. Bank of Poplar Bluff Millspaugh, Mo. 412. collecting bank's obligation is pay the proceeds of collection in cash or its equivalent. This duty not discharged until the fund is put into the possession of the the bank chooses to transfer the fund by means of draft, has not discharged its obligation until the fund actually transferred. In the instant case, it was unquestionably the intention of the parties to transfer the trust fund by means of draft. The fund, represented as it was by draft, did not change in character because of the means chosen to accomplish the transfer. Custom this case did not amount to an agreement to accept the exchange of the bank. Heretofore, the obligation of the bank to remit had been discharged by check or draft that had been paid. It was impractical to remit by shipment of and it was currency, convenient and proper to transfer the fund by means of good check draft. In an annotation, is said: regards the establishment of preference in the assets of an insolvent bank in favor of one who forwarded to item for colan lection, and received from by way of remittance cashier's check for the amount thereof. it appears, as other cases where bank collects forwarded to it tains the proceeds, to be necessary (1) that the collection and retention of the money created the relation of trustee and beneficiary between the bank and the creditor, that the assets of bank were thereby augmented, and (3) that the creditor be able to trace the fund into the hands the receiver. If this test, in all its parts, met, then the creditor titled to preference for the of the proceeds collected, or cashier's check sent by of remittance way thereof." Colorado Co. Docking, 124 Kan. 48; Hawaiian Pineapple Co. Browne, 69 Mont. 140; Hornick, More Porterfield Farmers Merchants Bank, 568 Dak. National Bank Porter, Idaho, 514. different rule prevails in jurisdictions. Peurifoy First Nat. Bank, Car. 370; Leach Battle Creek Savings 202 Bank, 519. However, this court has long been committed to the doctrine that the collecting bank holds both the item and the proceeds thereof as trustee, and in the absence of an tention to accept in payment rather than as means of payment the change of the bank, the relationship not changed. There no intention on the part of the Federal Reserve Bank, either express or implied, to accept the exchange of the Farmers State Bank as payment. It was the usual means of transmittal, but when was not paid. failed in its purpose and not, in fact, payment. The judgment of the district court

AFFIRMED. false statement, with intent to deceive and insists that the of the conauthorized to examine into tract of settlement above referred person the of state bank, it is not was in the note case of the bank, toessential to the commission of the gether with that the offense that the statement be made in the hands of question the of two directors an for collection, and that presence attorney the bank. the examiner and examined the Where state bank undergo- contract and The bank ing an examination by state bank examiner testified that no such conand the cashier the tract there, it shown to was nor Bank makes and him, did he have knowledge nor any statment of the assets of the thereof, or knowledge or informaany bank, he be liable to tion that Lipman had been released may prosecution if the statement knowingly from the liability on note. false and made with intent to deceive Defendant contends that he did not the examiner, regardless of the fact have fair trial, and assigns numthat such examination is not made in erous errors, which will not require the presence of of the bank's discussion. We shall confine our disectors. cussion of errors to those which seem Incompetency of person to be proper for the disposition of as juror will be held waived the case. by the failure to interrogate the juror It is contended that the evidence his VOIR DIRE as to his compet- insufficient to sustain the verdict, ency, and to challenge for that cause. because examination made of the Defendant in criminal action Bassett State Bank by the examiner has right to inquire of state wit- did not occur in the of presence two whether he is biased and pre- of the bank's directors, as required judiced against the defendant, and by law. The statute, making it an ofwitness in the negative fense for an officer of bank to has further right to make false statement to person quire specific of the witness, authorized to examine bank, tending to disclose such bias and not confined to statements made judice. when the bank is undergoing reguOne convicted of criminal lar examination by bank examiner. fense is entitled to new trial if material false statement is made appears that he has been denied by officer of the bank to any perfair and impartial trial, as guaranteed authorized to examine into its by the Constitution. affairs, with an intent to deceive

Heard before Goss, C. Rose, Dean, Good, Eberly, Day and Paine, GOOD, Flannigan (hereinafter called defendant), cashier of the Bassett State Bank, was convicted of scribing to false statement concernthe assets of said bank, with tent to deceive persons authorized by law to examine into the affairs of the bank. He was sentenced to prisonment in the penitentiary for of not less than one nor more than ten years. He brings to this court for review the record of his conviction. The particular false statement charged is that, in statement made him as cashier, defendant represented that the bank owned promissory note of one Lipman for $3,000, when, in fact, at the time the statement was made the bank did not own or possess any note on which Lipman was liable for $3,000, for any other amount. The evidence discloses beyond dispute that some time prior to the of the making statement the bank had in its possession an asset promissory note for purporting to have been signby Lipman; that to previous the examination had been made on this note of $600, that it was being carried as an asset to the extent of $3,000. The payee named in this note was the First National Bank, and that bank indorsand delivered the note to the Bassett State Bank. The Bassett State Bank was organized by officers of the First National Bank and took over the assets and business of the latter bank, after which the First National Bank ceased operations banking institution. Lipman claimed the note to be forgery, and there appears to have been considerable litigation between Lipman, the First National Bank and the Bassett State Bank and other banks, of which fendant and his brothers were On the 10th of April, 1929, these several banks and their officers and Lipman entered into an agreement whereby they settled all controversies between them, including all notes liabilities of kind any owing by Lipman to one of any the banks, including the Bassett State Bank. contract of settlement was executed in triplicate. Lipman and other witnesses for the state testified that the note in question at that time was surrendered to Lipman. Defendand other witnesses in his behalf testified that the note was not at that time surrendered to Lipman, but the hands of the bank's attorney O'Neill, Nebraska, for collection, and defendant contends that, while man was released from liability, the First National Bank was liable as indorser to the Bassett State Bank, and the note was carried an asset because of the liability of the indorser. July 1929, state bank iner examined into the affairs of the Bassett State Bank, and at that time defendant, cashier of the bank, subscribed to statement showing the list of assets owned by the bank. In that list appears note of Lipman, $3,000. The bank's record of bills showed note of Lipman, but did not disclose that the First National Bank was liable thereindorser. the bank examiner inquired for this note, he was formed that it was in the hands of the bank's attorney for collection. fendant insists that at the time of the he examination disclosed to the examiner that Lipman was not liable the note, but that it being held liability against the First NationBank because of its indorsement, such examiner, it constitutes an offense, regardless of whether such examination or statement was made in the presence of two directors. Complaint is made that member of the jury was incompetent to act as juror because he deputy sheriff. The statute, defining those who are competent to sit as jurors. excludes therefrom sheriffs, but does not specifically mention deputy sheriffs. has been held by the United States circuit of court appeals in the case of Robinson Territory of Oklahoma, 520, that statute which disqualifies from forming jury service applies as well to deputies as to principal sheriffs. Certainly, every reason that would exclude sheriff from jury service would apply to the sheriff's deputy. In the instant case, however, the question of the competency of the jury was not raised until after verdiet and in affidavits in support of motion for new trial. Defendant was accorded an opportunity to examine the jury as to their qualifications before they were sworn to try the cause. Evidently, he failed to question the juror with respect his official capacity. In this ant was negligent. Had he at that time examined the juror, developed the fact that he was deputy sheriff, and challenged him on that ground, we think the court should, and no doubt would, have sustained the challenge. However, the objection in this case is unavailing. It is general rule that incompetency of to person serve as will be held waived by the failure juror interrogate the juror on his voir dire to his competency, and to challenge cause. The proposition supported by the following decisions: Marino State, 111 Neb. 623, 197 396; Reed State, 75 Neb. 106 Turley State, 74 Neb. 471, 104 Coil State, 62 Neb. 15, Hickey State, Neb. 490, 744. Defendant complains that the trial court failed to submit his defense to the jury in any of the instructions given. What defendants terms his defense was that the asset, appearing under the name of the Lipman note, was carried in that for convenience only, and that representliability of the First National Bank on its indorsement on the back the note. think the real question is whether, in the making of the statement, there was an intent to deceive the bank examiner or the banking department. That was fairly and fully submitted to the We find no prejudicial error in the instructions given by the court, or the court's refusal to those give requested by defendant. Defendant complains because the trial limited his ation of the witness Lipman, in that he was not permitted to show on that Lipman was unfriendly biased and prejudiced against the defendant. The witness stated that he had nothing against the defendant, but, inferentially, that he was prejudiced against defendant's Then followed series questions, wherein it sought to show that the witness had taken an active in part instigating the prosecution of defendant and working against him in various ways, and in employing others to work and testify against defendant. This dence was excluded. Counsel for defendant stated that the only of the evidence was to show the and prejudice of the but witness, he not permitted to The Constitution guarantees to fendant criminal action the Continued on Page