Click image to open full size in new tab

Article Text

Happenings During the World's Series Games

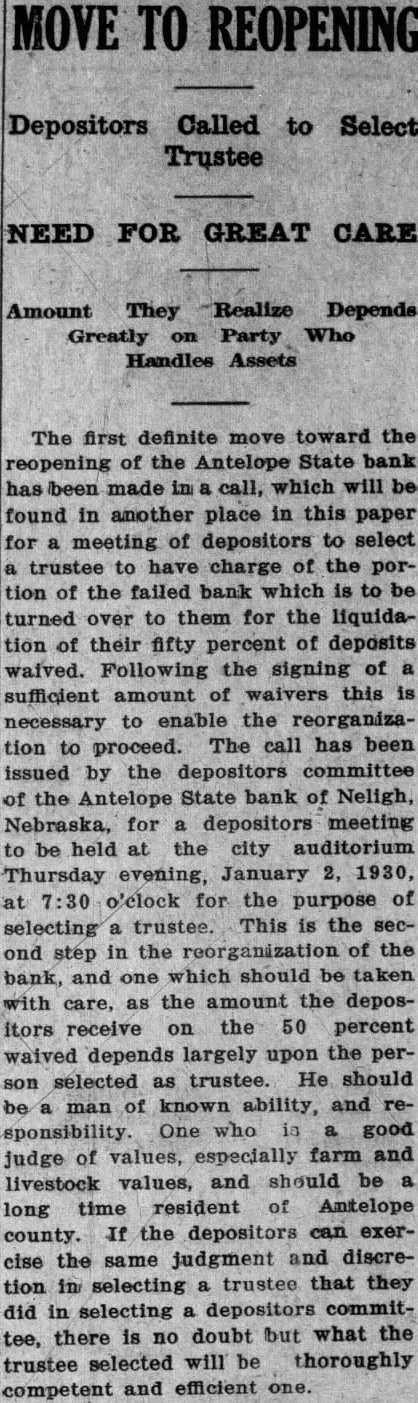

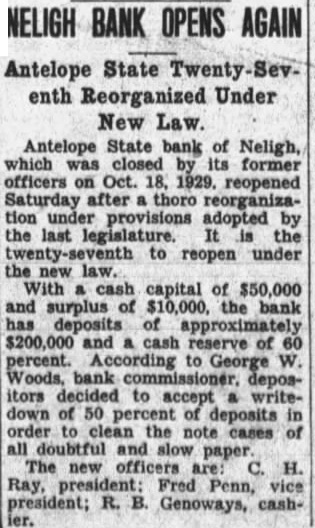

Cora Neilson of Wynnewood. Pa., took along " cot. U. S. Senator-Suspect William Scott Vare went out In a crowd for the first time since he fell sick a year ago. Worshipful Master Ralph A. Werthein fell dead beside his radio. William Tennyson of Philadelphia stood in line a day and night and sold his place for $5. One Edward Johnson of Decatur. III. sat on camp stool in the street all night, bought $1 ticket, sat down again in the bleachers and slept through what he had come to Nee. Deputy Marshal McBride of Utica. Miss. had an ar gument with James H. Llewellyn at filling station Llewellyn drew knife McBride shot him dead. Re porter Tsunekawa of the Osaka Maini chi Shimbun and Reporter Saburo Su zuki of the Tokyo and Osaka Asahi sat among 105 telegraphers and sent stories by direct cable to Japan. In 15 Chicago public schools children marched two by two into assembly halls, listened to broadeasting. later told their fathers, many of whom complained by letter against "misedu cation." Eight ticket scalpers were arrested and let off. One J. A. Nor wood. who had come from Texas, and A hundred other people presented tickets they had bought from sealpers and were sent home Mrs. Stanley Field dropped a $3,000 brooch, re ceived it back from an honest finder came back next day without jewels All these things and more hap pened last week because in Chi ago and then in Phildaelphia, the Chicago Cubs played the Philadelphia Ath leties for the championship of the world." FIRST GAME People who had figured that 35-year-old Spitballer Howard Ehmke would work in the series only If every other Philadelphia pitcher WHS sick or knocked out of the box, did not reckon on an odd under standing between Ehmke and Manager Connie Mack Before the regular season ended Manager Mack sent Ehmke to scout the Cubs. He told friend in confidence that though Ehmke had needed relief in each of the only two games he won for the Athleties this year, he would let him start if Ehmke said he wanted to. "He has one good day a year, and he knows when it's coming.' Amazed the Chicago rooters saw Pitcher Ehmke's easy looking curves. mixed with occasional fast ones, break a world series record by striking out 13, saw him in the third inning, with two men on. fan famed hitters Rogers Hornsby and Hack Wilson with a total of seven pitched balls. Every delivery, made with sidearm motion wide of the box, kept the ball lined against a blind spot, made by some extra bleachers in the green outfield which Ehmke had noticed in practice Rallying behind him, the Athleti took enough hits from Chicago Pitcher Charley Root to win. 3 to 1. SECOND GAME. Outfielder Jimmy Foxx. the youngest Philadelphian. knocked wild pitch for a homerun. his second of the series, with two friends on base In the fourth in ning the Athletics scored three time more and Manager McCarthy of Chi cago took out Maloue, one of his best pitchers. With one out, the bases filled. and the infield playing close 80 as to be able to field a grounder home, Cub Shortstop English honeheaded to second. Pitcher Earnshaw, if Philadelphia, tired but his successor muscular Robert Moses Grove. proved that good left handed pitcher can do better than tradition says against a team of right handed hitters. Athleties 9. Cubs 3. THIRD GAME. Cub Pitcher Guy Bush coming up to bat at the start of the sixth, capered. skipped and grimaced according to instructions of McCarthy. who had said to him "See if you can diddle a walk." With Bush and English on base, Hornsby and Cuyler razzed as they came up for having struck out twelve times in two games and a half. each made clean hits After that Pitcher Bush reemed to get more speed on the ball his curve broke faster and Philadel phia only got one more hit. Cubs 3, FOURTH GAME. Pitcher Charlie Root had kept the Athletics to three senttered hits and the Cubs were leading. 8 to 0 when Left Fielder Simmons I Philadelphia came up to hat in he seventh inning. While a phonograph pushed up against amplifiers dayed, "I've Got a Feeling I'm Fallng and the crowd screamed as no World Series crowd has screamed for decade, Simmons hit home run Foxx. Miller. Dykes, Boley and Bis op singled. Old handed Arthur Nehf who used to pitch for the Giants. vent in for Root. Then Pitcher Blake vent in. then Pitcher Malone went in le hit Hiller in the ribs with a crazy itch while the Athletics in their clean ream-colored uniforms continued to run around the bases. After that inning the Cubs (8) were too shaken score. the Athletics (10) too tired FIFTH GAME. President Hoover fter watching a pitcher's battle ap parently won by Pat Malone Chica (0). was getting up to go when Phila lelphia's Mule Hans came up to at in the Linth inning and knocked straight pitch over the right field fence, bringing in Bishop and tying the score. By slaps and gesticulations since words could not be heard. Cubs tried to make Malone feel better, but his nerve was gone. He took a long breath, got rid of Mickey Cochrane on a grounder: burly Simmons doubled Joe McCarthy signalled to pass Foxx While the crowd, inimical to strategy, was hooting this, Miller's two bagger brought the run that won the champlonship and $6,000 prize money for each first-string Athletic: to each Cub loser's dole-went $4,000. been able to weather the storm. making payments to all depositors within a reasonable time Dan Swaoson. state land commissioner. whose son. Ray, purchased and had been operating the bank for the past five years, said that the run was the result of a direct statement during the course of a club meeting at Neligh three weeks ago. "It was purely malicious and absoIntely unfounded," he declared. He quoted the author of a chance remarks as having said. "you had better get your money out of that bank before closes. The bank. Mr. Swanson added. had deposits in excess of 250 thousand dollars, and though now experiencing dull time of the year. would have been able to stem the tide of with In appealing to the attorney general Woods asked for specific instructions in proceeding against the author of the alleged remarks. In a reply, prepared immediately after the commissioner's query, Mr. Sorensen advised that a law dealing with a situation of this sort had been presented to the last legisla ture but had failed of passage. 'While we do not have any eriminal statute covering the situation at the present time. the persons guilty of circulating false statements about a bank can be sued civilly for dam ges. Where the closing of a bank due to false reports causes loss to depositors, this office will co-operate with you in bringing suit for damages against the persons circulating the reports.' Mr. Sorensen added. The Antelope bank. Mr Swanson said. after a conference with Commis sioner Woods and Secretary Bliss was housed in one of the finest build ings in the state, having been built at a cost of more than SO thousand dollars Though not a stockholder or director. Mr. Swanson said he had been interested at times through his son. While receivership was first asked by the cashier. he went to Lincoln Monday for a conference with bank ing department officials, it was stated Though stockholders may lose heavily in the transaction, Mr. Woods states depositors will doubtless be paid off in full. R. H. Peterson was People had better be careful when they utter words that are a detriment not only to themselves but to business institutions of the city. Here Is case where a bank was as sound as could be, but a few words dropped by a person, possibly unihtentionally, caused a run on this institution with disastrous results. What must be the conscience of the man or woman who uttered those words that caused grief and sorrow to officials as well as the countless depositors. He should make restitution and help the people in getting back their bank. Down in Taylorville, III., the other day. the last of four banks, the Farmers' National Bank, defied the psy. chological fear that caused the closing of five banks in that county following the failure of one bank Officials of the bank declared that they could pay every depositor every cent if need be at the beginning of a day's business. and it seemed like every depositor intended to resort to the old fashioned saving sock and test the word of the Then early in the afternoon, with line of depositors numbering more than 250 extending far into the street, who were making a run on the bank. there came the droning of an airplane. Overhead the giant bird circled. sought he landing field and darted from "It's come." shouted a bank official.

"What?" asked a depositor. "Money from Chicago!" The word went down the line. A few dropped out. Others were skeptical. While some were debating with themselves the sheriff and seven deputies, each armed with a shotgun. have into sight. With them were three Chicago Federal Reserve bank offitals carrying money bags. There was a cheer Glum faces were replaced by smiling ones. The line melted into nothing as if by magic. Almost before the Chicago money got into the cages another line was forming. It was depositors putting their money back in the bank When the officials uttered those words they did not suspect that the people would take the matter seriously and start a run on the bank. With the strife that has been had among the banks over the country during the deflation period. people ha become quite skeptical. They live in fear of losing their life's saving and they take precautions to guard against it he bank at Taylorville made its worl good. although it must have cost them quite sum of money to stem the long line of depositors who were there to draw their money. In Bloomfield, we are very fortunate. Although the depositors have taken their loss in both of the banks which closed last spring, they have re organized the institutions so that no fear may be entertained as to their stability and safeness. All shadows of doubt have been removed and our banks are once more on a better and firmer foundation than they have ever been before. With the men behind these institutions-with their wealth and is every reason to believe that a reoccurrence of the sad situation which faced these Institutions after the great war, when defla- tion swept the country will be averted in the future. People are, gradually restoring their confidence in our banks, and each month marked in crease in th. amount of money and the number of depositors can be noticeably seen.