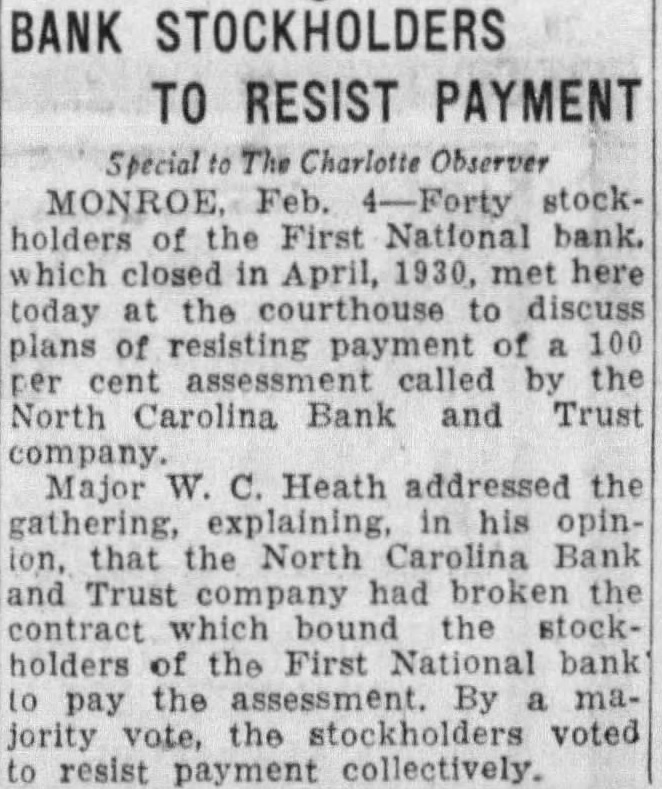

Article Text

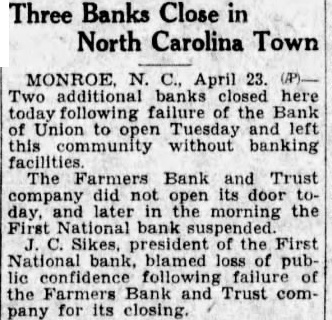

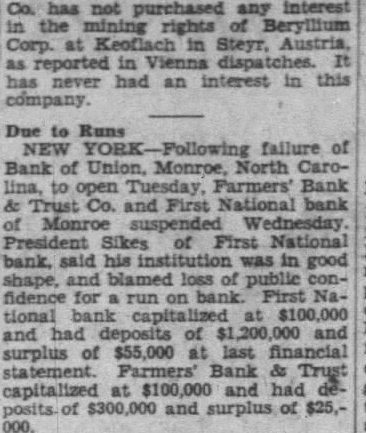

Three Banks Close in North Carolina Town MONROE. N. C., April 23. Two additional banks closed here today following failure of the Bank of Union to Tuesday and left this community without banking facilities The Farmers Bank and Trust company did not open its door day. and later in the morning the First National bank Sikes, president of the First National bank, blamed loss of public confidence following failure of the Farmers Bank and Trust company for its closing.