Article Text

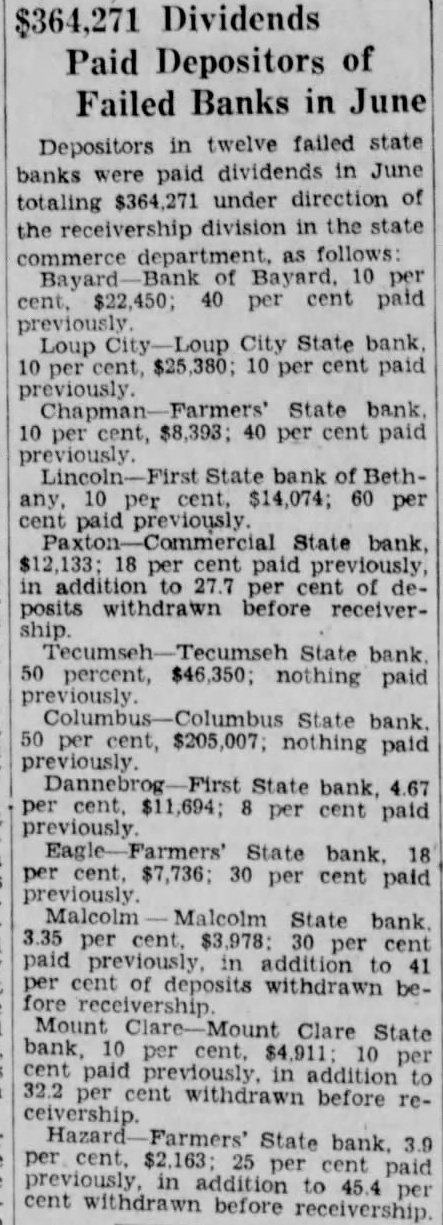

$364,271 Dividends Paid Depositors of Failed Banks in June Depositors in twelve failed state banks were paid dividends in June totaling $364,271 under direction of the receivership division in the state department, as follows cent, 40 cent paid City State bank Loup per paid State bank per per paid State bank of Bethcent, $14,074; 60 per State bank, 18 per cent paid previously, in addition to 27.7 per cent withdrawn before receiverState bank 50 percent, $46,350; nothing paid State bank. 50 per cent, nothing paid State bank, 8 per cent paid Farmers' State bank. cent, $7,736; 30 per cent paid previously. Malcolm Malcolm State bank 3.35 per cent paid addition to per of deposits withdrawn beMount Clare State bank, per in 32.2 per cent withdrawn before receivership. State bank. 3.9 addition to per cent withdrawn before