Article Text

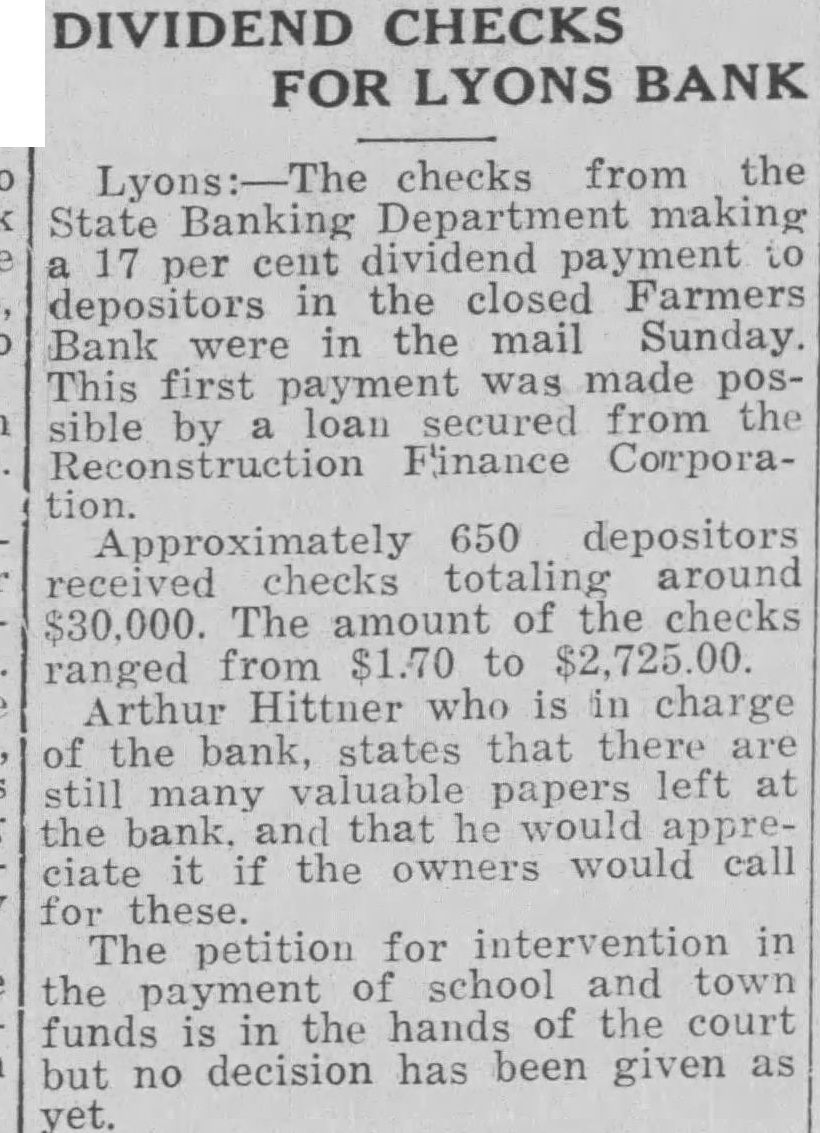

DIVIDEND CHECKS FOR LYONS BANK checks from the State Banking Department making 17 per cent dividend payment to depositors in the closed Farmers Bank were in the mail Sunday. This first payment was made possible by loan secured from the Finance Corporation. Approximately 650 depositors checks totaling around The amount of the checks ranged from to Arthur Hittner who is in charge of the bank, states that there are still many papers left the bank. and that he would ciate it the owners would call for these. The petition for intervention in school and town the payment funds in the hands of the court but no decision has been given as yet.