Article Text

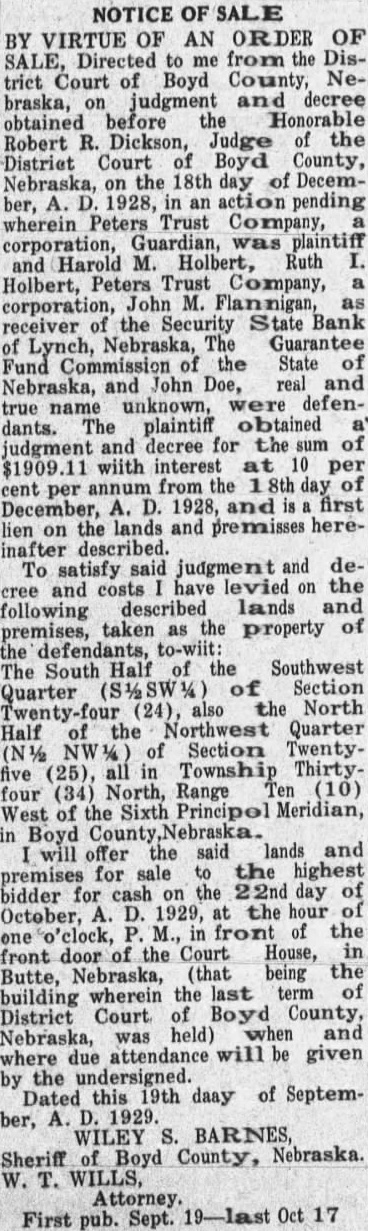

NOTICE OF SALE BY VIRTUE OF AN ORDER OF SALE, Directed to me from the District Court of Boyd County, Nebraska, on judgment and decree obtained before the Honorable Robert R. Dickson, Judge of the District Court of Boyd County, Nebraska, on the 18th day of December, A. D. 1928, in an action pending wherein Peters Trust Company, a corporation, Guardian, was plaintiff and Harold M. Holbert, Ruth I. Holbert, Peters Trust Company, a corporation, John M. Flannigan, as receiver of the Security State Bank of Lynch, Nebraska, The Guarantee Fund Commission of the State of Nebraska, and John Doe, real and true name unknown, were defendants. The plaintiff obtained judgment and decree for the sum of $1909. wiith interest at 10 per cent per annum from the 8th day of December, A. D. 1928, and is first lien on the lands and premisses hereinafter described. To satisfy said judgment and decree and costs I have levied on the following described lands and premises, taken as the property of the defendants, to-wiit: The South Half of the Southwest Quarter (S%SW%) of Section Twenty-four (24), also the North Half of the Northwest Quarter (N½ NW%) of Section Twentyfive (25), all in Township Thirtyfour (34) North, Range Ten (10) West of the Sixth Principol Meridian, in Boyd County,Nebraska. I will offer the said lands and premises for sale to the highest bidder for cash on the 22nd day of October, A. D. 1929, at the hour of one o'clock, P. M., in front of the front door of the Court House, in Butte, Nebraska, (that being the building wherein the last term of District Court of Boyd County, Nebraska, was held) when and where due attendance will be given by the undersigned. Dated this 19th daay of September, A. D. 1929. WILEY S. BARNES, Sheriff of Boyd County, Nebraska. W. T. WILLS. Attorney. First pub. Sept. 19-last 17