Article Text

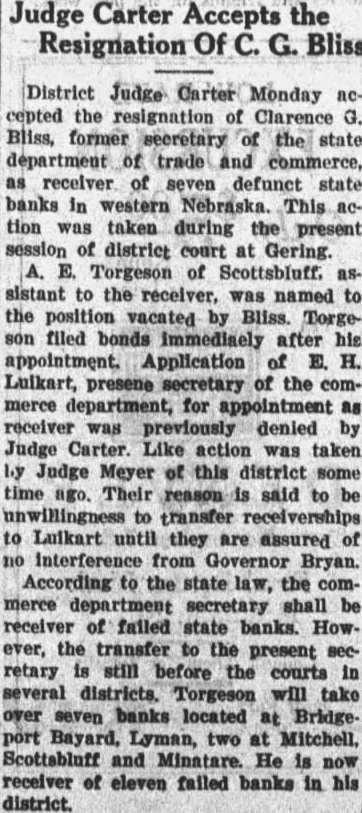

Judge Carter Accepts the Resignation Of C. G. Bliss District Judge Carter Monday accepted the resignation of Clarence G. Bliss, former secretary of the state department of trade and commerce, as receiver of seven defunct state banks in western Nebraska. This action was taken during the present session of district court at Gering. A. E. Torgeson of Scottsbluff, assistant to the receiver, was named to the position vacated by Bliss. Torge son filed bonds immediaely after his appointment. Application of E. H. Luikart, presene secretary of the commerce department, for appointment as receiver was previously denied by Judge Carter. Like action was taken by Judge Meyer of this district some time ago. Their reason is said to be unwillingness to transfer receiverships to Luikart until they are assured of no interference from Governor Bryan. According to the state law, the commerce department secretary shall be receiver of failed state banks. However, the transfer to the present Becretary is still before the courts in several districts. Torgeson will take over seven banks located at Bridgeport Bayard, Lyman, two at Mitchell. Scottsbluff and Minatare. He is now receiver of eleven failed banks in his district.