Click image to open full size in new tab

Article Text

DEPOSITORS' MEETING LARGELY ATTENDED

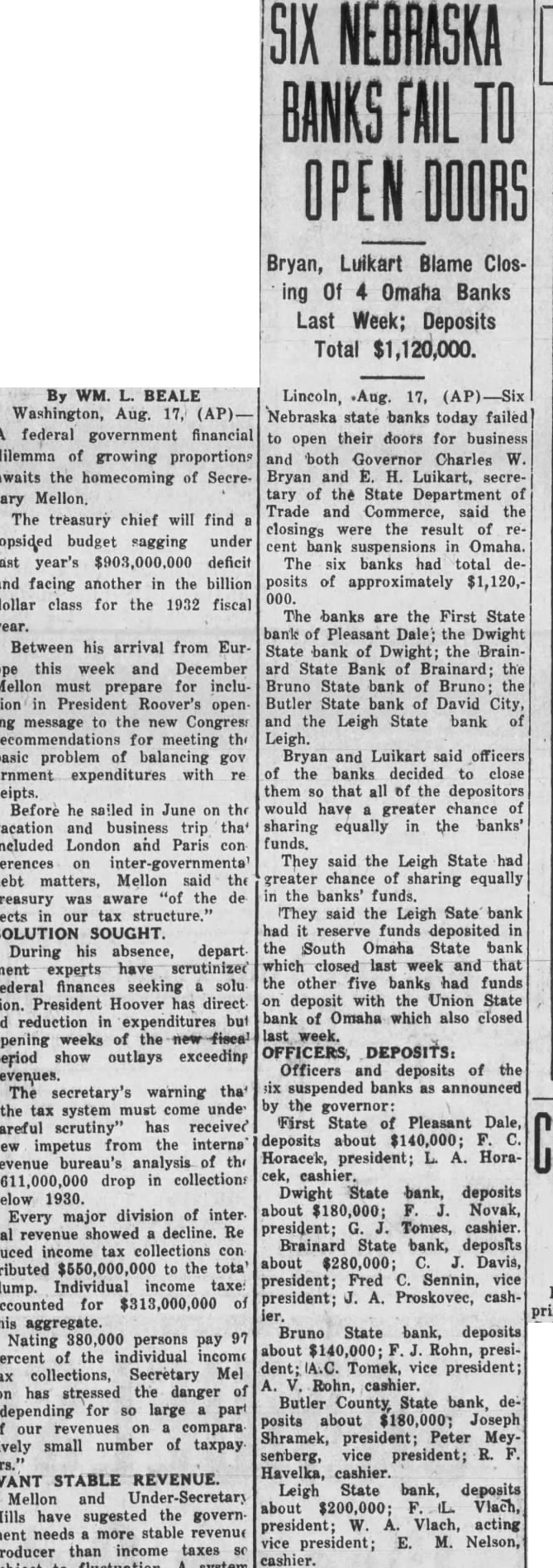

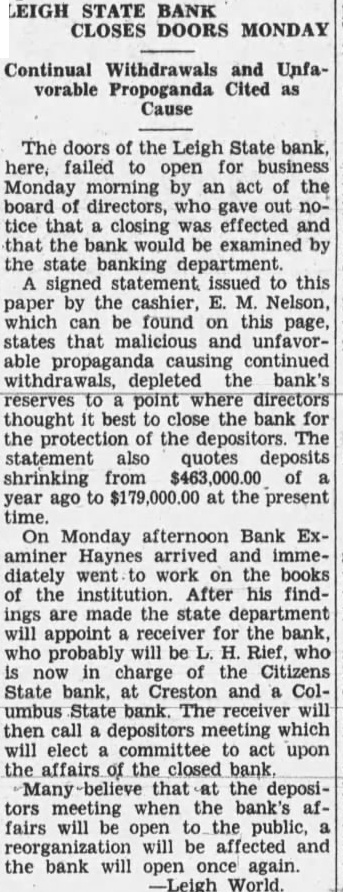

A large number of depositors of the Clarkson State Bank attended the meeting called last Thursday for the purpose of acquainting the depositors of said bank with new plan under which the bank is to operate. The meeting was presided over by A. J. Vlach, chairman, who after brief talk introduced Jos. T. Votava, prominent attorney of Omaha, who is well versed in these matters and who has thorough knowledge of the banking situation as it now stands. In the opening part of his talk, Mr. Votava stated what experience he has had with the handling of banks in distress. The banks he cited, according to his version, were in much worse condition than is the case with the Clarkson State Bank and these institutions at this time are gradually working out of their difficulties. He pointed out that receiverships are very expensive and oftimes work hardship not only on the depositors, but the borrowers as well. As rule, he stated, when matters are wound up, everyone concerned in the liquidation of the closed institution is a loser, notwithstanding the community in itself. Mr. Votava stressed the point that the present law known as House Roll 167, was created for the purpose of alleviating these depressed conditions, and he strongly urged the depositors to sign the required waiver agreements. A large number of depositors signed the waivers at the meeting and since the meeting nearly two-thirds of the bank's depositors have already signed the contracts. As soon as the required percentage of deposits is obtained, the state banking department will name a depositors committee which will look after the interests of the depositors and the institution itself. There are some who hesitate to sign the waivers, but those acquainted with the affairs of the bank, feel that it is the only wise thing to do under present conditions. To throw bank into receivership is not always the best thing for depositors to do. The Leigh State Bank, for instance, closed its doors two years ago and under its form of receivership has thus far paid out only 6 per cent. A Snyder bank closed in 1927, and in charge of a receiver, has brought about a big loss to depositors and still the matter remains unsettled. Another similar case exists over at Scribner, and there are hundreds of same cases all over the state. The following item appearing in last Monday's gives a fair idea as to what costs to liquidate a bank through receivership. In many other instances where banks were liquidated through receivership the cost and expenses were even much greater.

"Fee Payment Allowed in Bank Receivership

Harlan, Ia., May 7.-Following hearing before Judge Wheeler on allowance of court costs in the Elk Horn bank case, Receiver F. H. Kruse is to receive from the main trust fund for his services to date, $1,200. V. H. Byers, attorney for the receiver, will receive $1,500. Kruse had previousreceived approximately 11 thousand dollars, while Byers had received $11,346.50."

The above item plainly shows that the receivership of a bank is very costly proposition. It is far better for the depositors to have their bank liquidated by the officers of the bank in an orderly and less expensive manner than to place a stranger in charge of the bank's assests. There are many other factors to be taken into consideration before anything permanent is done. The fact that you sign the waiver agreement does not deprive the depositors of their privilege of placing the bank into receivership in case the officers in charge can show no progress in the liquidation process. Under the new Nebraska law, H. R. 167, SO we are informed, those employed at the bank operating under restrictions, must earn their own salaries from the profits of the bank. In view of this the depositors have nothing to lose and everything to gain. With the price of small grain and live stock increasing daily, there is no question but what we will a great improvement in conditions before the next few months and from our observations it would appear to be downright crime to permit the closing of a bank at this time when improvement seems to be SO near. At times like these of today, the welfare of the community must also be taken into consideration when it comes to the settling of a vital matter such as the one now confronting us. Where there is will there is a way. Save your banks and business institutions and the community of Clarkson will be sure to prosper as it has in former years. Sound judgment on the part of the depositors, borrowers, bank officials and all concerned will greatly help in bringing our banking institutions back to the top where they once were. Forget petty jealousies and let all pull at one end of the rope. We owe it to our town and community.