Click image to open full size in new tab

Article Text

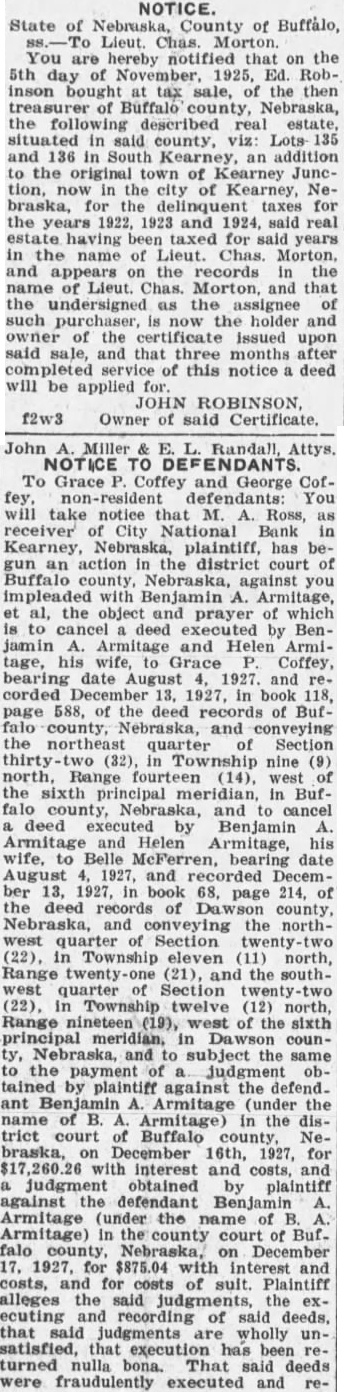

NOTICE. State of Nebruska, County of Buffálo, Lieut. Chas. You are hereby notified that on the 5th day of November, 1925, Ed. Robinson bought tax sale, of the then treasurer of Buffalo county, Nebraska, the following described real estate, situated in said county, viz: Lots- 135 and in South Kearney, an addition to the original town of Kearney Junetion, now in the city of Kearney, Nebraska, for the taxes for the years 1922, 1923 and 1924, said real having been taxed for said years in the name of Lieut. Chas. Morton. and appears the records in the name of Lieut. Chas. Morton, and that the undersigned as the assignee of such purchaser, is now the holder and owner of the certificate issued upon said sale, and that three months after completed service of this notice deed will be applied for. JOHN f2w3 Owner of said Certificate.

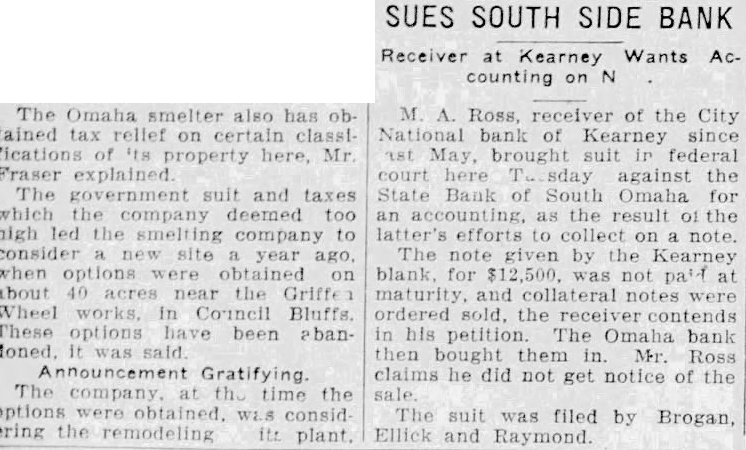

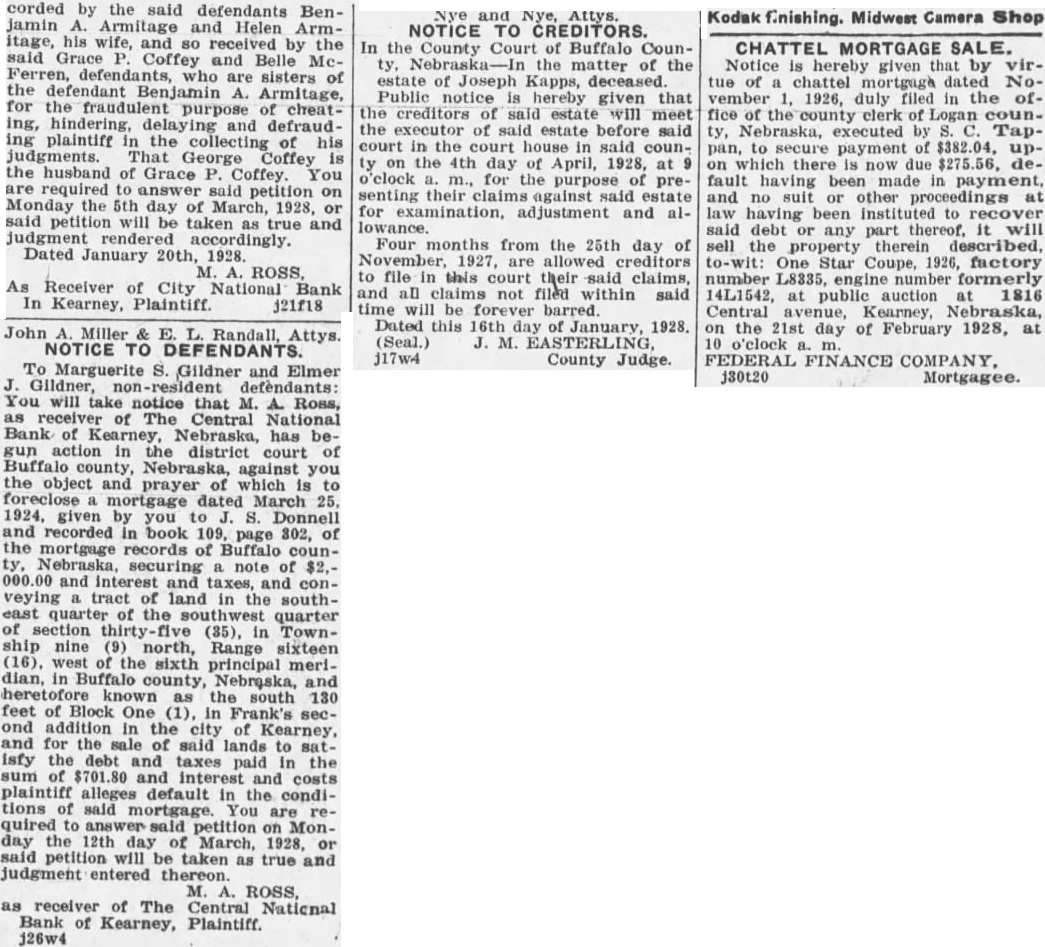

John Miller E. Randall, Attys. NOTICE TO DEFENDANTS. To Grace P. Coffey and George Coffey, non-resident defendants: You will take notice that M. A. Ross, as receiver City National Bank in Kearney, Nebraska, plaintiff, has begun an action in the district court of Buffalo county, Nebraska, against you impleaded with Benjamin A. Armitage, al, the object and prayer of which to deed executed by Benjamin and Helen Armitage, his wife, to Grace Coffey, bearing date August 1927. and recorded December 13, 1927, in book 118, page 588, of the deed records of Buffalo county, Nebraska, and conveying the northeast quarter Section (32), in Township nine (9) north, Range (14), west of the sixth principal in Buffalo Nebraska, and to cancel deed by Benjamin A. Armitage and Helen Armitage, his wife, to Belle McFerren, bearing date August 1927, and recorded December 13, 1927, in book 68, page 214, of the deed records of Dawson county, Nebraska, and conveying the northwest of Section (22), in Township eleven (11) north, Range twenty-one (21), and the southwest quarter of Section (22), in Township twelve (12) north, Range nineteen (19), west of the sixth principal meridian, county, Nebraska, and to subject the same to the payment of judgment obtained by plaintiff against the defend. ant Benjamin A. Armitage (under the name of B. Armitage) in the district court of Buffalo county. Nebraska, December 16th, 1927, for with interest and costs, and a judgment obtained by plaintiff against the defendant Benjamin A. Armitage (under the name of B. Armitage) the county court of Buffalo county, Nebraska, on December 17. 1927, for $875.04 with interest and costs, and for costs of suit. Plaintiff alleges the said judgments, the executing and recording of said deeds, that said judgments are wholly unsatisfied, that execution has been returned nulla bona. That said deeds were fraudulently executed and re-