Click image to open full size in new tab

Article Text

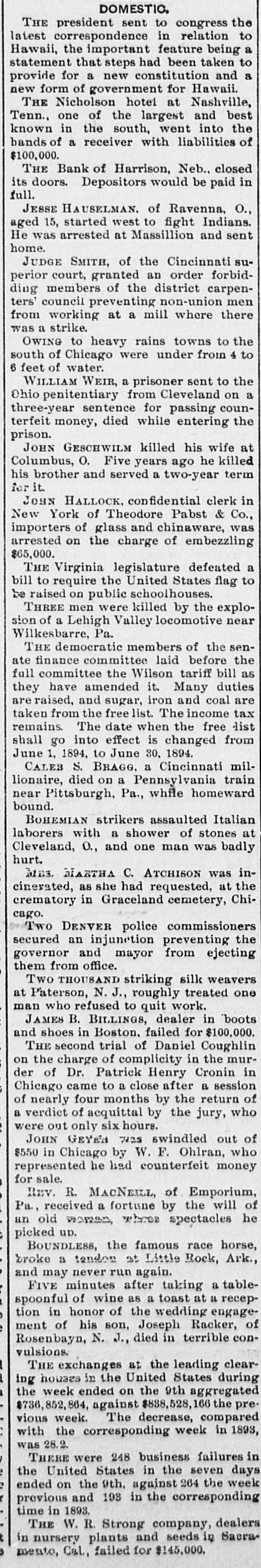

DOMESTIC. THE president sent to congress the latest correspondence in relation to Hawaii, the important feature being a statement that steps had been taken to provide for a new constitution and a new THE form Nicholson of government hotel at for Nashville, Hawaii. Tenn., one of the largest and best known in the south, went into the bands of a receiver with liabilities of $100,000. THE Bank of Harrison, Neb., closed its doors. Depositors would be paid in full. JESSE HAUSELMAN, of Ravenna, O., aged 15, started west to fight Indians. He was arrested at Massillion and sent home. JUDGE SMITH, of the Cincinnati superior court, granted an order forbidding members of the district carpenters' council preventing non-union men from working at a mill where there was a strike. OWING to heavy rains towns to the south of Chicago were under from 4 to 6 feet of water. WILLIAM WEIR, a prisoner sent to the Ohio penitentiary from Cleveland on a three-year sentence for passing counterfeit money, died while entering the prison. JOHN GESCHWILM killed his wife at Columbus, O. Five years ago he killed his brother and served a two-year term for it. JOHN HALLOCK, confidential clerk in New York of Theodore Pabst & Co., importers of glass and chinaware, was arrested on the charge of embezzling $65,000. THE Virginia legislature defeated a bill to require the United States flag to be raised on public schoolhouses. THREE men were killed by the explosion of a Lehigh Valley locomotive near Wilkesbarre, Pa. THE democratic members of the senate finance committee laid before the full committee the Wilson tariff bill as they have amended it. Many duties are raised, and sugar, iron and coal are taken from the free list. The income tax remains. The date when the free list shall go into effect is changed from June 1. 1894, to June 30, 1894. CALEB S. BRAGG. a Cincinnati millionaire, died on a Pennsylvania train near Pittsburgh, Pa., while homeward bound. BOHEMIAN strikers assaulted Italian laborers with a shower of stones at Cleveland, O., and one man was badly hurt. MRS. MARTHA C. ATCHISON was incinerated, as she had requested, at the crematory in Graceland cemetery, Chicago. Two DENVER police commissioners secured an injunction preventing the governor and mayor from ejecting them from office. Two THOUSAND striking silk weavers at Paterson, N.J., roughly treated one man who refused to quit work. JAMES B. BILLINGS, dealer in boots and shoes in Boston, failed for $100,000. THE second trial of Daniel Coughlin on the charge of complicity in the murder of Dr. Patrick Henry Cronin in Chicago came to a close after a session of nearly four months by the return of a verdict of acquittal by the jury, who were out only six hours. JOHN GEYEA was swindled out of $550 in Chicago by W. F. Ohlran, who represented he had counterfeit money for sale. REV. R. MACNEILL, of Emporium, Pa., received a fortune by the will of an old WOMEN, whose spectacles he picked un. BOUNDLESS, the famous race horse, broke a tendon 3t Little Rock, Ark., and may never run again. FIVE minutes after taking a tablespoonful of wine as a toast at a reception in honor of the wedding engagement of his son, Joseph Racker, of Rosenbayn, N. J., died in terrible convulsions. THE exchanges at the leading clearing houses in the United States during the week ended on the 9th aggregated $736,852,864, against $888,528,166 the previous week. The decrease, compared with the corresponding week in 1893, was 28.2. THERE were 248 business failures in / the seven e ended c United on the States 9th, against in the 264 the week days r previous and 193 in the corresponding time in 1893. THE W. R. Strong company, dealers t in nursery plants and seeds in Sacramento, Cal, failed for $145,000.