Article Text

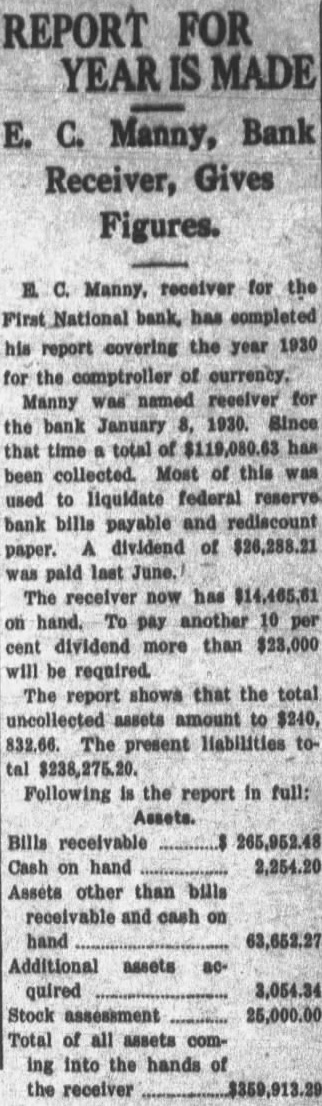

Sessions in Senate Advanced as Means of InsurSpeedy Conclusion Tariff Debate ARGUE LUMBER RATES Smoot Has Support of Leaders Coalition in His Move for Night To Limit Debate by Unanimous Consent Washington, Feb. by long grind night sessions, the senate today ened debate on on amendment to the tariff bill by Senator Jones, republican, Washington, to place duty of three dollars thousand board feet on lumber, now on the free list. Chairman Smoot, of the finance committee, expects to hold the senate in session until 10 o'clock each night until the bill passed. Senator said there had been 20 percent reduction in employment in the lumber industry. Production of domestic lumber in 1929 the lowest in seven years, he said, and the average value had detariff clined from around $31 per thousand house. feet in 1923 to $25 last year. Senator Barkley, democrat, Kenspeed tucky, asked tariff would not increase prices and hinder construction. Senator Jones answered in the negative. prosperity of the state of Washington," said Jones, "depends ator largely upon the prosperity of the lumber industry. The lumber industry in Washington is greatly depressed, as has been largely throughout the country." views Consider Lumber Rates Washington, Feb. 27. leaders today undertook to insure Ord, speedy conclusion of the tariff debate Martin by forcing series of night sessions, tered to continue until the final vote reached. The chieftains of all factions were agreement that enough votes could be obtained to bring about the overtime work, although efforts to limit debate by unanimous consent failed. The plan is that the senate be in from 11 until every day but Saturday. Fred Coe A renewal of the senate's old controversy on whether lumber to be kept the free list was in prospect today. Senator Jones, republican, Washington, served notice that he would call amendment place duty of three dollars thousand feet, board measure, on all imported lumber. Some question arose as to whether The the shingles schedule should be con- March. sidered part of the Jones amendment, taken up separately. The senate has already voted, by comfortable margin, to keep shingles on Omaha the free list, as opposed to duty in of percent approved by the the house. Jones said he would not demand separate vote on shingles, but added he hoped duty satisfactory to his be agreed upon when the tariff bill goes to con- Portis ference. against Chairman Smoot of the finance committee. in charge of the bill, actively behind the move for night sessions, and he has the support leaders of the ent republican coalition, which, with working majority, is rewriting the bill, as received from the Numerous efforts were made action by unanimous consent agreements, but in each case, some senator found cause for objection. Senator Simmons, democrat, North Carolina, proposed that debate be limited to ten minutes for each seneach amendment. This was blocked by Senator Copeland. democrat, New York, who argued that his state had not been given an opportunity to present its tariff needs and fully. ORD NEWS BRIEFS Neb., Feb. The Chinese claim to Weigardt of this city has ators the newspaper. veterans hospital at Denver Gazette of Peking for treatment. He has been in been published for over health for several months. Mr. Welgardt served in France. A full carload of butter and eggs was shipped to eastern markets this week by the Ord Co-operative Creamcompany. better price and lower freight rates can be secured by shipping in carload lots, Manager says. basketball game scheduled here NECKBAND last Friday night between St. Paul and Ord high school teams. was postSizes 14 and poned when the St. Paul school board refused to allow that team to come to Ord, because of the illness, with spinal meningitis, of Donald Williaman Ord high school freshman. game will be played sometime in for These are old Miss Ethelyn Ellis, sister of Mrs. E. Leggett of Ord, has secured are tired position as feature writer on the them Bee-News. Miss Ellis' home Alliance and she graduate University of Missouri school journalism. Joe Krejci, Ord high school coach, CLOTHING returned Sunday from Portis, Kas where he played basketball the from town team Saturday night Yancey Hotel the Blain Commission com- team from Grand Island. The Dynamos won, 72 to Krejci big factor in the Portis victory. Bert M. Hardenbrook, Ord lawyer. has been appointed attorney to the receiver the defunct First Naitonal bank of Greeley, Neb. Mr. Hardenbrook received his appointment week from the comptroller the currency, Washington, Manny, Shawnee, Okla., the receiver. The world's largest ice skating rink Davos, Switzerland, feet above sea level. the originThe Imperial said have years.