Article Text

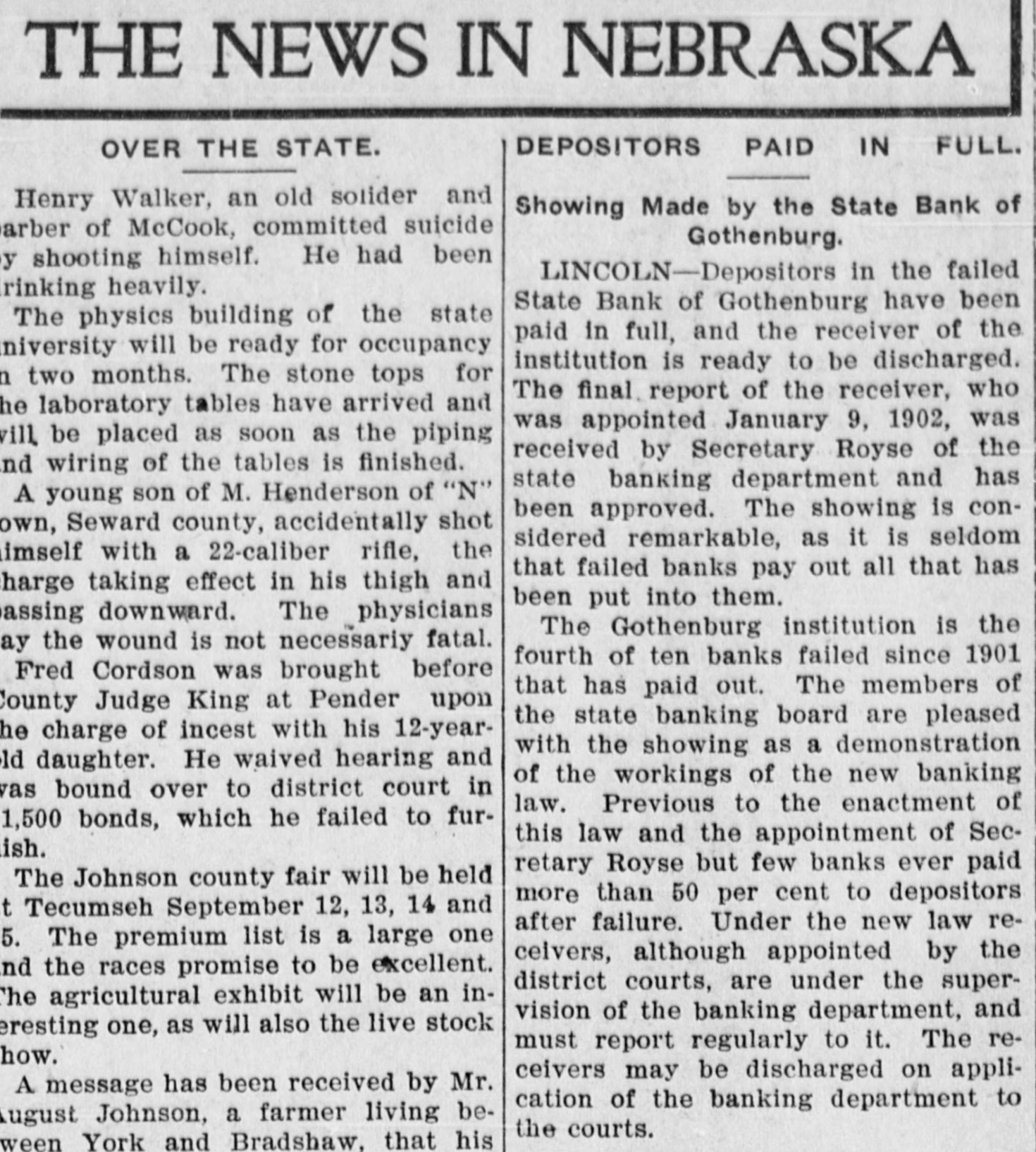

THE NEWS IN NEBRASKA DEPOSITORS PAID IN FULL. OVER THE STATE. Henry Walker, an old solider and Showing Made by the State Bank of arber of McCook, committed suicide Gothenburg. shooting himself. He had been LINCOLN-Depositors in the failed rinking heavily. State Bank of Gothenburg have been The physics building of the state paid in full, and the receiver of the niversity will be ready for occupancy institution is ready to be discharged. two months. The stone tops for The final report of the receiver, who laboratory tables have arrived and was appointed January 9, 1902, was vill be placed as soon as the piping received by Secretary Royse of the wiring of the tables is finished. state banking department and has A young son of M. Henderson of "N" been approved. The showing is conSeward county, accidentally shot sidered remarkable, as it is seldom imself with a 22-caliber rifle, the that failed banks pay out all that has harge taking effect in his thigh and been put into them. assing downward. The physicians The Gothenburg institution is the the wound is not necessariy fatal. fourth of ten banks failed since 1901 Fred Cordson was brought before that has paid out. The members of County Judge King at Pender upon the state banking board are pleased he charge of incest with his 12-yearwith the showing as a demonstration daughter. He waived hearing and of the workings of the new banking bound over to district court in law. Previous to the enactment of 1,500 bonds, which he failed to furthis law and the appointment of Secretary Royse but few banks ever paid The Johnson county fair will be held more than 50 per cent to depositors Tecumseh September 12, 13, 14 and after failure. Under the new law reThe premium list is a large one ceivers, although appointed by the the races promise to be excellent. district courts, are under the superThe agricultural exhibit will be an invision of the banking department, and eresting one, as will also the live stock must report regularly to it. The rehow. ceivers may be discharged on appliA message has been received by Mr. cation of the banking department to August Johnson, a farmer living bethe courts. ween York and Bradshaw, that his