Article Text

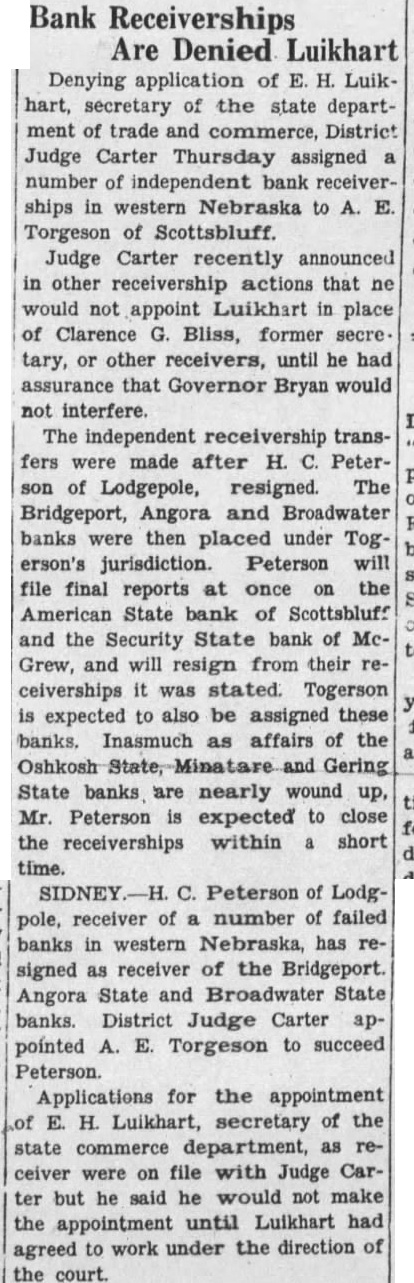

Bank Receiverships Are Denied Luikhart Denying application of Luikhart, secretary of the state department of trade and commerce, District Judge Carter Thursday assigned number of independent bank receiverships in western Nebraska to Torgeson of Scottsbluff. Judge Carter recently announced in other receivership actions that ne would not appoint Luikhart in place of Clarence Bliss, former secre. tary, or other receivers, until he had assurance that Governor would not interfere. The independent receivership transfers were made after H. Peterof Lodgepole, resigned. The Bridgeport, Angora and Broadwater banks were then placed under Togerson's jurisdiction. Peterson will file final reports at once on the American State bank of Scottsbluff and the Security State bank of McGrew, and will resign from their ceiverships was stated. Togerson expected to also be assigned these banks. Inasmuch as affairs of the Oshkosh Gering State banks are nearly wound up, Mr. Peterson is expected to close the receiverships within short time. Peterson of Lodgpole, receiver of number of failed banks in western Nebraska, has signed as receiver of the Bridgeport. Angora State and Broadwater State banks. District Judge Carter pointed E. Torgeson to succeed Peterson. Applications for the appointment H. Luikhart, secretary of the state commerce department, as receiver were on file with Judge Carter but he said he would not make the until Luikhart had appointment agreed to work under the direction of the court.