Article Text

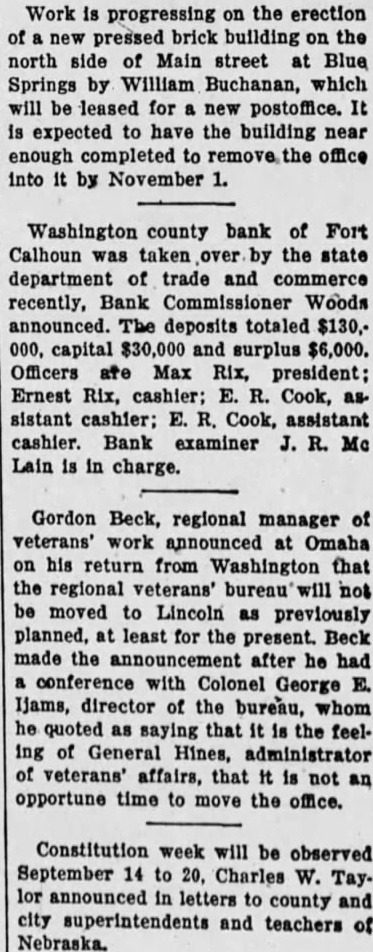

Work progressing the erection pressed brick building the north side of Main street at Blue Springs by William Buchanan, which will be leased for postoffice. It expected to have the building near enough completed office into by November Washington county bank of Fort Calhoun was taken the state department of trade and commerce recently, Bank Commissioner Woods announced. deposits totaled $130,capital $30,000 and surplus $6,000. Officers Rix, president: Ernest Rix, cashier: Cook, sistant cashier; Cook, assistant cashier. Bank examiner Mc Lain charge. Gordon Beck, regional manager of work announced Omaha on from Washington that regional veterans' bureau not moved Lincoln previously planned, least for the present. Beck made the after he had conference Colonel George Ijams, director the bureau, whom he quoted saying that the feeling of General Hines, veterans' affairs, that opportune time move the office. Constitution week will be observed September 14 to Charles Taylor announced in letters county and city superintendents and teachers of Nebraska.