Article Text

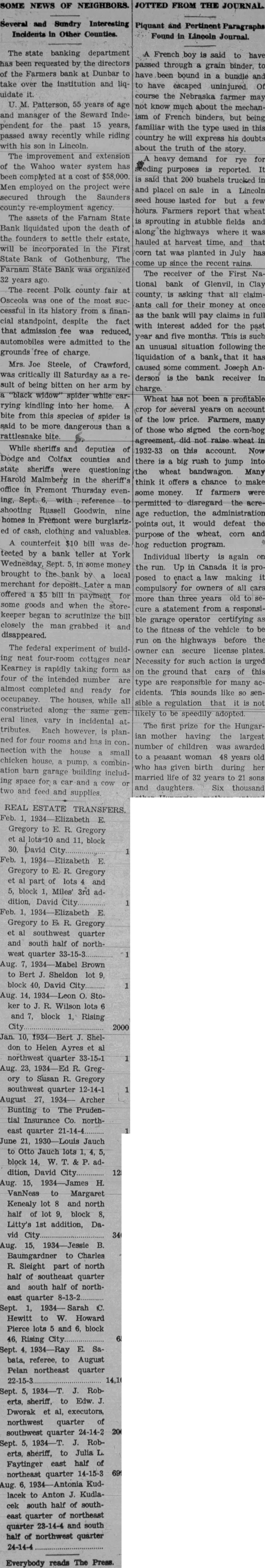

SOME NEWS OF NEIGHBORS. Several and Sundry Interesting Incidents in Other Counties. The state banking department French boy is said to have has been requested by the directors passed through grain binder, to of the Farmers bank at Dunbar to have been bound in bundle and take over the institution and liq- to have escaped uninjured. Of uidate it. course the Nebraska farmer may Patterson, 55 years of age not know much about the mechanand manager of the Seward Indeism of French binders, but being pendent for the past 15 years, familiar with the type used in this passed away recently while riding country he will his doubts express his son in Lincoln. about the truth of the story. The improvement and extension heavy demand for rye for of the Wahoo water system has purposes is reported. been completed at cost of $58,000. said that 200 bushels trucked in Men employed on the project were and placel on sale in Lincoln secured through the Saunders seed house lasted for but few county re-employment agency hours. Farmers report that wheat The assets of the Farnam State is sprouting in stubble fields and Bank liquidated upon the death of along the highways where it was the founders to settle their estate, hauled at harvest time, and that will be incorporated in the First corn tat was planted in July has State Bank of Gothenburg, The come up since the recent rains Farnam State Bank was organized The receiver of the First Nayears tional bank of in Clay The recent Polk county fair at county, is asking that all claimOsceola was one of the most sucants call for their money at once cessful in its history from finanas the bank will pay claims in full cial standpoint, despite the fact with interest added for the past that admission fee was reduced, year and five months This is such automobiles were admitted to the an unusual situation following the grounds free of charge. liquidation of bank, that it has Mrs. Joe Steele, of Crawford, caused some comment. Joseph Ancritically ill Saturday derson the bank receiver in sult of being bitten on her arm by charge. "black widow" Wheat has not been profitable rying kindling into her home. A crop for several years on account bite from this species of spider is of the low price. Farmers, many said to be more dangerous than of those who signed the corn-hog rattlesnake agreement, did While sheriffs and deputies of 1932-33 on this account. Now Dodge and Colfax counties and there big rush to jump into state sheriffs were questioning wheat the bandwagon. Many Harold Malmberg in the sheriff's think it offers chance to make office in Fremont Thursday evensome money. If farmers were reference permitted to the shooting Russell nine age reduction, the administration homes in Fremont were burglarizpoints out, it would defeat the of cash, clothing and valuables of the wheat, corn and purpose counterfeit $10 bill was hog reduction program. tected by bank teller at York Individual liberty is again on Sept. in some money the run. Up in Canada it is probrought to by local posed to enact law making merchant for man compulsory for owners of all cars offered $5 bill in payment for more than three years some goods and when the storecure statement from responsikeeper began to scrutinize the bill ble garage operator certifying closely the man grabbed it and to the fitness of the vehicle to disappeared. before the The federal experiment of buildowner can secure license plates. ing neat four-room cottages near Necessity for such action is urged Kearney is rapidly taking form as on the ground that cars of this four of the intended number type are responsible for many acalmost completed and ready for cidents. This sounds like so senoccupancy. The houses, while all sible that regulation not constructed along the same likely to be speedily adopted eral lines, vary in incidental The first prize for the Hungartributes Each however, is planian mother having the largest ned for four rooms and has in con. number of children was awarded nection with the house small peasant woman 48 years old chicken house, pump, combinwho has given birth during her barn garage building includmarried life of years to 21 sons ing space for car and cow and daughters Six thousand and feed and supplies REAL ESTATE TRANSFERS. Feb. E. Gregory to R. Gregory et lots-10 and 11, block 30, David City Feb. Gregory to Gregory et part lots and 5, block Miles' 3rd addition, David City Feb. E. Gregory to R. Gregory et southwest quarter and south half of north- west quarter 33-15-3 Aug. Brown to Bert Sheldon lot block 40, David City. Aug 14, O. Stoker to R. Wilson lots and block Rising City 10, Sheldon to Helen Ayres et northwest quarter 33-15-1 Aug. 23, Gregory to Susan R. Gregory southwest quarter 12-14-1 August 27, 1934- Archer Bunting to The Prudential Insurance Co. northeast quarter 21-14-4 June 21, Jauch east quarter 8-13-2 Sept. Sarah C. Hewitt to W. Howard Pierce lots and 6, block 46, Rising City Sept. E. Sabata, referee, to August Pelan northeast quarter 22-15-3 2000 24-14-4 Everybody reads The