Article Text

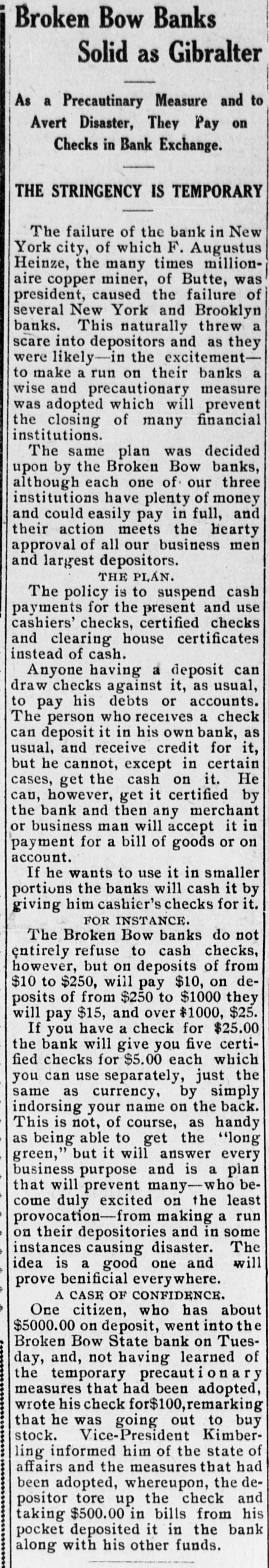

Broken Bow Banks Solid as Gibralter As a Precautinary Measure and to Avert Disaster, They Pay on Checks in Bank Exchange. THE STRINGENCY IS TEMPORARY The failure of the bank in New York city, of which F. Augustus Heinze, the many times millionaire copper miner, of Butte, was president, caused the failure of several New York and Brooklyn banks. This naturally threw a scare into depositors and as they were likely-in the excitementto make a run on their banks a wise and precautionary measure was adopted which will prevent the closing of many financial institutions. The same plan was decided upon by the Broken Bow banks, although each one of our three institutions have plenty of money and could easily pay in full, and their action meets the hearty approval of all our business men and largest depositors. THE PLÁN. The policy is to suspend cash payments for the present and use cashiers' checks, certified checks and clearing house certificates instead of cash. Anyone having a deposit can draw checks against it, as usual, to pay his debts or accounts. The person who receives a check can deposit it in his own bank, as usual, and receive credit for it, but he cannot, except in certain cases, get the cash on it. He can, however, get it certified by the bank and then any merchant or business man will accept it in payment for a bill of goods or on account. If he wants to use it in smaller portions the banks will cash it by giving him cashier's checks for it. FOR INSTANCE. The Broken Bow banks do not entirely refuse to cash checks, however, but on deposits of from $10 to $250, will pay $10, on deposits of from $250 to $1000 they will pay $15, and over $1000, $25. If you have a check for $25.00 the bank will give you five certified checks for $5.00 each which you can use separately, just the same as currency, by simply indorsing your name on the back. This is not, of course, as handy as being able to get the "long green," but it will answer every business purpose and is a plan that will prevent many-who become duly excited on the least provocation-from making a run on their depositories and in some instances causing disaster. The idea is a good one and will prove benificial every where. A CASE OF CONFIDENCE. One citizen, who has about $5000.00 on deposit, went into the Broken Bow State bank on Tuesday, and, not having learned of the temporary precaut a r measures that had been adopted, wrote his check remarking that he was going out to buy stock. Vice-President Kimberling informed him of the state of affairs and the measures that had been adopted, whereupon, the depositor tore up the check and taking $500.00 in bills from his