Article Text

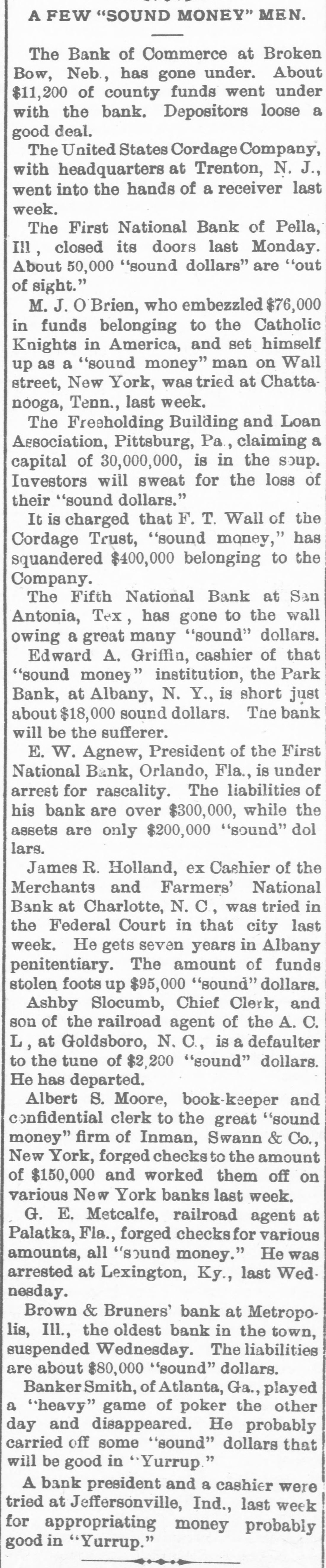

A FEW "SOUND MONEY" MEN. The Bank of Commerce at Broken Bow, Neb, has gone under. About $11,200 of county funds went under with the bank. Depositors loose a good deal. The United States Cordage Company, with headquarters at Trenton, N. J., went into the hands of a receiver last week. The First National Bank of Pella, III, closed its doors last Monday. About 50,000 "sound dollars" are "out of sight." M. J. O Brien, who embezzled $76,000 in funds belonging to the Catholic Knights in America, and set himself up as a "sound money" man on Wall street, New York, was tried at Chattanooga, Tenn., last week. The Freeholding Building and Loan Association, Pittsburg, Pa, claiming a capital of 30,000,000, is in the soup. Investors will sweat for the loss of their "sound dollars." It is charged that F. T. Wall of the Cordage Trust, "sound money," has squandered $400,000 belonging to the Company. The Fifth National Bank at San Antonia, Tex, has gone to the wall owing a great many "sound" dollars. Edward A. Griffin, cashier of that "sound money" institution, the Park Bank, at Albany, N. Y., is short just about $18,000 sound dollars. The bank will be the sufferer. E. W. Agnew, President of the First National Bank, Orlando, Fla., is under arrest for rascality. The liabilities of his bank are over $300,000, while the assets are only $200,000 "sound" dol lars. James R. Holland, ex Cashier of the Merchants and Farmers' National Bank at Charlotte, N. C, was tried in the Federal Court in that city last week. He gets seven years in Albany penitentiary. The amount of funds stolen foots up $95,000 "sound" dollars. Ashby Slocumb, Chief Clerk, and son of the railroad agent of the A. C. L, at Goldsboro, N. C., is a defaulter to the tune of $2,200 "sound" dollars. He has departed. Albert S. Moore, book-keeper and confidential clerk to the great "sound money" firm of Inman, Swann & Co., New York, forged checks to the amount of $150,000 and worked them off on various New York banks last week. G. E. Metcalfe, railroad agent at Palatka, Fla., forged checks for various amounts, all "sound money." He was arrested at Lexington, Ky., last Wednesday. Brown & Bruners' bank at Metropolis, Ill., the oldest bank in the town, suspended Wednesday. The liabilities are about $80,000 "sound" dollars. Banker Smith, of Atlanta, Ga., played a "heavy" game of poker the other day and disappeared. He probably carried off some "sound" dollars that will be good in "Yurrup." A bank president and a cashier were tried at Jeffersonville, Ind., last week for appropriating money probably good in "Yurrup."