Click image to open full size in new tab

Article Text

STUDENTS PLAN BIG "ROUNDUP"

Nebraska University Old Grads to Return to Alma Mater.

(By the Associated Press.) Lincoln, Neb., May for the sixth annual of braska roundup here May 26, and 28, rapidly are taking shape and the principal part of the program has been completed. grads" from all sections of the United States here during the big part of the program has been arranged for their benefit. May 26 will be devoted entirely to the celebration of "Ivy day, university ceremony includes the coronation of the May queen. Friday is "Class and College day' while Saturday is 'Alumni day.

SAYS NIOBRARA CHALK CLIFFS FIT SUBJECT FOR POETS Lincoln, Neb braska's chalk bluffs should be recognized bit of verse in some other manner. Condra, director of the conservation and vey division of the University of Nebraska, believes. The thick chalk formation outerops prominently along the Missouri river northeastern counties of the state and extends under the state to Kansas. Long ago was given the name of Niobrara chalk. This chalk forms steep cliffs bordering the Missouri river between Boyd and Cedar counties and similarly along the south side the Republican river in Franklin and Webster counties. It is bluish gray where freshly exposed, but be comes buff, yellowish, or brownish on have heard much about the chalk cliffs of England, and know that the Kansas university yell is in part about Niobrara chalk rock," Prof. Condra says. "But, who to paint the picture write verse about Nebraska's chalk cliffs?"

HIGH WIND DOES MUCH DAMAGE IN HOLT COUNTY O'Neill, Neb., May 10.-Special: 75-mile an hour wind through the northern part of Holt county assumed the proportions tornado north of here, destroying property and trees stretch 10 miles, two four miles width. John Dick, Frank Kubik and other farmers living the district swept by the storm reported the loss of chicken houses and other outbuildings. Poles and lines of the Utilities company, Creighton, Atkinson and Stuart, were blown down by the gale and the line force has been constantly at work in an effort to continue service at all ponits.

WINNEBAGO INDIAN LANDS

BRING IN $50,554

Neb., May 10.-At the sale of lands on the Omaha and reservations, held at the here, 14 tracts ag. gregating acres were sold. The lands brought an average price more than $68 an acre, a total of being received. The indicates increased demand for farm lands in this locality.

FATHER OF PIONEER HOMESTEADER, IS DEAD O'Neill, Neb., May Ernest Henry Stein, Holt county pioneer, died of heart disease his home oin the part of the county Mr. Stein, born in Ger many, came here in ing on the on which he lived til the time of his death. He is survived by nine children.

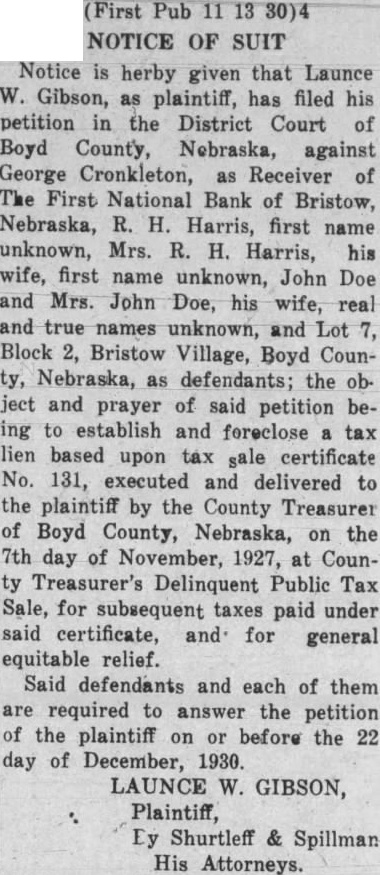

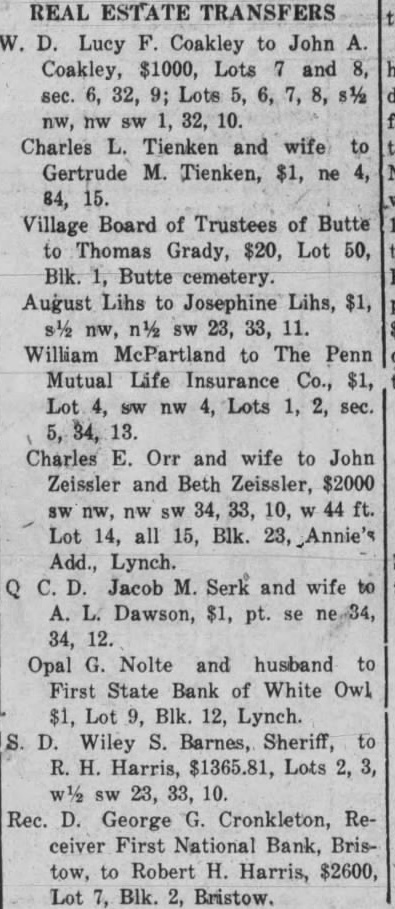

Bank's Affairs Wound Up. Bristow, Neb., May 10.-Special: George Cronkleton, receiver of the First National bank at Bristow, and also of the bank Spencer, has wound up the affairs at both places. few records from the Spencer bank he took him to Wausa, Neb., where he is receiver for bank there. The trust is closed. That bank paid more than one-half to its creditors.

Popcorn Saves Nebraskan. to Ord, Neb., May Carkowski, Ord farmer, tried numerous ways to make his living from the soil but had small success. Then he hit on the idea of raising popcorn. He planted 20 acres of popcorn and realenough to pay year's rent 300-acre farm and still have some profit. Now he has contract to grow seed corn at price of 20 cents above the market quotations.

Early Day Settler Dies. Geddes, 8. D., May Funeral were held for John Olofpioneer of this of the state. was born Jamtland, Sweden, in and located farm Bovee in 1883. on He by four children and five