Article Text

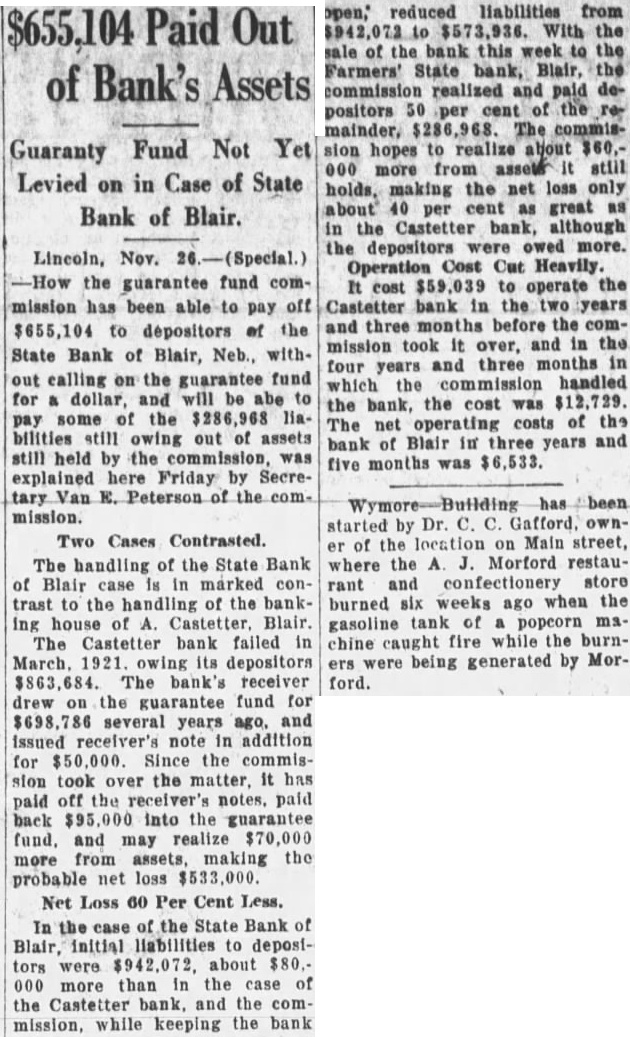

$655,104 Paid Out of Bank's Assets Guaranty Fund Not Yet Levied on in Case of State Bank of Blair. -How the guarantee fund commission has been able to pay off $655,104 to dépositors of the State Bank of Blair, Neb., without calling on the guarantee fund for a dollar, and will be abe to pay some of the $286,968 liabilities till owing out of assets still held by the commission, was explained here Friday by Secretary Van E. Peterson of the commission. Two Cases Contrasted. The handling of the State Bank of Blair case in marked contrast to the handling of the banking house of A. Castetter. Blair. The Castetter bank failed in March. 1921 owing its depositors $863,684. The bank's receiver drew on the guarantee fund for $698,786 several years ago, and Issued receiver's note in addition for $50,000. Since the commission took over the matter, it has paid off the receiver's notes. paid back $95 into the guarantee fund. and may realize $70,000 more from assets, making the probable net loss $533,000. Net Loss 60 Per Cent Less. In the case of the State Bank of Blair, initial liabilities to depositors were $942,072. about $80. 000 more than in the case of the Castetter bank, and the commission, while keeping the bank open," reduced liabilities from $942,072 to $573,936. With the sale of the bank this week to the Farmers' State bank, Blair, the commission realized and paid depositors 50 per cent of the remainder, $286,968. The commission hopes to realize about $60,000 more from assets it still holds, making the net loss only about 40 per cent as great as in the Castetter bank, although the depositors were owed more. Operation Cost Cut Heavily. It cost $59,039 to operate the Castetter bank in the two years and three months before the commission took it over, and in the four years and three months in which the commission handled the bank, the cost was $12,729. The net operating costs of the bank of Blair in three years and five months was $6,533. started by Dr. C. C. Gafford, owner of the location on Main street, where the A. J. Morford restaurant and confectionery store burned six weeks ago when the gasoline tank of a popcorn machine caught fire while the burners were being generated by Morford.