Article Text

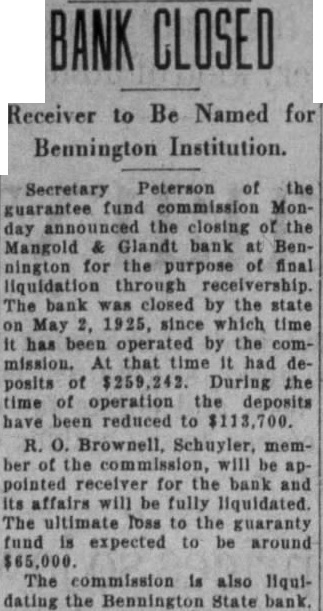

BANK CLOSED Receiver to Be Named for Bennington Institution. Secretary Peterson of the guarantee fund commission Monday announced the closing of the Mangold & Glandt bank at Bennington for the purpose of final liquidation through receivership. The bank was closed by the state on May 2, 1925, since which time it has been operated by the commission. At that time It had deposits of $259,242. During the time of operation the deposits have been reduced to $113,700. R. O. Brownell, Schuyler, member of the commission, will be appointed receiver for the bank and its affairs will be fully liquidated. The ultimate loss to the guaranty fund is expected to be around $65,000. The commission is also liquidating the Bennington State bank.