Article Text

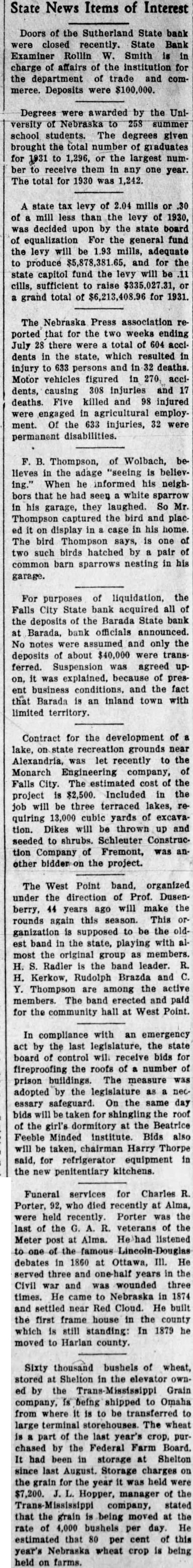

State News Items of Interest Doors of the Sutherland State bank were closed recently. State Bank Examiner Rollin W. Smith is in charge of affairs of the institution for the department of trade and commerce. Deposits were $100,000. Degrees were awarded by the University of Nebraska to 258 summer school students. The degrees given brought the total number of graduates for 1931 to 1,296, or the largest number to receive them in any one year. The total for 1930 was 1,242. A state tax levy of 2.04 mills or .30 of a mill less than the levy of 1930, was decided upon by the state board of equalization For the general fund the levy will be 1.93 mills, adequate to produce $5,878,381.65, and for the state capitol fund the levy will be .11 cills, sufficient to raise $335,027.31, or a grand total of $6,213,408.96 for 1931. The Nebraska Press association reported that for the two weeks ending July 28 there were a total of 604 accidents in the state, which resulted in injury to 633 persons and in 32 deaths. Motor vehicles figured in 270, accidents, causing 308 injuries and 17 deaths. Five killed and 98 injured were engaged in agricultural employment. Of the 633 injuries, 32 were permanent disabilities. F. B. Thompson, of Wolbach, believes in the adage "seeing is believing." When he informed his neighbors that he had seen a white sparrow in his garage, they laughed. So Mr. Thompson captured the bird and placed it on display in cage in his home. The bird Thompson says, is one of two such birds hatched by a pair of common barn sparrows nesting in his garage. For purposes of liquidation, the Falls City State bank acquired all of the deposits of the Barada State bank at Barada, bank officials announced. No notes were assumed and only the deposits of about $40,000 were transferred. Suspension was agreed upon, it was explained, because of present business conditions, and the fact that Barada is an inland town with limited territory. Contract for the development of a lake, on state recreation grounds near Alexandria, was let recently to the Monarch Engineering company, of Falls City. The estimated cost of the project is $2,500. Included in the job will be three terraced lakes, requiring 13,000 cubic yards of excavation. Dikes will be thrown up and seeded to shrubs. Schleuter Construction Company of Fremont, was another bidden the project. The West Point band, organized under the direction of Prof. Dusenberry, 44 years ago will make the rounds again this season. This organization is supposed to be the oldest band in the state, playing with almost the original group as members. H. S. Radler is the band leader. R. H. Kerkow, Rudolph Brazda and C. Y. Thompson are among the active members. The band erected and paid for the community hall at West Point. In compliance with an emergency act by the last legislature, the state board of control will receive bids for fireproofing the roofs of a number of prison buildings. The measure was adopted by the legislature as a necessary safeguard. On the same day bids will betaken for shingling the roof of the girl's dormitory at the Beatrice Feeble Minded institute. Bids also will be taken, chairman Harry Thorpe said, for refrigerator equipment in the new penitentiary kitchens. Funeral services for Charles R. Porter, 92, who died recently at Alma, were held recently. Porter was the last of the G. A. R. veterans of the Meter post at Alma. He had listened to one of the famous Lincoln Douglas debates in 1860 at Ottawa, III. He served three and one-half years in the Civil war and was wounded three times. He came to Nebraska in 1874 and settled near Red Cloud. He built the first frame house in the county which is still standing: In 1879 he moved to Harlan county. Sixty thousand bushels of wheat, stored at Shelton in the elevator owned by the Trans-Mississippi Grain company, is being shipped to Omaha from where it is to be transferred to large terminal storehouses. The wheat is a part of the last year's crop. purchased by the Federal Farm Board. It had been in storage at Shelton since last August. Storage charges on the grain for the year it was held were $7,200. J. L. Hopper, manager of the Trans-Mississippi company, stated that the grain is being moved at the rate of 4,000 bushels per day. He estimated that 80 per cent of this year's Nebraska wheat crop is being held on farms.