Article Text

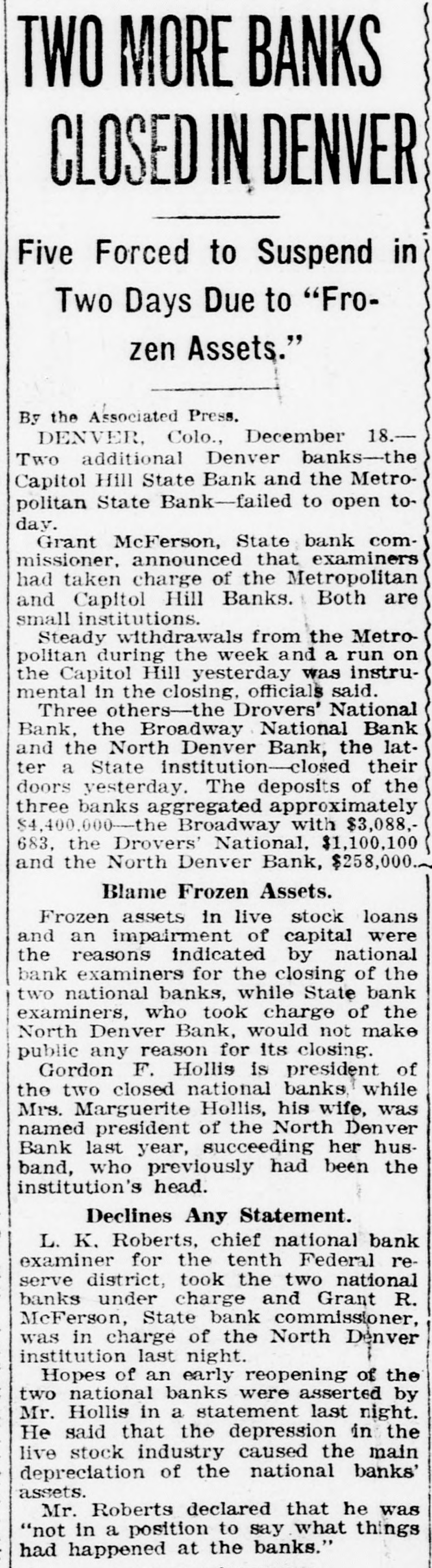

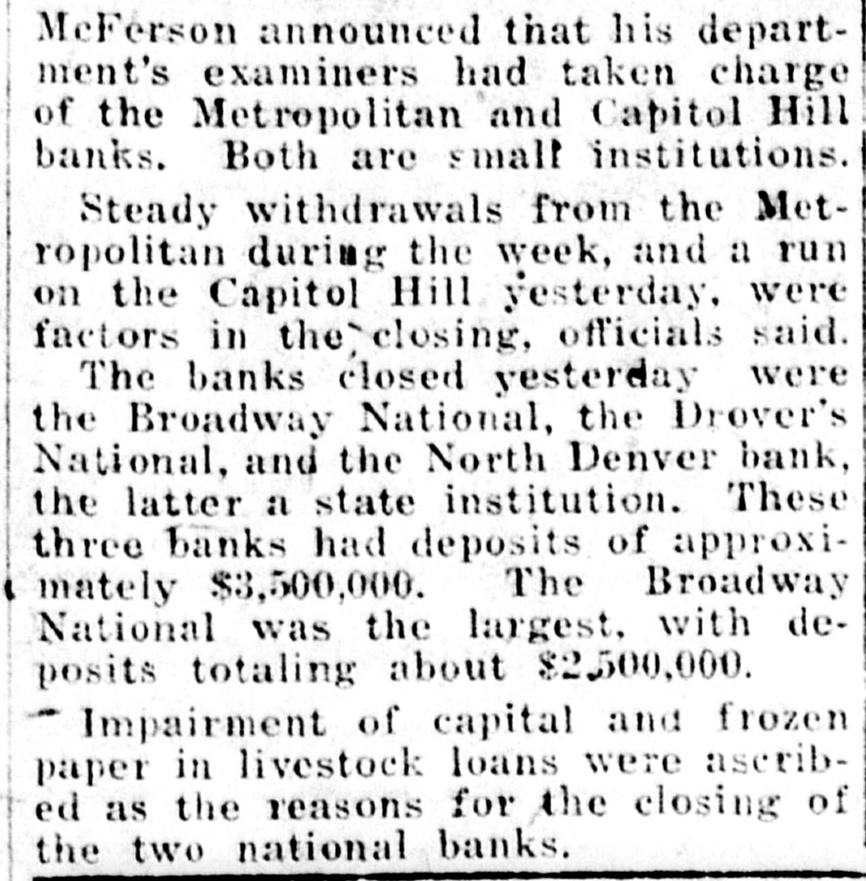

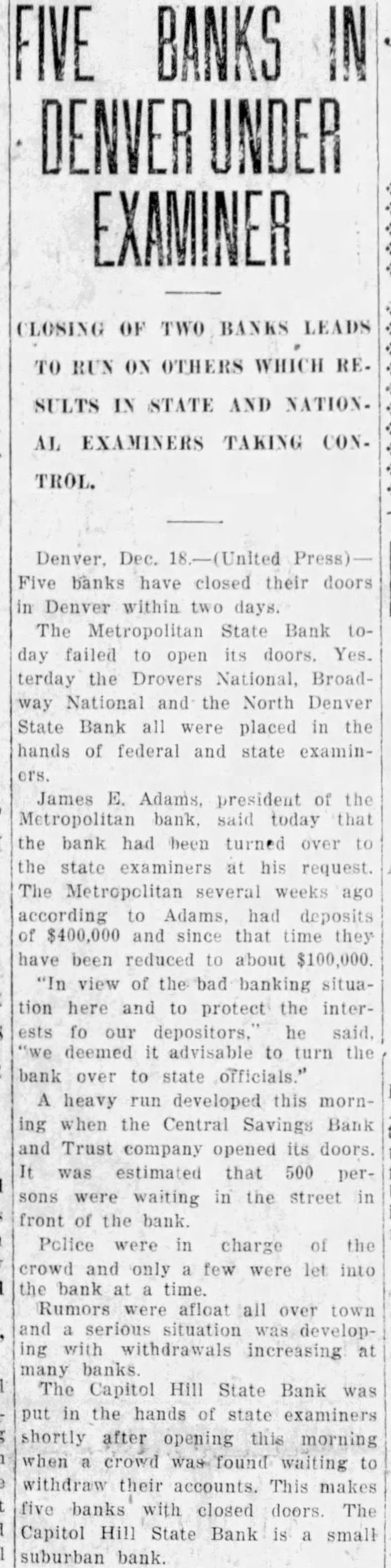

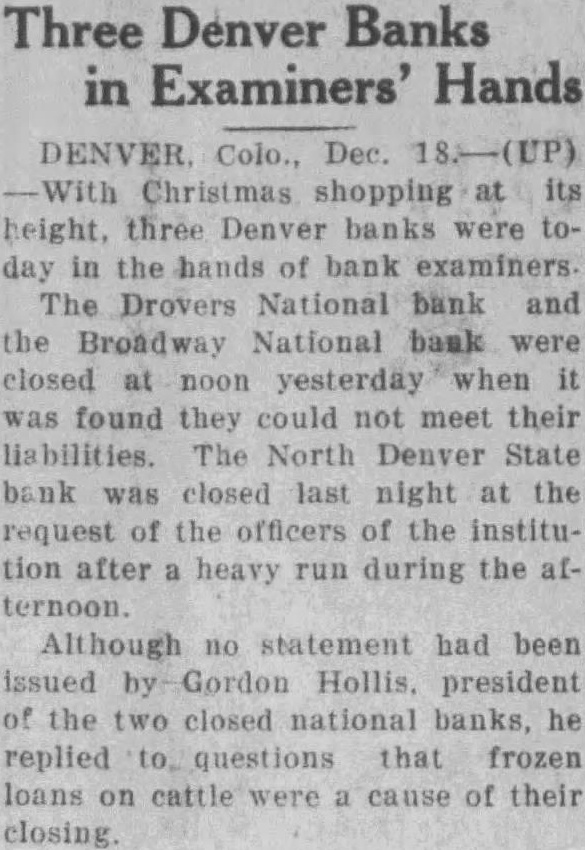

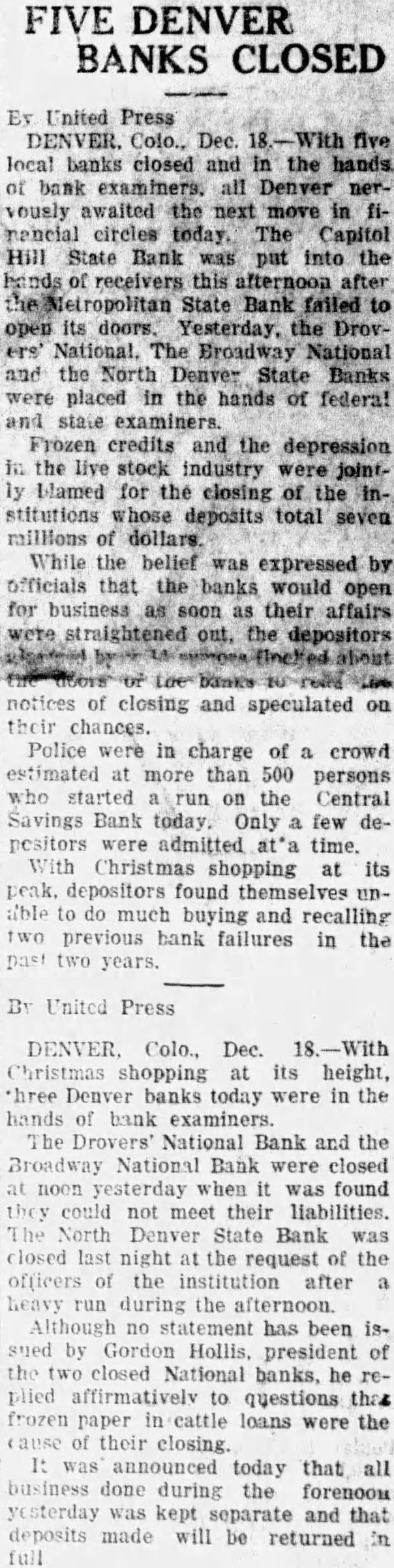

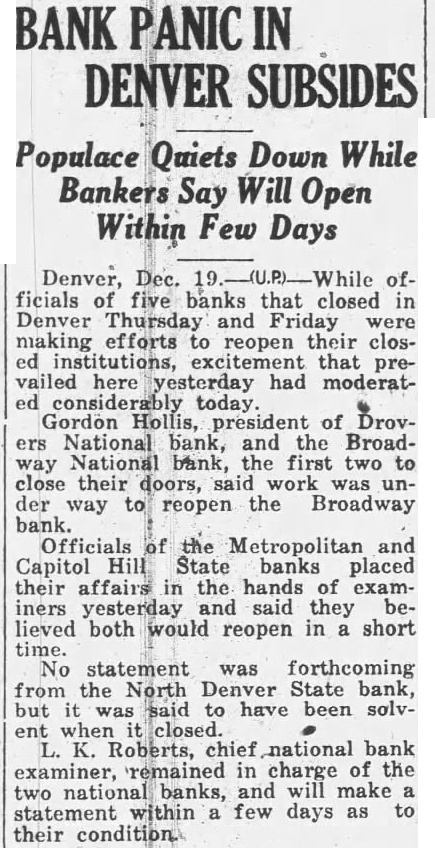

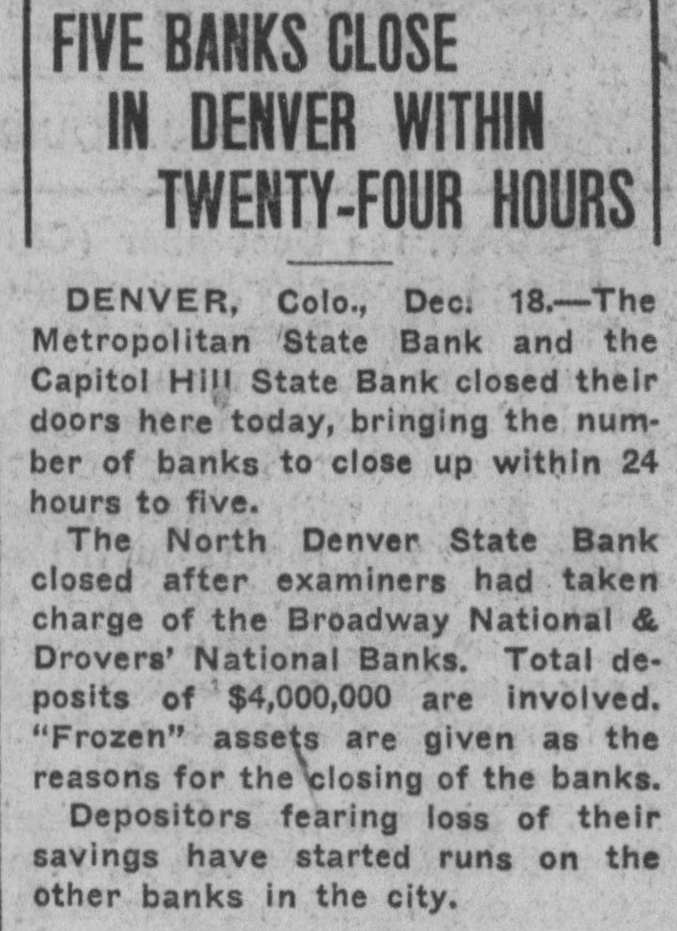

State Items By Telegraph (United Press Leased Wire) SAN FRANCISCO, Dec. 17.-Car' Anton Feien, Tulare county rancher, today held a judgment of $4,371 damages against Mrs. Georgia Swain, whom he sued for $25,000 as a result of injuries when run down by the woman's automobile here June 1924. Mrs. Swain later was involved is another accident, and is serving year sentence in the county jail for intoxicated driving. SAN FRANCISCO, Dec. 17.-Sixty-seven men stood charged today with violation of the city gambling ordinances as a result of a police raid led by Captain Charles Goff, late prohibition chief, against four alleged horse race bookmakers. SAN DIEGO, Dec. 17 Harold A. Nester, the jilted suitor of Miss Mildred Dern, of Salt Lake City, was en route to his home in the east, and his bride-to-have-been and her mother, Mrs. Fred C. Dern, today refused to make any further comment on the sudden cancellation of plans for the nuptials, which were to have taken place in this city yesterday. An "agreement to disagree" was the explanation given by Mrs. Dern yesterday in her only statement regarding the unhappy climax of her daughter's romance. Miss Dern is reported to have broken her engagement to Nester, scion of a wealthy family of Geneva, N. Y., once before. Miss Deern is the daughter of Fred C. Dern, wealthy banker and stock broker of Salt Lake City, and niece of George H. Dern, Governor of Utah. LOS ANGELES, Dec. 17.-Two mysterious jewel robberies perpetrated on wealthy society women were reported to Los Angeles and Long Beach police today. Jewelry valued at $10,000 was stolen from Mrs. George L. Washburn of Long Beach. Mrs. Francis G. Packard. wealthy New York society woman, reported $2,200 in gems had been taken from her while on deposit in the safety vault of a local hotel where she was a guest. Both women said they had brought the jewels to California with them in their trunks. They were locked up for safe keeping and last night when they decided to wear the gems discovered they were Police attribute both robberies to the same gang of society thieves. The "pobs" were carried out in similar manner, it was said. LOS ANGELES, Dec. 17-With a recommendation for life imprisonment, a jury returned a verdict of guilty here early today in the case of Harry Alpine, accused slayer of Barney Blum. Blum was shot down in a bootleg war on September Alpine was formally charged with the murder when Bium died several days, after the altercation. LOS ANGELES, Dec 17.-R. H. Conley, insurance salesman, was found in a dying condition on an uptown street corner here today, apparently the victim of a wouldbe slayer. His head had been crushed from a terrific blow with a bludgeon, police surgeons said, and he was expected to live. Jewelry and money on Conley's person indicated robbery was not the motive of the strange attack Police are making a thorough in vestigation, in the belief he was murdered. SAN FRANCISCO, Dec. The steamer West O'Rowa is adrift in the North Pacific, 1400 miles from Tokio, according to messages relayed today from Cordova, Alaska, to the Chamber of Commerce marine department here today. Thirty-five members of the crew were reported in grave peril. The steamers Oakridg and West Holbrook are going to the ship's assistance. BERKELEY, Dec. 17.-The almost-forgotten hospital training of Miss Adelaide O'Brien 70, today saved the life of her brother-in Joseph R. Daly, 70, after he had cut his throat with two razors in a suicide attempt. Miss O'Brien stopped the flow of blood when Daly staggered out of the bathroom and attended him on che way to the hospital. Surgeons there said her prompt attention saved his life. MODESTO, Dec. 17.-Sentence will be pronounced Monday in superior court here on Levi Jones, retired rancher, found guilty by jury of involuntary manslaughter in the death of A. M. Herndon. Herndon died as a result of injuries when automobiles driven by him and by Jones collided April 12. DENVER. Colo., Dec. 17.-Two Denver banks, the Drovers National bank and the Broadway National bank, closed their doors at noon today and are in the hands of federal examiners. The examiners who ordered the banks closed have made no statement or explanation. A crowd of several hundred stood in the street in front of the Broadway bank at 1 o'clock, waiting for some information concerning the condition of the institution. A heavy run started this afternoon on the North Denver bank, another of the Hollis banks. Between three and four hundred persons were crowding about the teller's cage and in the street shortly before closing time. Payments had not been stopped at 2:30. Get a-going and keep a-going and let the "Times' Want Ads help you every day.