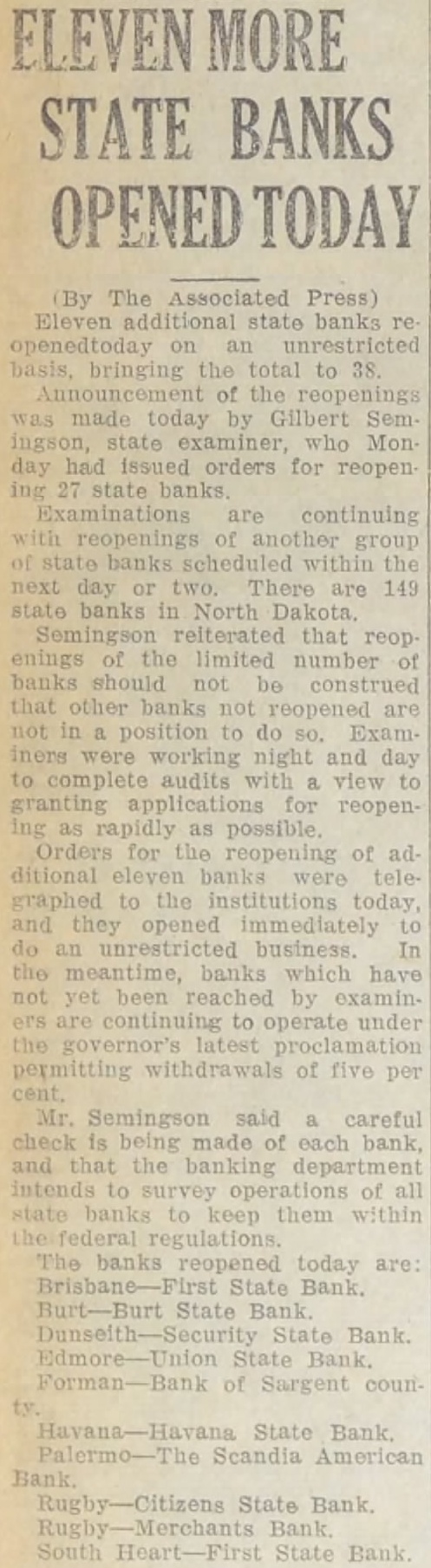

Article Text

ELEVEN MORE STATE BANKS OPENED TODAY By The Associated Press) Eleven additional state banks re openedtoday basis, bringing the total to 38. of the reopenings was made today by Gilbert Sem ingson, examiner, who Mon day had issued orders for reopen ing 27 state banks Examinations are continuing reopenings of another group the next day or two. There are 149 banks in North Dakota, Semingson that reop enings of the limited number banks should construed that banks not reopened not position to do Exam. iners were working night and day to complete audits view to granting for reopening as possible Orders for the reopening of ad ditional graphed to the institutions today and they opened immediately do an business. In the banks which have not yet been reached by examiners to operate under the latest permitting withdrawals of five per Mr. Semingson said careful check is being made of each bank and that the banking department of all state banks to them within banks reopened today are Bank. Burt-Burt State Bank Dunseith- State Bank State Bank of Sargent ty State Bank Scandia Bank Rugby-Citizens State Bank Bank South Heart-First State Bank