Article Text

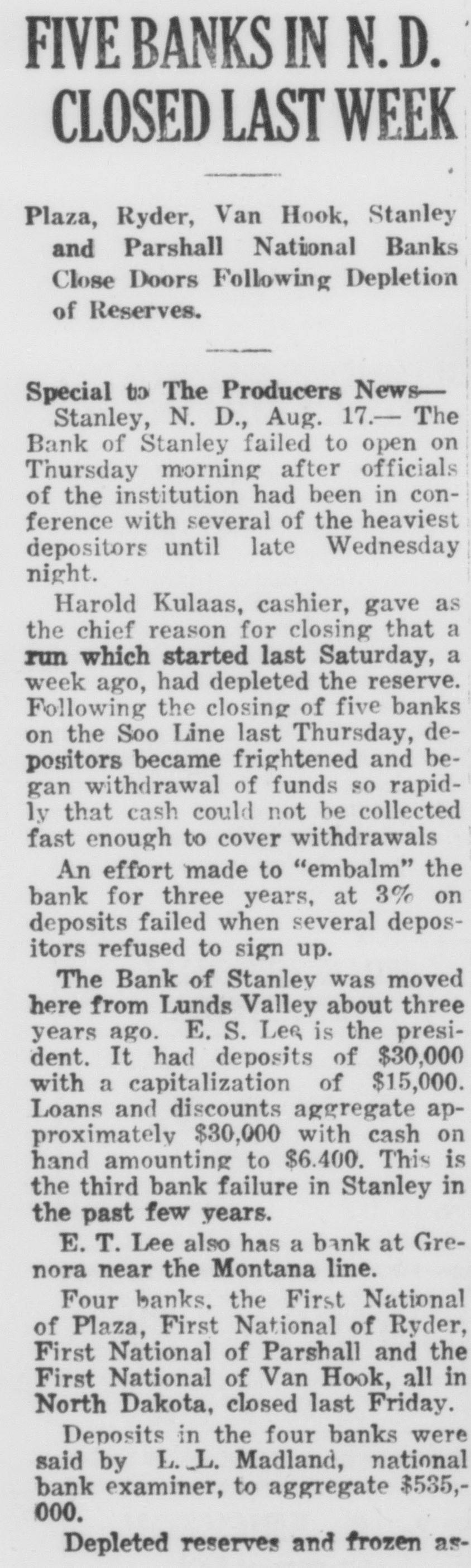

FIVE BANKS IN N.D. CLOSED LAST WEEK Plaza, Ryder, Van Hook, Stanley and Parshall National Banks Close Doors Following Depletion of Reserves. Special to The Producers News— Stanley, N. D., Aug. 17.- The Bank of Stanley failed to open on Thursday morning after officials of the institution had been in conference with several of the heaviest depositors until late Wednesday night. Harold Kulaas, cashier, gave as the chief reason for closing that a run which started last Saturday, a week ago, had depleted the reserve. Following the closing of five banks on the Soo Line last Thursday, depositors became frightened and began withdrawal of funds so rapidly that cash could not be collected fast enough to cover withdrawals An effort made to "embalm" the bank for three years, at 3% on deposits failed when several depositors refused to sign up. The Bank of Stanley was moved here from Lunds Valley about three years ago. E. S. LeG is the president. It had deposits of $30,000 with a capitalization of $15,000. Loans and discounts aggregate approximately $30,000 with cash on hand amounting to $6.400. This is the third bank failure in Stanley in the past few years. E. T. Lee also has a bank at Grenora near the Montana line. Four banks. the First National of Plaza, First National of Ryder, First National of Parshall and the First National of Van Hook, all in North Dakota, closed last Friday. Deposits in the four banks were said by L. L. Madland, national bank examiner, to aggregate $535,000. Depleted reserves and frozen as-