Article Text

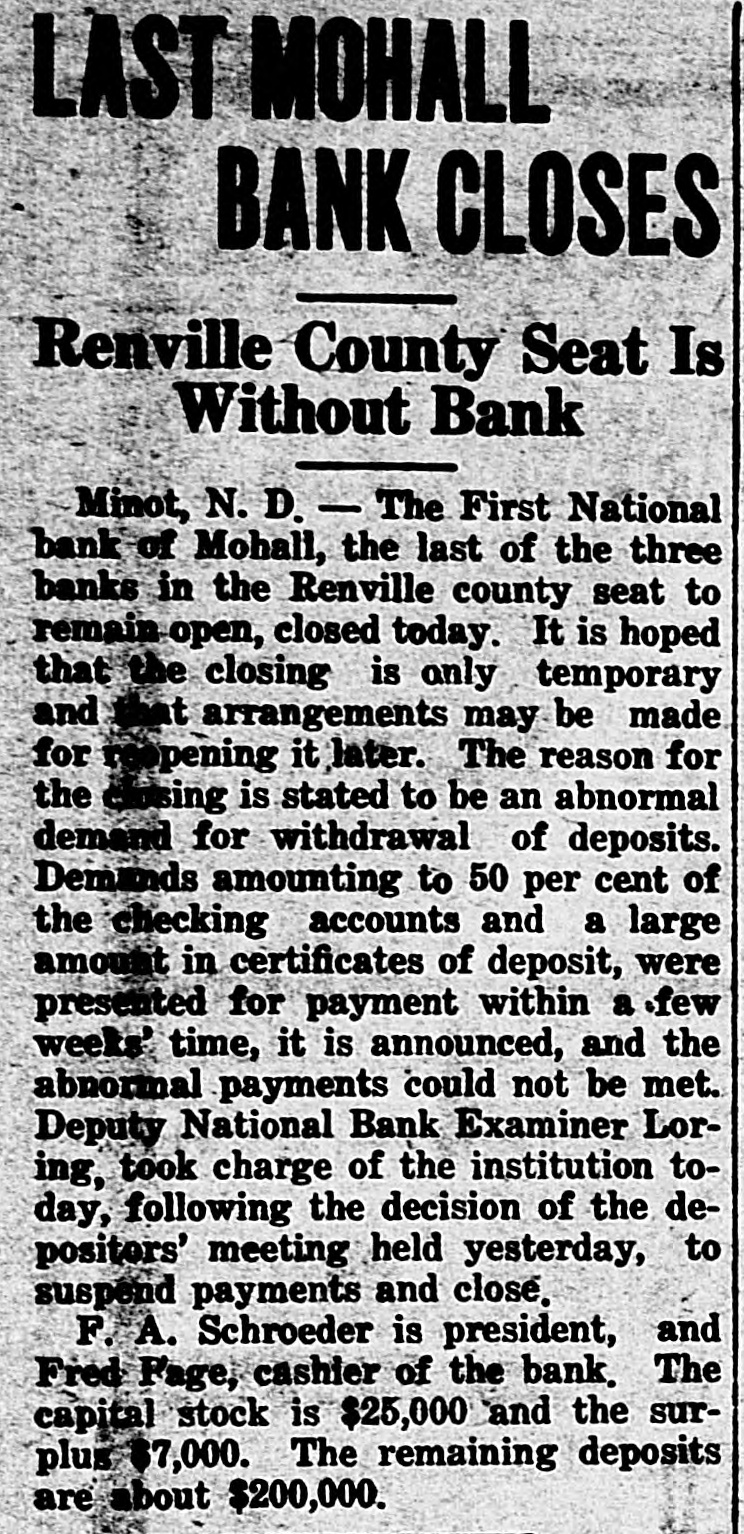

LAST MOHALL BANK CLOSES Renville County Seat Is Without Bank Minot, N. D. - The First National bank of Mohall, the last of the three banks in the Renville county seat to remain open, closed today. It is hoped that the closing is only temporary and that arrangements may be made for reepening it later. The reason for the closing is stated to be an abnormal demand for withdrawal of deposits. Demands amounting to 50 per cent of the checking accounts and a large amount in certificates of deposit, were presented for payment within a .few weeks' time, it is announced, and the abnormal payments could not be met. Deputy National Bank Examiner Loring, took charge of the institution today, following the decision of the depositors' meeting held yesterday, to suspend payments and close. F. A. Schroeder is president, and Fred Page, cashier of the bank. The capital stock is $25,000 and the sur$1,57,000. The remaining deposits are about $200,000.