Article Text

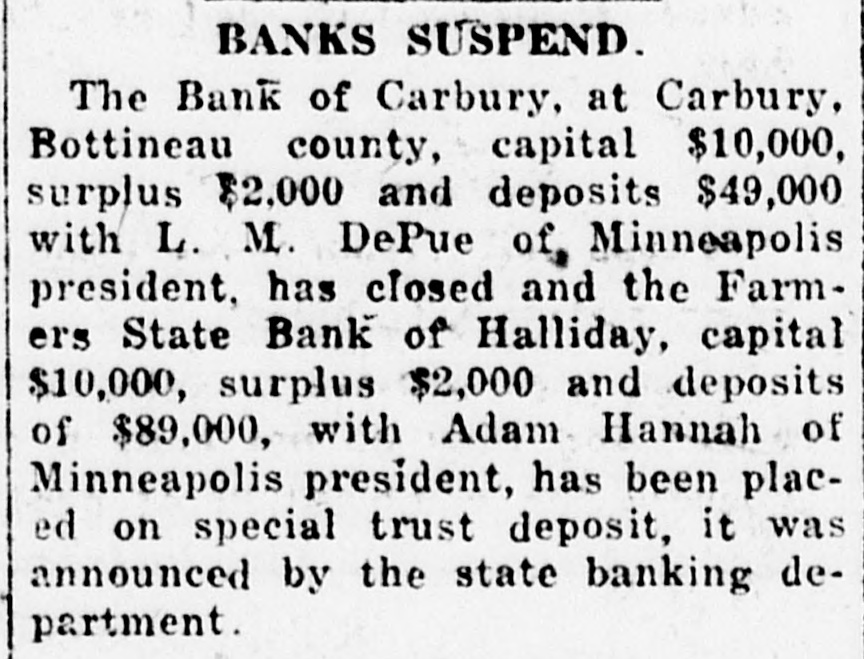

BANKS SUSPEND. The Bank of Carbury, at Carbury, Bottineau county, capital $10,000, surplus $2,000 and deposits $49,000 with L. M. DePue of, Minneapolis president, has closed and the Farmers State Bank of Halliday, capital $10,000, surplus $2,000 and deposits of $89,000, with Adam Hannah of Minneapolis president, has been placed on special trust deposit, it was announced by the state banking department.