Article Text

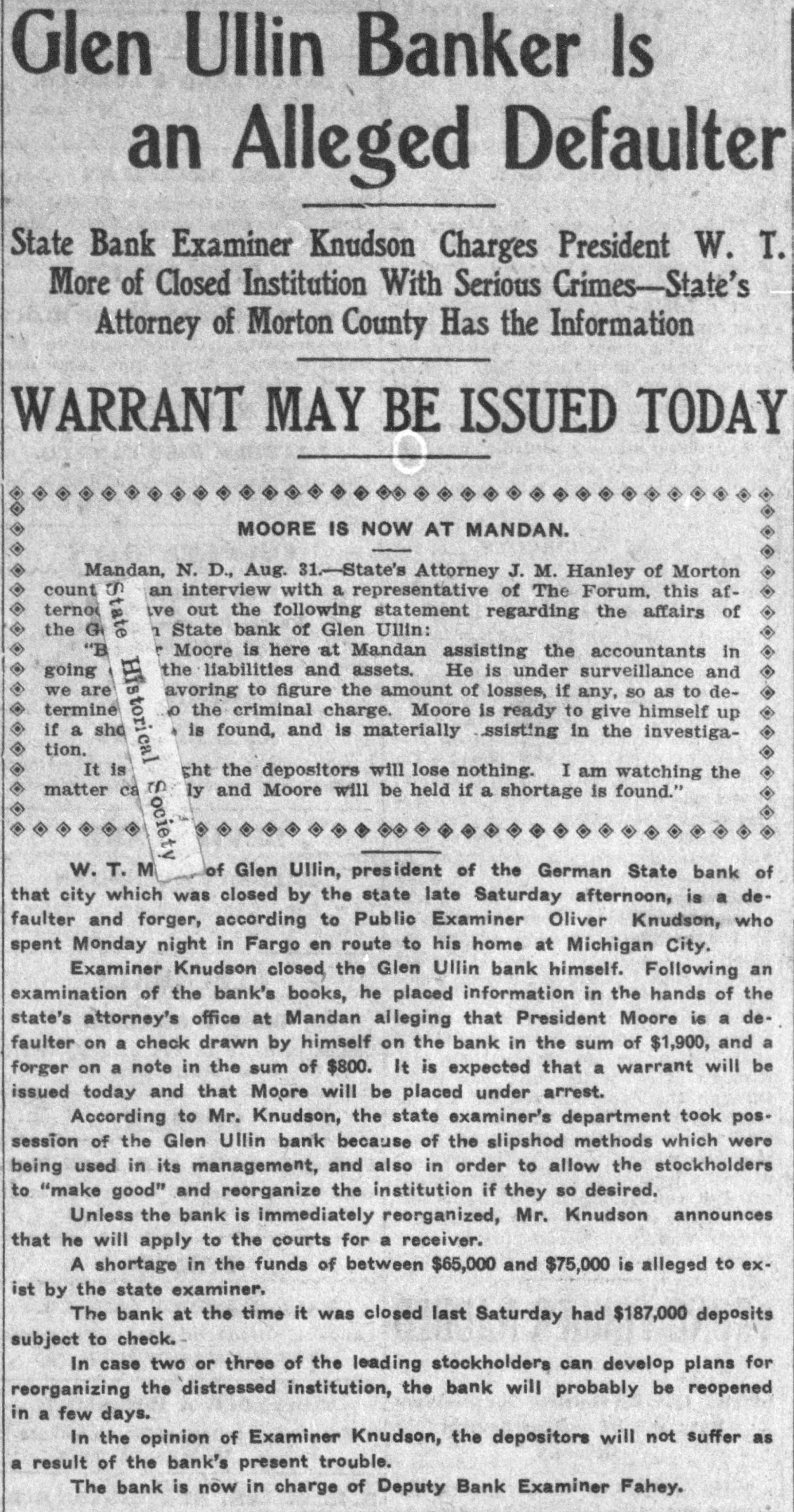

Glen Ullin Banker Is an Alleged Defaulter State Bank Examiner Knudson Charges President W. T. More of Closed Institution With Serious Crimes-State's Attorney of Morton County Has the Information WARRANT MAY BE ISSUED TODAY MOORE IS NOW AT MANDAN. Mandan, N. D., Aug. 31.-State's Attorney J. M. Hanley of Morton count an interview with a representative of The Forum, this afive out the following statement regarding the affairs of State bank of Glen Ullin: Moore is here at Mandan assisting the accountants in the liabilities and assets. He is under surveillance and going we are avoring to figure the amount of losses, if any, so as to determine the criminal charge. Moore is ready to give himself up if a shd is found, and is materially .ssisting in the investigation. It is ght the depositors will lose nothing. I am watching the matter ca ly and Moore will be held if a shortage is found." W. T. M of Glen Ullin, president of the German State bank of that city which was closed by the state late Saturday afternoon, is a defaulter and forger, according to Public Examiner Oliver Knudson, who spent Monday night in Fargo en route to his home at Michigan City. Examiner Knudson closed the Glen Ullin bank himself. Following an examination of the bank's books, he placed information in the hands of the state's attorney's office at Mandan alleging that President Moore is a defaulter on a check drawn by himself on the bank in the sum of $1,900, and a forger on a note in the sum of $800. It is expected that a warrant will be issued today and that Moore will be placed under arrest. According to Mr. Knudson, the state examiner's department took pos. session of the Glen Ullin bank because of the slipshod methods which were being used in its management, and also in order to allow the stockholders to "make good" and reorganize the institution if they so desired. Unless the bank is immediately reorganized, Mr. Knudson announces that he will apply to the courts for a receiver. A shortage in the funds of between $65,000 and $75,000 is alleged to exist by the state examiner, The bank at the time it was closed last Saturday had $187,000 deposits subject to check. In case two or three of the leading stockholders can develop plans for reorganizing the distressed institution, the bank will probably be reopened in a few days. In the opinion of Examiner Knudson, the depositors will not suffer as a result of the bank's present trouble. The bank is now in charge of Deputy Bank Examiner Fahey.