Article Text

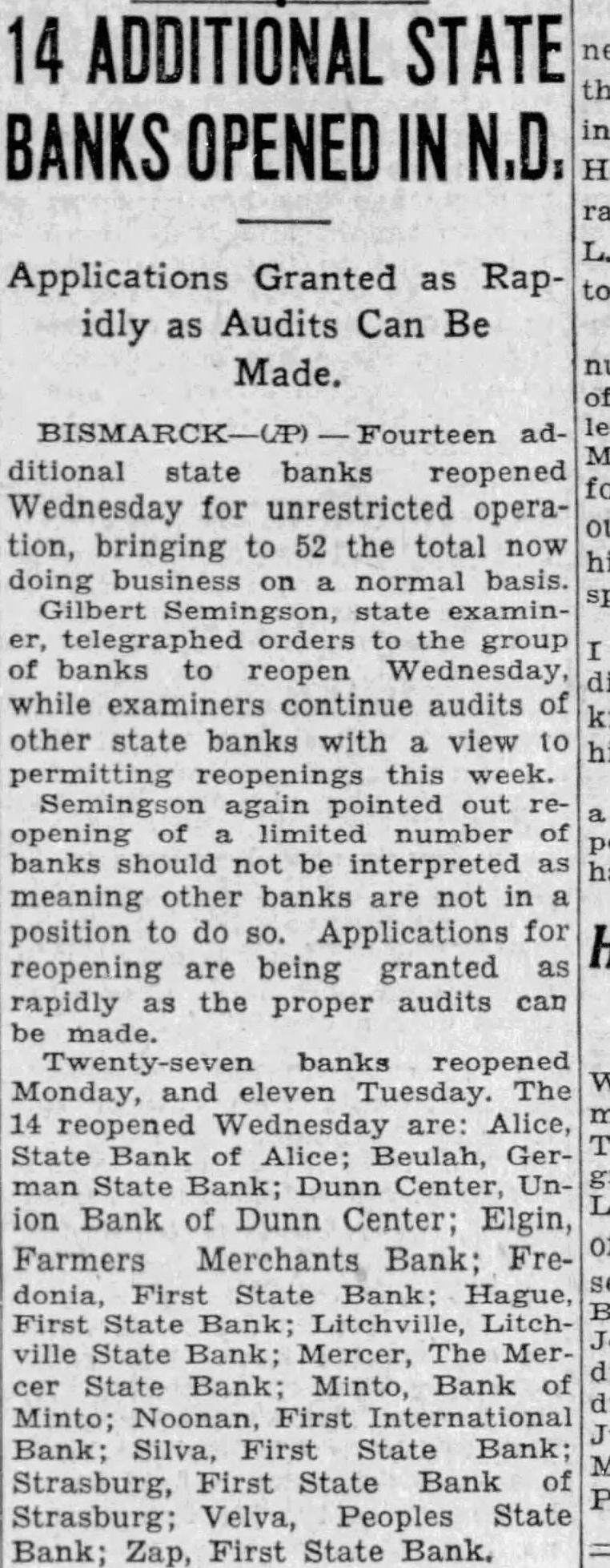

14 ADDITIONAL STATE BANKS OPENED IN N.D. Applications Granted as Rapidly as Audits Can Be Made. additional state banks reopened Wednesday for unrestricted operation, bringing to 52 the total now doing on normal basis examinorders the group of banks reopen Wednesday, while examiners continue audits of other state banks with view to permitting reopenings week. Semingson again out opening of number of banks should not be interpreted as meaning other banks are not in position to do Applications for reopening are being granted as rapidly as the proper audits can made. banks reopened Monday, and eleven Tuesday. The 14 reopened Wednesday are: Alice, State Bank of Alice: Beulah, German State Bank; Dunn Center, Union Bank of Dunn Center; Elgin, Farmers Merchants Bank; Fredonia, First State Bank: Hague, First State Bank; Litchville, Litchville State Bank; Mercer, The Mercer State Bank; Minto, Bank of Minto; Noonan, First International Bank; Silva, First State Bank Strasburg, First State Bank of Strasburg; Velva, Peoples State Bank; Zap, First State Bank.